Virgin Media 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Condensed Consolidated Financial Statements — (Continued)

June 30, 2014

(unaudited)

14

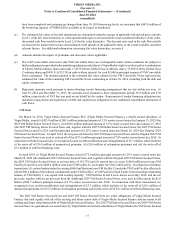

Virgin Media Capped Calls and the derivative embedded in the VM Convertible Notes were not significantly impacted by forecasted

volatilities.

As further described in note 3, we have entered into various derivative instruments to manage our interest rate and foreign

currency exchange risk. The recurring fair value measurements of these derivative instruments are determined using discounted

cash flow models. Most of the inputs to these discounted cash flow models consist of, or are derived from, observable Level 2

data for substantially the full term of these derivative instruments. This observable data includes applicable interest rate futures

and swap rates, which are retrieved or derived from available market data. Although we may extrapolate or interpolate this data,

we do not otherwise alter this data in performing our valuations. We incorporate a credit risk valuation adjustment in our fair value

measurements to estimate the impact of both our own nonperformance risk and the nonperformance risk of our counterparties.

Our and our counterparties’ credit spreads are Level 3 inputs that are used to derive the credit risk valuation adjustments with

respect to our various interest rate and foreign currency derivative valuations. As we would not expect changes in our or our

counterparties’ credit spreads to have a significant impact on the valuations of these derivative instruments, we have determined

that these valuations fall under Level 2 of the fair value hierarchy. Our credit risk valuation adjustments with respect to our cross-

currency and interest rate swaps are quantified and further explained in note 3.

Fair value measurements are also used in connection with nonrecurring valuations performed in connection with impairment

assessments and acquisition accounting. These nonrecurring valuations include the valuation of customer relationship intangible

assets, property and equipment and the implied value of goodwill. The valuation of customer relationships is primarily based on

an excess earnings methodology, which is a form of a discounted cash flow analysis. The excess earnings methodology requires

us to estimate the specific cash flows expected from the customer relationship, considering such factors as estimated customer

life, the revenue expected to be generated over the life of the customer, contributory asset charges and other factors. Tangible

assets are typically valued using a replacement or reproduction cost approach, considering factors such as current prices of the

same or similar equipment, the age of the equipment and economic obsolescence. The implied value of goodwill is determined

by allocating the fair value of a reporting unit to all of the assets and liabilities of that unit as if the reporting unit had been acquired

in a business combination, with the residual amount allocated to goodwill. All of our nonrecurring valuations use significant

unobservable inputs and therefore fall under Level 3 of the fair value hierarchy. During the six months ended June 30, 2013, we

performed nonrecurring valuations for the purpose of determining the acquisition accounting for the LG/VM Transaction. We

used a discount rate of 9.0% for our valuation of the customer relationships acquired as a result of this acquisition. For additional

information, see note 1. We did not perform significant nonrecurring fair value measurements during the six months ended June

30, 2014.

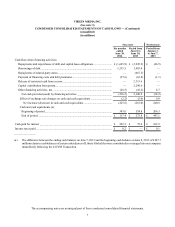

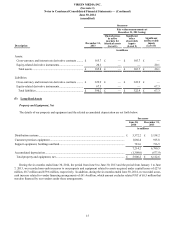

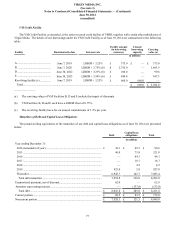

A summary of our derivative instrument assets and liabilities that are measured at fair value on a recurring basis is as follows:

Successor

Fair value measurements at

June 30, 2014 using:

Description June 30,

2014

Quoted prices

in active

markets for

identical assets

(Level 1)

Significant

other

observable

inputs

(Level 2)

Significant

unobservable

inputs

(Level 3)

in millions

Assets:

Cross-currency and interest rate derivative contracts............ £ 148.0 £ — £ 148.0 £ —

Equity-related derivative instruments.................................... 20.0 — — 20.0

Total assets.......................................................................... £ 168.0 £ — £ 148.0 £ 20.0

Liabilities:

Cross-currency and interest rate derivative contracts............ £ 400.5 £ — £ 400.5 £ —

Equity-related derivative instruments.................................... 64.9 — — 64.9

Total liabilities..................................................................... £ 465.4 £ — £ 400.5 £ 64.9