Virgin Media 2014 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Condensed Consolidated Financial Statements — (Continued)

June 30, 2014

(unaudited)

20

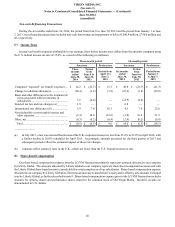

Non-cash Refinancing Transactions

During the six months ended June 30, 2014, the period from June 8 to June 30, 2013 and the period from January 1 to June

7, 2013, our refinancing transactions included non-cash borrowings and repayments of debt of £500.4 million, £750.0 million and

nil, respectively.

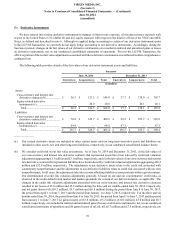

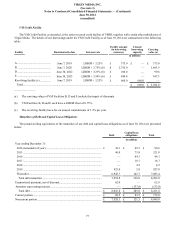

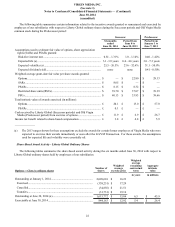

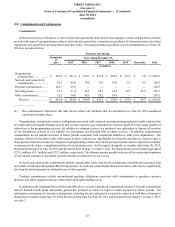

(7) Income Taxes

Income tax benefit (expense) attributable to our earnings (loss) before income taxes differs from the amounts computed using

the U.S. federal income tax rate of 35.0%, as a result of the following (in millions):

Three-month period Six-month period

Successor Predecessor Successor Predecessor

Three

months

ended

June 30,

2014

Period

from

June 8 to

June 30,

2013

Period from

April 1 to

June 7,

2013

Six months

ended

June 30,

2014

Period

from

June 8 to

June 30,

2013

Period from

January 1

to June 7,

2013

Computed “expected” tax benefit (expense).... £ 14.2 £ (22.7) £ 15.3 £ 48.8 £ (22.7) £ (41.3)

Change in valuation allowances....................... (20.4) (3.4)(7.8)(23.6)(3.4)(29.8)

Basis and other differences in the treatment of

items associated with investments in

subsidiaries ................................................... 3.6 (4.4) — (14.9)(4.4) —

Enacted tax law and rate changes (a) ............... 1.9 — — 6.0 — —

International rate differences (b)...................... 3.9 7.8 10.1 4.5 7.8 22.0

Non-deductible or non-taxable interest and

other expenses............................................... (3.4) 16.4 (12.6)(3.8) 16.4 31.9

Other, net.......................................................... (0.3) (0.2)(0.4)(2.4)(0.2)(0.9)

Total............................................................... £ (0.5) £ (6.5) £ 4.6 £ 14.6 £ (6.5) £ (18.1)

______________

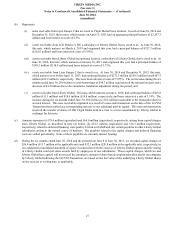

(a) In July 2013, a law was enacted that decreased the U.K. corporate income tax rate from 23.0% to 21.0% in April 2014, with

a further decline to 20.0% scheduled for April 2015. Accordingly, amounts presented for the third quarter of 2013 and

subsequent periods reflect the estimated impact of these rate changes.

(b) Amounts reflect statutory rates in the U.K., which are lower than the U.S. federal income tax rate.

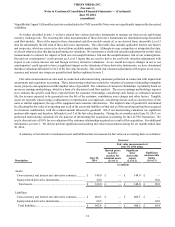

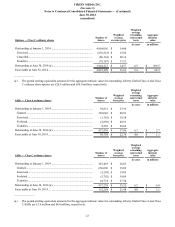

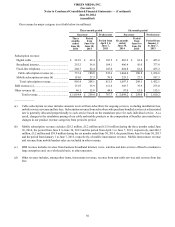

(8) Share-based Compensation

Our share-based compensation expense after the LG/VM Transaction primarily represents amounts allocated to our company

by Liberty Global. The amounts allocated by Liberty Global to our company represent share-based compensation associated with

the Liberty Global share-based incentive awards held by certain employees of our subsidiaries. Share-based compensation expense

allocated to our company by Liberty Global is reflected as an increase to shareholder’s equity and is offset by any amounts recharged

to us by Liberty Global, as further described in note 9. Share-based compensation expense prior to the LG/VM Transaction includes

amounts for options, shares and performance shares related to the common stock of Old Virgin Media. Incentive awards are

denominated in U.S. dollars.