Virgin Media 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(see note 1)

Notes to Condensed Consolidated Financial Statements

June 30, 2014

(unaudited)

8

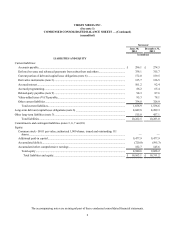

(1) Basis of Presentation

General

Virgin Media Inc. (Virgin Media) is a provider of digital cable, broadband internet, fixed-line telephony and mobile services

in the United Kingdom (U.K.) to both residential and business-to-business (B2B) customers. Virgin Media became a wholly-

owned subsidiary of Liberty Global plc (Liberty Global) as a result of a series of mergers that were completed on June 7, 2013

(the LG/VM Transaction), pursuant to which Liberty Global became the publicly-held parent company of the successors by merger

of the predecessor to Virgin Media (Old Virgin Media) and Liberty Global, Inc. (LGI) (the predecessor to Liberty Global). In

these notes, the terms “we,” “our,” “our company” and “us” may refer, as the context requires, to Virgin Media (or Old Virgin

Media) or collectively to Virgin Media (or Old Virgin Media) and its subsidiaries.

As a result of Liberty Global’s push-down of its investment basis in Virgin Media arising from the LG/VM Transaction, a

new basis of accounting was created on June 7, 2013. In these condensed consolidated financial statements, the results of operations

and cash flows of Old Virgin Media for the periods ended on or prior to June 7, 2013 are referred to as “Predecessor” consolidated

financial information and the results of operations and cash flows of Virgin Media for periods beginning on or after June 8, 2013

and the financial position of Virgin Media as of June 7, 2013 and subsequent balance sheet dates are referred to as “Successor”

consolidated financial information.

The Predecessor and Successor consolidated financial information presented herein is not comparable primarily due to the

fact that the Successor consolidated financial information reflects:

• the application of acquisition accounting as of June 7, 2013 of which the most significant implications are (i) increased

depreciation expense, (ii) increased amortization expense and (iii) increased share-based compensation expense;

• conforming accounting policy changes, primarily to align to Liberty Global’s accounting policy for the recognition of

installation fees received on B2B contracts, as further described below; and

• additional interest expense associated with debt financing arrangements entered into in connection with the LG/VM

Transaction and subsequently pushed down to our balance sheet.

On January 26, 2014, Liberty Global’s board of directors approved a share split in the form of a share dividend (the 2014

Share Dividend), which constitutes a bonus issue under Liberty Global’s articles of association and English law, of one Liberty

Global Class C ordinary share on each outstanding Liberty Global Class A, Class B and Class C ordinary share as of the February

14, 2014 record date for the share dividend. The distribution date for the 2014 Share Dividend was March 3, 2014. All Liberty

Global share and per share amounts presented herein have been retroactively adjusted to give effect to the 2014 Share Dividend.

Our unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles

generally accepted in the United States (U.S. GAAP). Accordingly, these financial statements do not include all of the information

required by U.S. GAAP for complete financial statements. In the opinion of management, these financial statements reflect all

adjustments (consisting of normal recurring adjustments) necessary for a fair presentation of the results of operations for the interim

periods presented. The results of operations for any interim period are not necessarily indicative of results for the full year. These

unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements

and notes thereto included in our 2013 annual report.

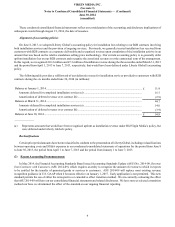

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts

of revenue and expenses during the reporting period. Estimates and assumptions are used in accounting for, among other things,

the valuation of acquisition-related assets and liabilities, allowances for uncollectible accounts, programming expenses, deferred

income taxes and related valuation allowances, loss contingencies, fair value measurements, impairment assessments, capitalization

of internal costs associated with construction and installation activities, useful lives of long-lived assets, share-based compensation

and actuarial liabilities associated with certain benefit plans. Actual results could differ from those estimates.

Unless otherwise indicated, convenience translations into pound sterling are calculated as of June 30, 2014.