Virgin Media 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

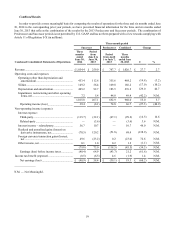

During the six months ended June 30, 2014 and 2013, we reported net earnings (loss) of (£124.7 million) and £158.3 million,

respectively, including (i) operating income of £58.1 million and £216.6 million, respectively, (ii) non-operating expense of £197.4

million and £33.7 million, respectively, and (iii) income tax benefit (expense) of £14.6 million and (£24.6 million), respectively.

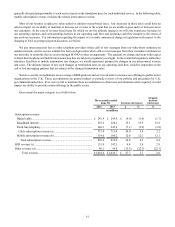

Gains or losses associated with items such as (i) changes in the fair values of derivative instruments and (ii) movements in

foreign currency exchange rates are subject to a high degree of volatility, and as such, any gains from these sources do not represent

reliable sources of income. In the absence of significant gains in the future from these sources or from other non-operating items,

our ability to achieve earnings from continuing operations is largely dependent on our ability to increase our aggregate operating

cash flow to a level that more than offsets the aggregate amount of our (a) share-based compensation expense, (b) depreciation

and amortization, (c) impairment, restructuring and other operating items, net, (d) interest expense, (e) other net non-operating

expenses and (f) income tax expenses. Operating cash flow is defined as revenue less operating and SG&A expenses (excluding

share-based compensation, depreciation and amortization and impairment, restructuring and other operating items).

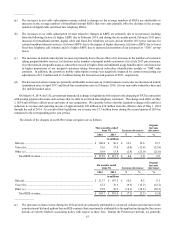

Due largely to the fact that Liberty Global generally seeks to cause our company to maintain our debt at levels that result in

a consolidated debt balance that is between four and five times our consolidated operating cash flow, as discussed under Material

Changes in Financial Condition — Capitalization below, we expect that we will continue to report significant levels of interest

expense for the foreseeable future. For information with respect to certain trends that may affect our operating results in future

periods, see the discussion under Overview above. For information concerning the reasons for changes in specific line items in

our condensed consolidated statements of operations, see the above discussion.

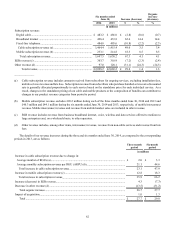

Material Changes in Financial Condition

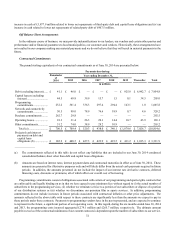

Sources and Uses of Cash

Cash and cash equivalents

At June 30, 2014, we had cash and cash equivalents of £117.4 million, of which £42.7 million was held by our subsidiaries.

The terms of the instruments governing the indebtedness of certain of these subsidiaries may restrict our ability to access the assets

of these subsidiaries. In addition, our ability to access the liquidity of our subsidiaries may be limited by tax and legal considerations

and other factors.

Liquidity of Virgin Media

Our sources of liquidity at the parent level include (i) our cash and cash equivalents, (ii) funding from Lynx Europe 2 (and

ultimately from Liberty Global or other Liberty Global subsidiaries) in the form of loans or contributions, as applicable, and (iii)

subject to the restrictions noted above, proceeds in the form of distributions or loans from our subsidiaries. For information

regarding limitations imposed by our subsidiaries’ debt instruments, see note 6 to our condensed consolidated financial statements.

The ongoing cash needs of Virgin Media include corporate general and administrative expenses and interest expense on the

VM Convertible Notes. From time to time, Virgin Media may also require cash in connection with (i) the repayment of outstanding

debt and related-party obligations, (ii) the satisfaction of contingent liabilities or (iii) acquisitions and other investment opportunities.

No assurance can be given that funding from Lynx Europe 2 (and ultimately from Liberty Global or other Liberty Global

subsidiaries), our subsidiaries or external sources would be available on favorable terms, or at all.

Liquidity of our Subsidiaries

In addition to cash and cash equivalents, the primary sources of liquidity of our operating subsidiaries are cash provided by

operations and, in the case of VMIH, any borrowing availability under the VM Credit Facility. For details of the borrowing

availability of the VM Credit Facility, see note 6 to our condensed consolidated financial statements.

The liquidity of our operating subsidiaries generally is used to fund property and equipment additions, debt service requirements

and other liquidity requirements that may arise from time to time. For additional information regarding our consolidated cash

flows, see the discussion under Condensed Consolidated Statements of Cash Flows below. Our subsidiaries may also require

funding in connection with (i) the repayment of outstanding debt, (ii) acquisitions and other investment opportunities or (iii)

distributions or loans to Virgin Media, Liberty Global or other Liberty Global subsidiaries. No assurance can be given that any

external funding would be available to our subsidiaries on favorable terms, or at all.