Virgin Media 2014 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Condensed Consolidated Financial Statements — (Continued)

June 30, 2014

(unaudited)

19

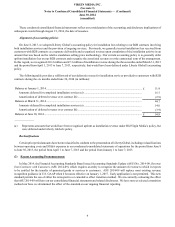

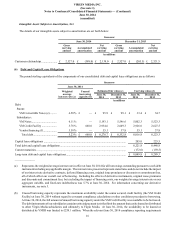

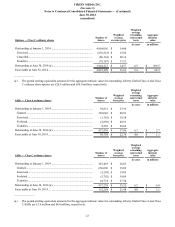

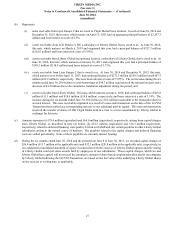

VM Credit Facility

The VM Credit Facility, as amended, is the senior secured credit facility of VMIH, together with certain other subsidiaries of

Virgin Media. The details of our borrowings under the VM Credit Facility as of June 30, 2014 are summarized in the following

table:

Facility Final maturity date Interest rate

Facility amount

(in borrowing

currency)

Unused

borrowing

capacity Carrying

value (a)

in millions

A............................................... June 7, 2019 LIBOR + 3.25% £ 375.0 £ — £ 375.0

B ............................................... June 7, 2020 LIBOR + 2.75% (b) $ 2,755.0 — 1,603.9

D............................................... June 30, 2022 LIBOR + 3.25% (b) £ 100.0 — 99.8

E ............................................... June 30, 2023 LIBOR + 3.50% (b) £ 849.4 — 847.3

Revolving facility (c) ............... June 7, 2019 LIBOR + 3.25% £ 660.0 660.0 —

Total................................................................................................................................................... £ 660.0 £ 2,926.0

_______________

(a) The carrying values of VM Facilities B, D and E include the impact of discounts.

(b) VM Facilities B, D and E each have a LIBOR floor of 0.75%.

(c) The revolving facility has a fee on unused commitments of 1.3% per year.

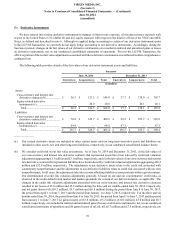

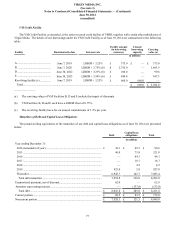

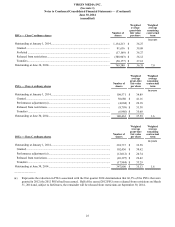

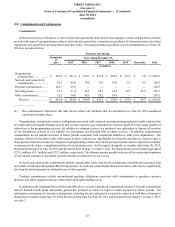

Maturities of Debt and Capital Lease Obligations

The pound sterling equivalents of the maturities of our debt and capital lease obligations as of June 30, 2014 are presented

below:

Debt Capital lease

obligations Total

in millions

Year ending December 31:

2014 (remainder of year) .............................................................................. £ 41.1 £ 49.5 £ 90.6

2015 .............................................................................................................. 46.0 75.8 121.8

2016 .............................................................................................................. — 44.3 44.3

2017 .............................................................................................................. — 18.7 18.7

2018 .............................................................................................................. — 4.2 4.2

2019 .............................................................................................................. 925.0 2.8 927.8

Thereafter...................................................................................................... 6,942.7 142.7 7,085.4

Total debt maturities................................................................................... 7,954.8 338.0 8,292.8

Unamortized premium, net of discount........................................................... 62.0 — 62.0

Amounts representing interest........................................................................ —(133.0)(133.0)

Total debt.................................................................................................... £ 8,016.8 £ 205.0 £ 8,221.8

Current portion................................................................................................ £ 88.5 £ 83.5 £ 172.0

Noncurrent portion.......................................................................................... £ 7,928.3 £ 121.5 £ 8,049.8