Virgin Media 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

_____________

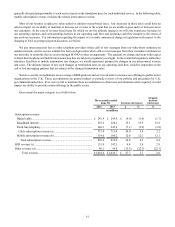

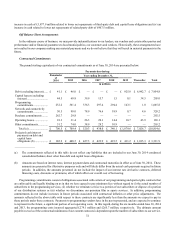

(a) Includes share-based compensation expense related to Liberty Global PSUs and the Challenge Performance Awards, which

were issued on June 24, 2013.

(b) In connection with the LG/VM Transaction, Liberty Global issued Virgin Media Replacement Awards to employees and

former directors of our company in exchange for corresponding Old Virgin Media awards. During the post-acquisition

period ended June 30, 2013, £18.3 million of the June 7, 2013 estimated fair value of the Virgin Media Replacement Awards

was charged to expense in recognition of the Virgin Media Replacement Awards that were fully vested on June 7, 2013 or

for which vesting was accelerated pursuant to the terms of the LG/VM Transaction Agreement on or prior to June 30, 2013.

For additional information concerning our share-based compensation, see note 8 to our condensed consolidated financial

statements.

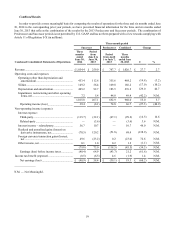

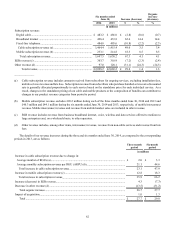

Depreciation and amortization expense

Our depreciation and amortization expense increased £129.0 million or 46.7% and £288.6 million or 54.9% during the three

and six months ended June 30, 2014, respectively, as compared to the corresponding periods in 2013, due primarily to the net

impacts of (i) higher cost bases of our intangible assets and property and equipment as a result of the push-down of acquisition

accounting in connection with the LG/VM Transaction, (ii) increases associated with property and equipment additions related to

the installation of customer premises equipment, the expansion and upgrade of our networks and other capital initiatives and (iii)

decreases associated with certain assets becoming fully depreciated.

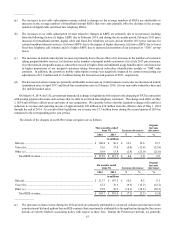

Impairment, restructuring and other operating items, net

We recognized impairment, restructuring and other operating items, net, of £7.2 million and £49.4 million during the three

months ended June 30, 2014 and 2013, respectively, and £12.7 million and £56.6 million during the six months ended June 30,

2014 and 2013, respectively. The 2014 amounts include severance and other costs of £8.9 million and £13.2 million, respectively,

substantially all of which were recorded in connection with certain organizational and staffing changes that we implemented in

connection with our ongoing integration with Liberty Global. The 2013 amounts include direct acquisition costs incurred in

connection with the LG/VM Transaction of £46.0 million and £53.8 million, respectively, and severance and other costs of £5.4

million and £5.8 million, respectively, substantially all of which were recorded in connection with certain organizational and

staffing changes that we implemented in connection with our ongoing integration with Liberty Global. We expect to incur additional

restructuring costs during the remainder of 2014 as the integration process with Liberty Global continues.

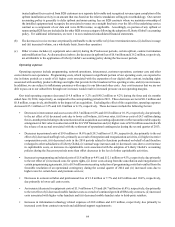

Interest expense – third-party

Our interest expense increased £16.5 million or 16.6% and £41.1 million or 21.8% during the three and six months ended

June 30, 2014, respectively, as compared to the corresponding periods in 2013, due primarily to the net effect of (i) higher average

outstanding debt balances and (ii) lower weighted average interest rates. The decreases in our weighted average interest rates are

primarily related to the completion of certain financing transactions that resulted in extended maturities and net decreases to certain

of our interest rates.

For additional information regarding our outstanding indebtedness, see note 6 to our condensed consolidated financial

statements.

Interest expense – related-party

Our related-party interest expense decreased £3.6 million during each of the three and six months ended June 30, 2014, as

compared to the corresponding periods in 2013, due to interest expense incurred during 2013 on a related-party note payable to

LGI that we entered into in connection with the LG/VM Transaction. For additional information regarding our related-party

indebtedness, see note 9 to our condensed consolidated financial statements.

Interest income – related-party

Our related-party interest income increased £46.0 million and £98.1 million during the three and six months ended June 30,

2014, respectively, as compared to the corresponding periods in 2013, primarily due to interest income earned on related-party

notes receivable from Lynx Europe 2 that we entered into following the LG/VM Transaction. For additional information, see note

9 to our condensed consolidated financial statements.