Virgin Media 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

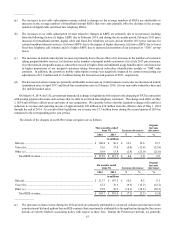

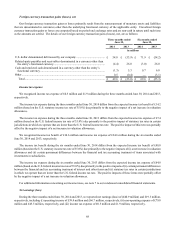

• An increase (decrease) in other direct costs of £0.6 million or 1.5% and (£2.4 million) or (2.7%), respectively, due primarily

to the net effect of (i) lower DSL usage as a result of a decline in our non-cable operations and (ii) net increases resulting

from other individually insignificant changes;

• An increase in network-related expenses of £1.9 million or 1.9% during the six-month period, due largely to an increase

in power costs. The three-month period was relatively unchanged from the prior-year period; and

• Net decreases resulting from individually insignificant changes in other operating expense categories.

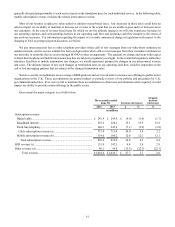

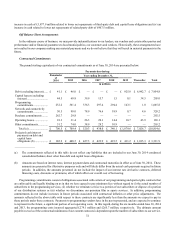

SG&A expenses

SG&A expenses include human resources, information technology, general services, management, finance, legal and sales

and marketing costs, share-based compensation and other general expenses. We do not include share-based compensation in the

following discussion and analysis of our SG&A expenses as share-based compensation expense is discussed separately below. As

noted above, we are subject to inflationary pressures with respect to our labor and other costs.

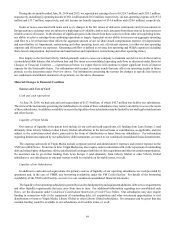

Our total SG&A expenses (exclusive of share-based compensation) increased £10.6 million or 8.1% and £9.4 million or 3.5%

during the three and six months ended June 30, 2014, respectively, as compared to the corresponding periods in 2013. These

increases include £0.2 million and £0.4 million, respectively, attributable to the impact of an acquisition. Excluding the effect of

this acquisition, SG&A expenses increased £10.4 million or 7.9% and £9.0 million or 3.3%, respectively. These increases include

the following factors:

• Increases in outsourced labor and professional fees of £1.1 million and £3.7 million, respectively, due primarily to increased

legal and consulting costs;

• An increase (decrease) in staff-related costs of £1.5 million or 2.7% and (£2.5 million) or (2.3%), respectively, due

primarily to the net effect of (i) higher incentive compensation costs, (ii) net decreases in defined benefit and contribution

plan costs, (iii) decreases in employee severance costs that are not classified as restructuring expenses, (iv) decreased

staffing levels as a result of integration and reorganization activities and (v) annual wage increases;

• An increase (decrease) in marketing and advertising costs of £3.2 million or 6.1% and (£0.2 million) or 0.2%, respectively,

due primarily to the net effect of (i) higher costs associated with advertising campaigns in the second quarter, (ii) lower

third-party sales commissions and (iii) lower costs from other individually insignificant changes; and

• Net increases resulting from individually insignificant changes in other SG&A expense categories.

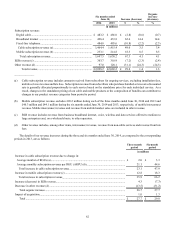

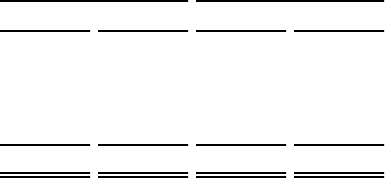

Share-based compensation expense (included in SG&A expenses)

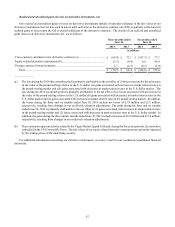

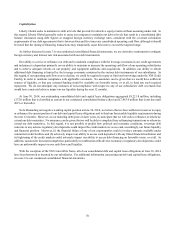

Our share-based compensation expense after the LG/VM Transaction primarily represents amounts allocated to our company

by Liberty Global. The amounts allocated by Liberty Global to our company represent share-based compensation associated with

the Liberty Global share-based incentive awards held by certain employees of our subsidiaries. Share-based compensation expense

allocated to our company by Liberty Global is reflected as an increase to shareholder’s equity and is offset by any amounts recharged

to us by Liberty Global, as further described in note 9 to our condensed consolidated financial statements. Share-based compensation

expense prior to the LG/VM Transaction includes amounts for options, shares and performance shares related to the common stock

of Old Virgin Media. A summary of the share-based compensation expense that is included in our SG&A expenses is set forth

below:

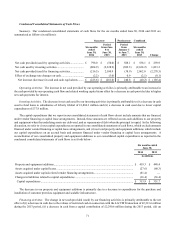

Three months ended

June 30, Six months ended

June 30,

2014 2013 2014 2013

in millions

Performance-based incentive awards (a)............................................................. £ 1.5 £ 5.1 £ 2.8 £ 10.2

Other share-based incentive awards.................................................................... 5.7 29.7 16.1 35.1

Total (b) .......................................................................................................... £ 7.2 £ 34.8 £ 18.9 £ 45.3