Virgin Media 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Condensed Consolidated Financial Statements — (Continued)

June 30, 2014

(unaudited)

22

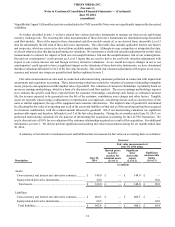

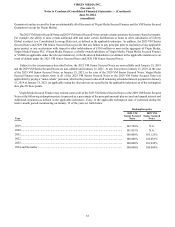

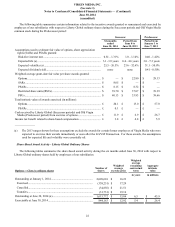

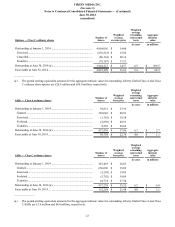

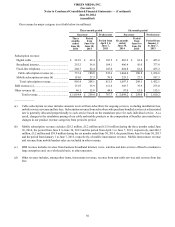

The following table summarizes certain information related to the incentive awards granted or remeasured and exercised by

employees of our subsidiaries with respect to Liberty Global ordinary shares during the Successor periods and Old Virgin Media

common stock during the Predecessor period:

Successor Predecessor

Six months

ended

June 30, 2014

Period from

June 8 to

June 30, 2013

Period from

January 1 to

June 7, 2013

Assumptions used to estimate fair value of options, share appreciation

rights (SARs) and PSARs granted:

Risk-free interest rate................................................................................ 0.81 - 1.31% 1.0 - 1.14% 0.40 - 1.42%

Expected life (a)........................................................................................ 3.1 -3.9 years 0.4 - 4.6 years 3.0 - 7.3 years

Expected volatility (a)............................................................................... 25.5 - 26.5% 23.6 - 32.6% 31.1 - 50.9%

Expected dividend yield............................................................................ none none 0.41 - 0.50%

Weighted average grant-date fair value per share awards granted:

Options...................................................................................................... $ — $ 22.80 $ 29.13

SARs ......................................................................................................... $ 8.05 $ — $ —

PSARs....................................................................................................... $ 8.15 $ 8.32 $ —

Restricted share units (RSUs) ................................................................... $ 39.70 $ 37.07 $ 39.39

PSUs.......................................................................................................... $ 40.13 $ 33.93 $ 39.66

Total intrinsic value of awards exercised (in millions):

Options...................................................................................................... £ 20.1 £ 13.0 £ 57.0

PSARs....................................................................................................... £ 0.1 £ — £ —

Cash received by Liberty Global (Successor periods) and Old Virgin

Media (Predecessor period) from exercise of options................................ £ 11.9 £ 6.9 £ 26.7

Income tax benefit related to share-based compensation .............................. £ 3.8 £ 4.8 £ 5.9

______________

(a) The 2013 ranges shown for these assumptions exclude the awards for certain former employees of Virgin Media who were

expected to exercise their awards immediately or soon after the LG/VM Transaction. For these awards, the assumptions

used for expected life and volatility were essentially nil.

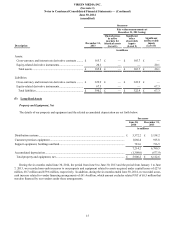

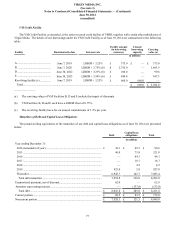

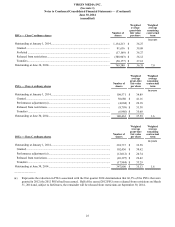

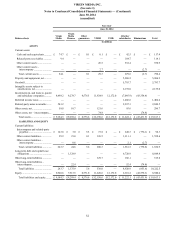

Share-Based Award Activity - Liberty Global Ordinary Shares

The following tables summarize the share-based award activity during the six months ended June 30, 2014 with respect to

Liberty Global ordinary shares held by employees of our subsidiaries:

Options — Class A ordinary shares Number of

shares

Weighted

average

exercise price

Weighted

average

remaining

contractual

term

Aggregate

intrinsic

value

in years in millions

Outstanding at January 1, 2014.......................................................... 2,020,610 $ 16.23

Exercised.......................................................................................... (338,251) $ 17.29

Cancelled.......................................................................................... (34,856) $ 21.51

Transfers........................................................................................... (31,731) $ 19.16

Outstanding at June 30, 2014 (a)........................................................ 1,615,772 $ 15.84 6.5 $ 45.9

Exercisable at June 30, 2014.............................................................. 844,163 $ 12.92 5.4 $ 26.4