Virgin Media 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

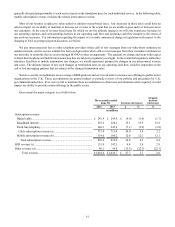

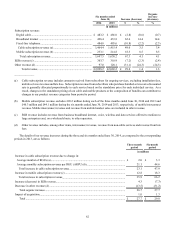

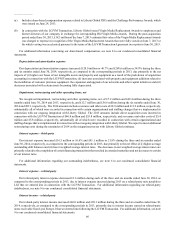

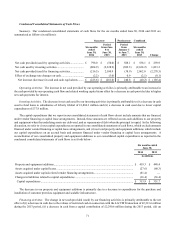

Realized and unrealized gains (losses) on derivative instruments, net

Our realized and unrealized gains or losses on derivative instruments include (i) unrealized changes in the fair values of our

derivative instruments that are non-cash in nature until such time as the derivative contracts are fully or partially settled and (ii)

realized gains or losses upon the full or partial settlement of the derivative contracts. The details of our realized and unrealized

gains (losses) on derivative instruments, net, are as follows:

Three months ended

June 30, Six months ended

June 30,

2014 2013 2014 2013

in millions

Cross-currency and interest rate derivative contracts (a) .................................... £(69.9) £ 73.1 £ (147.3) £ 77.1

Equity-related derivative instruments (b)............................................................ (3.3)(0.4) 0.8 96.9

Foreign currency forward contracts..................................................................... 2.7 (4.3)(0.1)(2.0)

Total................................................................................................................ £(70.5) £ 68.4 £ (146.6) £ 172.0

______________

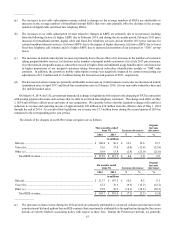

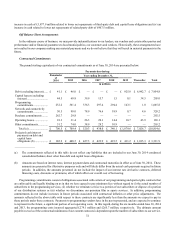

(a) The loss during the 2014 three-month period is primarily attributable to the net effect of (i) losses associated with an increase

in the value of the pound sterling relative to the U.S. dollar, (ii) gains associated with increases in market interest rates in

the pound sterling market and (iii) gains associated with decreases in market interest rates in the U.S. dollar market. The

loss during the 2014 six-month period is primarily attributable to the net effect of (a) losses associated with an increase in

the value of the pound sterling relative to the U.S. dollar, (b) gains associated with decreases in market interest rates in the

U.S. dollar market and (c) gains associated with increases in market interest rates in the pound sterling market. In addition,

the losses during the three and six months ended June 30, 2014 include net losses of £3.8 million and £5.2 million,

respectively, resulting from changes in our credit risk valuation adjustments. The gains during the three and six months

ended June 30, 2013 is primarily attributable to the net effect of (1) gains associated with increases in market interest rates

in the pound sterling market and (2) losses associated with increases in market interest rates in the U.S. dollar market. In

addition, the gains during the three and six months ended June 30, 2013 include net losses of £0.5 million and £17.0 million,

respectively, resulting from changes in our credit risk valuation adjustments.

(b) These amounts represent activity related to the Virgin Media Capped Calls and, during the Successor periods, the derivative

embedded in the VM Convertible Notes. The fair values of our equity-related derivative instruments are primarily impacted

by the trading prices of the underlying security.

For additional information concerning our derivative instruments, see notes 3 and 4 to our condensed consolidated financial

statements.