Virgin Media 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Condensed Consolidated Financial Statements — (Continued)

June 30, 2014

(unaudited)

28

(10) Commitments and Contingencies

Commitments

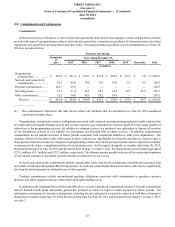

In the normal course of business, we have entered into agreements that commit our company to make cash payments in future

periods with respect to programming contracts, network and connectivity commitments, purchases of customer premises and other

equipment, non-cancelable operating leases and other items. Our pound sterling equivalents of such commitments as of June 30,

2014 are presented below:

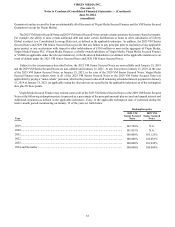

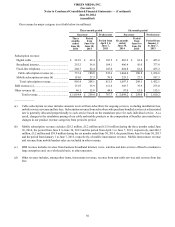

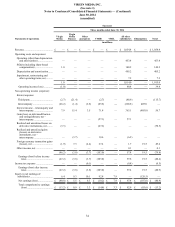

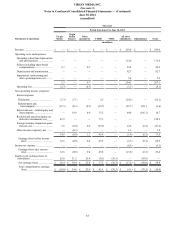

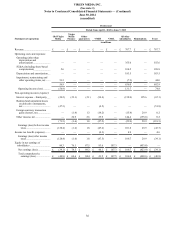

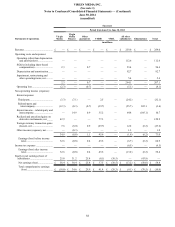

Payments due during:

Remainder

of

2014

Year ending December 31,

2015 2016 2017 2018 2019 Thereafter Total

in millions

Programming

commitments..................... £ 232.2 £ 361.4 £ 336.3 £ 297.4 £ 294.4 £ 143.1 £ 1.0 £ 1,665.8

Network and connectivity

commitments..................... 50.5 98.0 78.9 76.6 18.9 0.7 4.6 328.2

Purchase commitments......... 262.7 29.8 — — — — — 292.5

Operating leases ................... 18.3 31.4 26.3 20.1 14.4 10.7 43.9 165.1

Other commitments.............. 51.2 74.0 38.9 28.2 10.9 — — 203.2

Total (a) ........................... £ 614.9 £ 594.6 £ 480.4 £ 422.3 £ 338.6 £ 154.5 £ 49.5 £ 2,654.8

_______________

(a) The commitments reflected in this table do not reflect any liabilities that are included in our June 30, 2014 condensed

consolidated balance sheet.

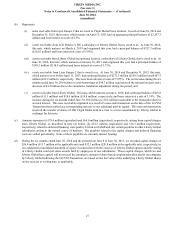

Programming commitments consist of obligations associated with certain of our programming and sports rights contracts that

are enforceable and legally binding on us in that we have agreed to pay minimum fees without regard to (i) the actual number of

subscribers to the programming services, (ii) whether we terminate service to a portion of our subscribers or dispose of a portion

of our distribution systems or (iii) whether we discontinue our premium film or sports services. In addition, programming

commitments do not include increases in future periods associated with contractual inflation or other price adjustments. The

amounts reflected in the above table with respect to these contracts are significantly less than the amounts we expect to pay in

these periods under these contracts. Payments to programming vendors have in the past represented, and are expected to continue

to represent in the future, a significant portion of our operating costs. In this regard, during the six months ended June 30, 2014,

the period from June 8 to June 30, 2013 and the period from January 1 to June 7, 2013, the programming costs incurred aggregated

£279.1 million, £33.5 million and £232.2 million, respectively. The ultimate amount payable in excess of the contractual minimums

of our content contracts is dependent upon the number of subscribers to our service.

Network and connectivity commitments include, among other items, only the fixed minimum commitments associated with

our mobile virtual network operator (MVNO) agreement. As such, the commitments shown in the above table may be significantly

less than the actual amounts we ultimately pay in these periods.

Purchase commitments include unconditional purchase obligations associated with commitments to purchase customer

premises and other equipment that are enforceable and legally binding on us.

In addition to the commitments set forth in the table above, we have significant commitments under (i) derivative instruments

and (ii) defined benefit plans and similar agreements, pursuant to which we expect to make payments in future periods. For

information concerning our derivative instruments, including the net cash paid or received in connection with these instruments

during the six months ended June 30, 2014, the period from June 8 to June 30, 2013 and the period from January 1 to June 7, 2013,

see note 3.