Virgin Media 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.64

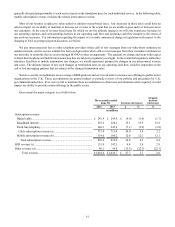

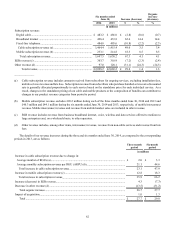

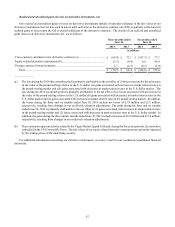

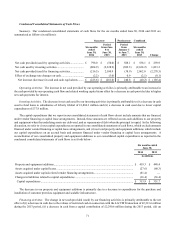

treated upfront fees received from B2B customers as a separate deliverable and recognized revenue upon completion of the

upfront installation activity in an amount that was based on the relative standalone selling price methodology. Our current

accounting policy is generally to defer upfront and nonrecurring fees on B2B contracts where we maintain ownership of

the installed equipment and recognize the associated revenue on a straight line basis over the life of the underlying service

contract as a component of our data and voice B2B revenue, as applicable. Accordingly, no portion of any upfront or

nonrecurring B2B fees are included in the other B2B revenue category following the adoption of Liberty Global’s accounting

policy. For additional information, see note 1 to our condensed consolidated financial statements.

(b) The decreases in voice revenue are primarily attributable to the net effect of (i) lower termination rates, (ii) declines in usage

and (iii) increased volume, on a wholesale basis, from other operators.

(c) Other revenue includes (i) equipment sales and (ii) during the Predecessor periods, certain upfront, contract termination

and modification fees. As discussed in (a) above, the decreases in upfront fees of £6.6 million and £16.2 million, respectively,

are attributable to the application of Liberty Global’s accounting policy during the Successor periods.

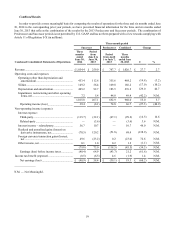

Operating expenses

Operating expenses include programming, network operations, interconnect, customer operations, customer care and other

costs related to our operations. Programming costs, which represent a significant portion of our operating costs, are expected to

rise in future periods as a result of (i) higher costs associated with the expansion of our digital cable content, including rights

associated with ancillary product offerings and rights that provide for the broadcast of live sporting events, and (ii) rate increases.

In addition, we are subject to inflationary pressures with respect to our labor and other costs. Any cost increases that we are not

able to pass on to our subscribers through rate increases would result in increased pressure on our operating margins.

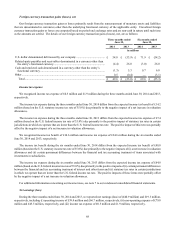

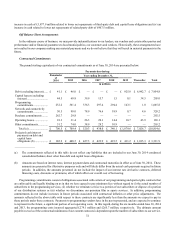

Our total operating expenses decreased £14.8 million or 3.2% and £40.2 million or 4.2% during the three and six months

ended June 30, 2014, respectively, as compared to the corresponding periods in 2013. These decreases are net of £0.3 million and

£0.8 million, respectively, attributable to the impact of an acquisition. Excluding the effect of this acquisition, operating expenses

decreased £15.1 million or 3.2% and £41.0 million or 4.3%, respectively. These decreases include the following factors:

• Decreases in interconnect and access costs of £6.3 million or 6.8% and £18.8 million or 10.1%, respectively, due primarily

to the net effect of (i) decreased costs due to lower call volume, (ii) lower rates, (iii) lower costs of £4.3 million during

the six-month period relating to the amortization of an acquisition accounting adjustment to reflect an unfavorable capacity

arrangement at fair value in connection with the LG/VM Transaction and (iv) higher costs of £2.0 million associated with

the release of an accrual associated with the settlement of operational contingencies during the second quarter of 2013;

• Decreases in personnel costs of £9.0 million or 14.6% and £18.3 million or 15.0%, respectively, due primarily to the net

effect of (i) decreased staffing levels, primarily as a result of integration and reorganization activities, (ii) higher incentive

compensation costs, (iii) decreased costs in the 2014 periods related to functions performed on behalf of and therefore

recharged to other subsidiaries of Liberty Global, (iv) annual wage increases and (v) decreased costs due to a net increase

in capitalizable costs, as increases in capitalizable costs associated with the adoption of Liberty Global’s accounting

policies during the Successor periods more than offset decreases in the level of other capitalizable activities;

• Increases in programming and related costs of £5.8 million or 4.4% and £12.1 million or 4.5%, respectively, due primarily

to the net effect of (i) increased costs for sports rights, (ii) lower costs arising from the cancellation and renegotiation of

certain programming agreements, (iii) a £6.9 million nonrecurring reduction of programming costs that resulted from the

favorable resolution of an operational contingency during the second quarter of 2014 and (iv) increased costs due to

higher rates for certain basic and premium services;

• Decreases in outsourced labor and professional fees of £1.8 million or 7.7% and £4.9 million and 10.4%, respectively,

due primarily to lower call center costs;

• An increase (decrease) in equipment costs of £1.9 million or 6.3% and (£4.7 million) or (6.4%), respectively, due primarily

to the net effect of (i) decreased mobile handset costs as a result of continued growth of SIM-only contracts, (ii) increased

costs associated with higher value handsets and (iii) decreased mobile handset sales to third-party retailers;

• Increases in information technology related expenses of £0.8 million and £2.9 million, respectively, due primarily to

increased costs from contract renewals and additional support requirements;