Virgin Media 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC.

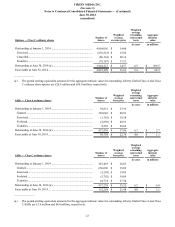

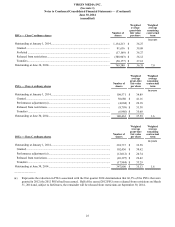

(See note 1)

Notes to Condensed Consolidated Financial Statements — (Continued)

June 30, 2014

(unaudited)

17

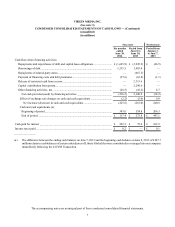

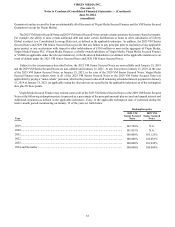

have been completed and assuming no changes from June 30, 2014 borrowing levels, we anticipate that £443.0 million of

the borrowing capacity of VMIH will be available to be loaned or distributed.

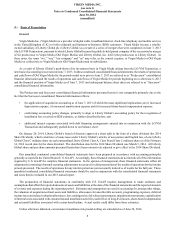

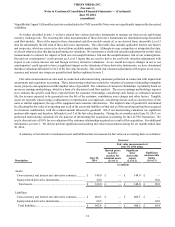

(c) The estimated fair values of our debt instruments are determined using the average of applicable bid and ask prices (mostly

Level 1 of the fair value hierarchy) or, when quoted market prices are unavailable or not considered indicative of fair value,

discounted cash flow models (mostly Level 2 of the fair value hierarchy). The discount rates used in the cash flow models

are based on the market interest rates and estimated credit spreads of the applicable entity, to the extent available, and other

relevant factors. For additional information concerning fair value hierarchies, see note 4.

(d) Amounts include the impact of premiums and discounts, where applicable.

(e) The 6.50% convertible senior notes (the VM Convertible Notes) are exchangeable under certain conditions for (subject to

further adjustment as provided in the underlying indenture and subject to Virgin Media’s right to settle in cash or a combination

of Liberty Global ordinary shares and cash) 13.4339 Liberty Global Class A ordinary shares, 33.4963 Liberty Global Class

C ordinary shares and $910.51 (£532.38) in cash (without interest) for each $1,000 in principal amount of VM Convertible

Notes exchanged. The amount reported in the estimated fair value column for the VM Convertible Notes represents the

estimated fair value of the remaining VM Convertible Notes outstanding as of June 30, 2014, including both the debt and

equity components.

(f) Represents amounts owed pursuant to interest-bearing vendor financing arrangements that are due within one year. At

June 30, 2014 and December 31, 2013, the amounts owed pursuant to these arrangements include £5.8 million and £3.0

million, respectively, of VAT that was paid on our behalf by the vendor. Repayments of vendor financing obligations are

included in repayments and repurchases of debt and capital lease obligations in our condensed consolidated statements of

cash flows.

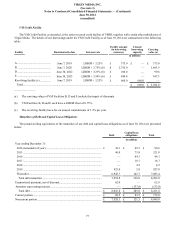

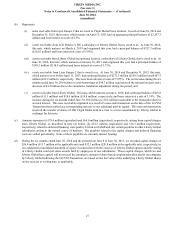

VM Notes

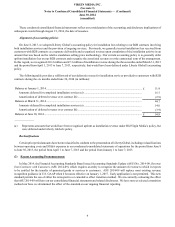

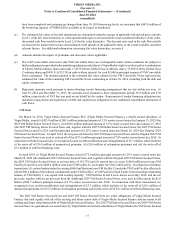

On March 14, 2014, Virgin Media Secured Finance PLC (Virgin Media Secured Finance), a wholly-owned subsidiary of

Virgin Media, issued (i) $425.0 million (£248.5 million) principal amount of 5.5% senior secured notes due January 15, 2025 (the

2025 VM Dollar Senior Secured Notes), (ii) £430.0 million principal amount of 5.5% senior secured notes due January 15, 2025

(the 2025 VM Sterling Senior Secured Notes and, together with the 2025 VM Dollar Senior Secured Notes, the 2025 VM Senior

Secured Notes) and (iii) £225.0 million principal amount of 6.25% senior secured notes due March 28, 2029 (the Original 2029

VM Senior Secured Notes). In April 2014, the net proceeds from the 2025 VM Senior Secured Notes and the Original 2029 VM

Senior Secured Notes were used to redeem all of the £875.0 million principal amount of 7.0% senior secured notes due 2018. In

connection with these transactions, we recognized a gain on debt modification and extinguishment of £3.1 million, which includes

(i) the write-off of £36.9 million of unamortized premium, (ii) £30.6 million of redemption premiums and (iii) the write-off of

£3.2 million of deferred financing costs.

In April 2014, (i) Virgin Media Secured Finance issued £175.0 million principal amount of 6.25% senior secured notes due

March 28, 2029 (the Additional 2029 VM Senior Secured Notes and, together with the Original 2029 VM Senior Secured Notes,

the 2029 VM Senior Secured Notes) at an issue price of 101.75% and (ii) entered into (a) a new £100.0 million term loan (VM

Facility D) and (b) a new £849.4 million term loan (VM Facility E), each under the VM Credit Facility. In connection with these

transactions, (1) certain lenders under the existing £600.0 million term loan (VM Facility C) under the VM Credit Facility effectively

rolled £500.4 million of their drawn commitments under VM Facility C to VM Facilities D and E and (2) the remaining outstanding

balance of VM Facility C was repaid with existing liquidity. VM Facilities D and E were drawn on in May 2014, and the net

proceeds, together with the net proceeds from the Additional 2029 VM Senior Secured Notes, were used to fully redeem the $1.0

billion (£584.7 million) principal amount of 6.5% senior secured notes due 2018. In connection with these transactions, we

recognized a loss on debt modification and extinguishment of £3.3 million, which includes (i) the write-off of £20.1 million of

unamortized premium, (ii) £19.3 million of redemption premiums and (iii) the write-off of £4.1 million of deferred financing costs.

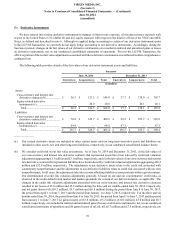

The 2025 VM Senior Secured Notes and 2029 VM Senior Secured Notes are senior obligations of Virgin Media Secured

Finance that rank equally with all of the existing and future senior debt of Virgin Media Secured Finance and are senior to all

existing and future subordinated debt of Virgin Media Secured Finance. The 2025 VM Senior Secured Notes and 2029 VM Senior

Secured Notes are guaranteed on a senior basis by Virgin Media and certain subsidiaries of Virgin Media (the VM Senior Secured