Virgin Media 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Condensed Consolidated Financial Statements — (Continued)

June 30, 2014

(unaudited)

10

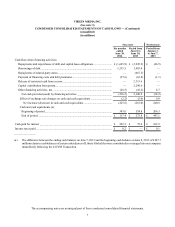

(3) Derivative Instruments

We have entered into various derivative instruments to manage (i) interest rate exposure, (ii) foreign currency exposure with

respect to the United States (U.S.) dollar ($) and (iii) equity exposure with respect to the dilutive effects of the VM Convertible

Notes, as defined and described in note 6. Although we applied hedge accounting to certain of our derivative instruments prior

to the LG/VM Transaction, we currently do not apply hedge accounting to our derivative instruments. Accordingly, during the

Successor periods, changes in the fair values of our derivative instruments are recorded in realized and unrealized gains or losses

on derivative instruments, net, in our condensed consolidated statements of operations. Prior to the LG/VM Transaction, the

effective portion of the net fair value adjustments associated with these derivative instruments was reflected in other comprehensive

earnings (loss).

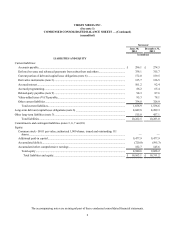

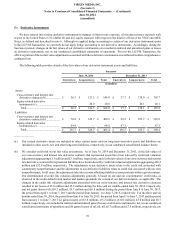

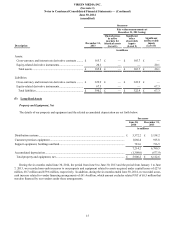

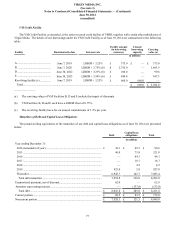

The following table provides details of the fair values of our derivative instrument assets and liabilities:

Successor

June 30, 2014 December 31, 2013

Current (a) Long-term (a) Total Current (a) Long-term (a) Total

in millions

Assets:

Cross-currency and interest rate

derivative contracts (b).................... £ 26.5 £ 121.5 £ 148.0 £ 27.7 £ 138.0 £ 165.7

Equity-related derivative

instruments (c)................................. — 20.0 20.0 — 20.1 20.1

Total................................................ £ 26.5 £ 141.5 £ 168.0 £ 27.7 £ 158.1 £ 185.8

Liabilities:

Cross-currency and interest rate

derivative contracts (b).................... £ 70.8 £ 329.7 £ 400.5 £ 69.2 £ 253.7 £ 322.9

Equity-related derivative

instruments (c)................................. 64.9 — 64.9 67.3 — 67.3

Total................................................ £ 135.7 £ 329.7 £ 465.4 £ 136.5 £ 253.7 £ 390.2

______________

(a) Our current derivative assets are included in other current assets and our long-term derivative assets and liabilities are

included in other assets, net, and other long-term liabilities, respectively, in our condensed consolidated balance sheets.

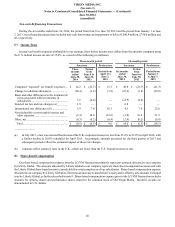

(b) We consider credit risk in our fair value assessments. As of June 30, 2014 and December 31, 2013, (i) the fair values of

our cross-currency and interest rate derivative contracts that represented assets have been reduced by credit risk valuation

adjustments aggregating £1.7 million and £3.1 million, respectively, and (ii) the fair values of our cross-currency and interest

rate derivative contracts that represented liabilities have been reduced by credit risk valuation adjustments aggregating £26.2

million and £32.8 million, respectively. The adjustments to our derivative assets relate to the credit risk associated with

counterparty nonperformance and the adjustments to our derivative liabilities relate to credit risk associated with our own

nonperformance. In all cases, the adjustments take into account offsetting liability or asset positions within a given contract.

Our determination of credit risk valuation adjustments generally is based on our and our counterparties’ credit risks, as

observed in the credit default swap market and market quotations for certain of our debt instruments, as applicable. The

changes in the credit risk valuation adjustments associated with our cross-currency and interest rate derivative contracts

resulted in net losses of £3.8 million and £5.2 million during the three and six months ended June 30, 2014, respectively,

and net gains (losses) of (£10.2 million), £9.7 million and (£6.8 million) during the period from June 8 to June 30, 2013,

the period from April 1 to June 7, 2013 and the period from January 1 to June 7, 2013, respectively. For the three and six

months ended June 30, 2014, the period from June 8 to June 30, 2013, the period from April 1 to June 7, 2013 and the period

from January 1 to June 7, 2013 (a) gains (losses) of (£3.8 million), (£5.2 million), (£10.2 million), £3.0 million and £0.7

million, respectively, are included in realized and unrealized gains (losses) on derivative instruments, net, in our condensed

consolidated statements of operations and (b) gains (losses) of nil, nil, nil, £6.7 million and (£7.5 million), respectively, are