Virgin Media 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Condensed Consolidated Financial Statements

June 30, 2014

VIRGIN MEDIA INC.

12300 Liberty Boulevard

Englewood, Colorado 80112

Table of contents

-

Page 1

Condensed Consolidated Financial Statements June 30, 2014 VIRGIN MEDIA INC. 12300 Liberty Boulevard Englewood, Colorado 80112 -

Page 2

VIRGIN MEDIA INC. TABLE OF CONTENTS Page Number CONDENSED CONSOLIDATED FINANCIAL STATEMENTS Condensed Consolidated Balance Sheets as of June 30, 2014 and December 31, 2013 (unaudited)...Condensed Consolidated Statements of Operations for the Three Months Ended June 30, 2014, the Period from June 8 ... -

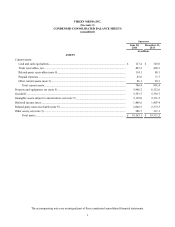

Page 3

... CONSOLIDATED BALANCE SHEETS (unaudited) Successor June 30, December 31, 2014 2013 in millions ASSETS Current assets: Cash and cash equivalents ...£ Trade receivables, net...Related-party receivables (note 9)...Prepaid expenses ...Other current assets (note 3)...Total current assets ...Property... -

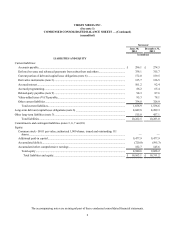

Page 4

...: Accounts payable...£ Deferred revenue and advanced payments from subscribers and others...Current portion of debt and capital lease obligations (note 6) ...Derivative instruments (note 3) ...Accrued interest...Accrued programming...Related-party payables (note 9)...Value-added taxes (VAT... -

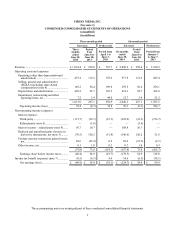

Page 5

... Six months from ended June 8 to June 30, June 30, 2014 2013 Predecessor Period from January 1 to June 7, 2013 Revenue ...£ 1,054.4 £ Operating costs and expenses: Operating (other than depreciation and 453.4 amortization) ...Selling, general and administrative (SG&A) (including share-based 149... -

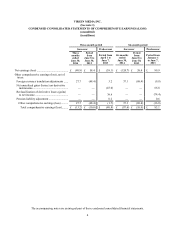

Page 6

VIRGIN MEDIA INC. (See note 1) CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE EARNINGS (LOSS) (unaudited) (in millions) Three-month period Successor Three Period months from ended June 8 to June 30, June 30, 2014 2013 Predecessor Period from April 1 to June 7, 2013 Six-month period Successor ... -

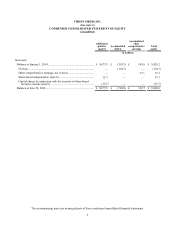

Page 7

...-in capital Total equity Successor: Balance at January 1, 2014 ...£ 9,477.9 £ Net loss ...- Other comprehensive earnings, net of taxes...- Share-based compensation (note 8)...15.7 Capital charge in connection with the exercise of share-based (15.7) incentive awards (note 9) ...Balance at June... -

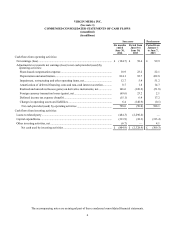

Page 8

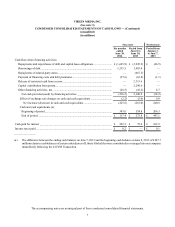

... to reconcile net earnings (loss) to net cash provided (used) by operating activities: Share-based compensation expense...Depreciation and amortization...Impairment, restructuring and other operating items, net...Amortization of deferred financing costs and non-cash interest accretion...Realized... -

Page 9

...financing costs and debt premiums...Release of restricted cash from escrow...- 2,313.6 Capital contribution from parent...- 2,290.6 (28.5) (10.2) Other financing activities, net ...(216.5) Net cash provided (used) by financing activities ...2,100.9 (2.2) (3.0) Effect of exchange rate changes on cash... -

Page 10

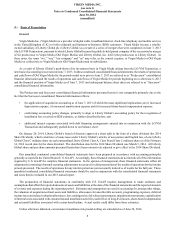

... of digital cable, broadband internet, fixed-line telephony and mobile services in the United Kingdom (U.K.) to both residential and business-to-business (B2B) customers. Virgin Media became a whollyowned subsidiary of Liberty Global plc (Liberty Global) as a result of a series of mergers that... -

Page 11

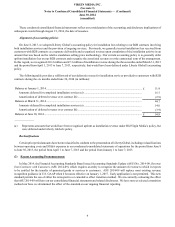

... 7, 2013, respectively, that would have been deferred under Liberty Global's accounting policy. The following table provides a rollforward of our deferred revenue for installation services provided to customers with B2B contracts during the six months ended June 30, 2014 (in millions): Balance at... -

Page 12

... table provides details of the fair values of our derivative instrument assets and liabilities: Successor June 30, 2014 Current (a) Long-term (a) Total Current (a) in millions December 31, 2013 Long-term (a) Total Assets: Cross-currency and interest rate derivative contracts (b) ...Equity-related... -

Page 13

...termination that relates to future periods is classified as a financing activity. The classification of these cash inflows (outflows) is as follows (in millions): Successor Six months Period ended from June June 30, 8 to June 2014 30, 2013 Predecessor Period from January 1 to June 7, 2013 Operating... -

Page 14

... 30, 2014, we present a single date that represents the applicable final maturity date. Cross-currency and Interest Rate Derivative Contracts Cross-currency Swaps: The terms of our outstanding cross-currency swap contracts at June 30, 2014, which are held by our subsidiary, Virgin Media Investment... -

Page 15

...We account for the Virgin Media Capped Calls at fair value using a binomial pricing model and changes in fair value are reported in realized and unrealized gains (losses) on derivative instruments, net, in our condensed consolidated statements of operations. The fair value of the Virgin Media Capped... -

Page 16

... value measurements at June 30, 2014 using: Quoted prices Significant Significant in active other unobservable markets for observable inputs identical assets inputs (Level 3) (Level 1) (Level 2) in millions Description June 30, 2014 Assets: Cross-currency and interest rate derivative contracts... -

Page 17

... at December 31, 2013 using: Quoted prices Significant Significant in active other unobservable markets for observable inputs identical assets inputs (Level 3) (Level 1) (Level 2) in millions Description December 31, 2013 Assets: Cross-currency and interest rate derivative contracts ...£ Equity... -

Page 18

... effect at June 30, 2014 for all borrowings outstanding pursuant to each debt instrument including any applicable margin. The interest rates presented represent stated rates and do not include the impact of our interest rate derivative contracts, deferred financing costs, original issue premiums or... -

Page 19

... hierarchy) or, when quoted market prices are unavailable or not considered indicative of fair value, discounted cash flow models (mostly Level 2 of the fair value hierarchy). The discount rates used in the cash flow models are based on the market interest rates and estimated credit spreads of the... -

Page 20

...) by paying a "make-whole" premium, which is the present value of all remaining scheduled interest payments to January 15, 2019 or January 15, 2021 (as applicable) using the discount rate (as specified in the applicable indenture) as of the redemption date plus 50 basis points. Virgin Media Secured... -

Page 21

... The pound sterling equivalents of the maturities of our debt and capital lease obligations as of June 30, 2014 are presented below: Debt Capital lease obligations in millions Total Year ending December 31: 2014 (remainder of year) ...2015 ...2016 ...2017 ...2018 ...2019 ...Thereafter...Total debt... -

Page 22

... recharged to us by Liberty Global, as further described in note 9. Share-based compensation expense prior to the LG/VM Transaction includes amounts for options, shares and performance shares related to the common stock of Old Virgin Media. Incentive awards are denominated in U.S. dollars. 20 -

Page 23

...the LG/VM Transaction, Liberty Global issued Liberty Global share-based incentive awards (Virgin Media Replacement Awards) to employees and former directors of our company in exchange for corresponding Old Virgin Media awards. During the post-acquisition period ended June 30, 2013, £18.3 million of... -

Page 24

... (RSUs) ...PSUs...Total intrinsic value of awards exercised (in millions): Options ...PSARs ...Cash received by Liberty Global (Successor periods) and Old Virgin Media (Predecessor period) from exercise of options...Income tax benefit related to share-based compensation ..._____ (a) 0.81 - 1.31... -

Page 25

... value for outstanding Liberty Global Class A and Class C ordinary share options are £26.8 million and £64.0 million, respectively. Weighted average remaining contractual term in years SARs - Class A ordinary shares Number of shares Weighted average base price Aggregate intrinsic value... -

Page 26

... value for outstanding Liberty Global Class A and Class C PSARs are £1.3 million and £4.6 million, respectively. Weighted average grant-date fair value per share Weighted average remaining contractual term in years RSUs - Class A ordinary shares Number of shares Outstanding at January 1, 2014... -

Page 27

...) Weighted average grant-date fair value per share Weighted average remaining contractual term in years RSUs - Class C ordinary shares Number of shares Outstanding at January 1, 2014...Granted ...Forfeited ...Released from restrictions ...Transfers ...Outstanding at June 30, 2014... 1,134,213 91... -

Page 28

...the outstanding balance of the loan was repaid in full during July 2013. This loan bore interest at a rate of 7.5%. The following table provides details of our related-party balances: Successor June 30, December 31, 2014 2013 in millions Receivables (a) ...£ Long-term notes receivable (b) ...Total... -

Page 29

... originated as a result of a non-cash transaction on the date of the LG/VM Transaction that resulted in a corresponding increase to our additional paid-in capital. This non-cash transaction involved the transfer of shares of Old Virgin Media held in a trust to a trust consolidated by Liberty Global... -

Page 30

... of business, we have entered into agreements that commit our company to make cash payments in future periods with respect to programming contracts, network and connectivity commitments, purchases of customer premises and other equipment, non-cancelable operating leases and other items. Our pound... -

Page 31

... potential losses or cash outflows that might result from any unfavorable outcomes. (11) Segment Reporting We operate in one geographical area, the U.K., within which we provide digital cable, broadband internet, fixed-line telephony and mobile services to residential and/or business customers. 29 -

Page 32

...services, excluding installation fees, mobile services revenue and late fees. Subscription revenue from subscribers who purchase bundled services at a discounted rate is generally allocated proportionally to each service based on the standalone price for each individual service. As a result, changes... -

Page 33

... period from April 1 to June 7, 2013, the six months ended June 30, 2014, the Successor period from June 8 to June 30, 2013 and the Predecessor period from January 1 to June 7, 2013, as required by the applicable underlying indentures. As of June 30, 2014, Virgin Media Finance is the issuer of the... -

Page 34

... to Condensed Consolidated Financial Statements - (Continued) June 30, 2014 (unaudited) Successor June 30, 2014 Virgin Media ASSETS Virgin Media Finance Other guarantors All other subsidiaries Balance sheets VMIH VMIL in millions Eliminations Total Current assets: Cash and cash equivalents... -

Page 35

... to Condensed Consolidated Financial Statements - (Continued) June 30, 2014 (unaudited) Successor December 31, 2013 Virgin Media ASSETS Virgin Media Finance Other guarantors All other subsidiaries Balance sheets VMIH VMIL in millions Eliminations Total Current assets: Cash and cash equivalents... -

Page 36

...months ended June 30, 2014 Virgin Media Virgin Media Finance Other guarantors All other subsidiaries Statements of operations VMIH VMIL in millions Eliminations Total Revenue ...£ Operating costs and expenses: Operating (other than depreciation and amortization) ...SG&A (including share-based... -

Page 37

...June 30, 2013 Virgin Media Virgin Media Finance Other guarantors All other subsidiaries Statements of operations VMIH VMIL in millions Eliminations Total Revenue ...£ Operating costs and expenses: Operating (other than depreciation and amortization) ...SG&A (including share-based compensation... -

Page 38

... 7, 2013 Old Virgin Media Virgin Media Finance Other guarantors All other subsidiaries Statements of operations VMIH VMIL Eliminations Total in millions Revenue ...£ Operating costs and expenses: Operating (other than depreciation and amortization)...SG&A (including share-based compensation... -

Page 39

...Financial Statements - (Continued) June 30, 2014 (unaudited) Successor Six months ended June 30, 2014 Virgin Media Virgin Media Finance Other guarantors All other subsidiaries Statements of operations VMIH VMIL in millions Eliminations Total Revenue...£ Operating costs and expenses: Operating... -

Page 40

...June 30, 2013 Virgin Media Virgin Media Finance Other guarantors All other subsidiaries Statements of operations VMIH VMIL in millions Eliminations Total Revenue ...£ Operating costs and expenses: Operating (other than depreciation and amortization) ...SG&A (including share-based compensation... -

Page 41

... Financial Statements - (Continued) June 30, 2014 (unaudited) Predecessor Period from January 1 to June 7, 2013 Old Virgin Media Virgin Media Finance Other guarantors All other subsidiaries Statements of operations VMIH VMIL in millions Eliminations Total Revenue ...£ Operating costs... -

Page 42

... Financial Statements - (Continued) June 30, 2014 (unaudited) Successor Six months ended June 30, 2014 Virgin Media Virgin Media Finance Other guarantors All other subsidiaries Statements of cash flows VMIH in millions VMIL Total Cash flows from operating activities: Net cash provided (used... -

Page 43

... June 30, 2013 Virgin Media Virgin Media Finance Other guarantors All other subsidiaries Statements of cash flows VMIH in millions VMIL Total Cash flows from operating activities: Net cash provided (used) by operating activities ...£ Cash flows from investing activities: Loans to related party... -

Page 44

...June 30, 2014 (unaudited) Predecessor Period from January 1 to June 7, 2013 Old Virgin Media Virgin Media Finance Other guarantors All other subsidiaries Statements of cash flows VMIH VMIL in millions Eliminations Total Cash flows from operating activities: Net cash provided (used) by operating... -

Page 45

... from April 1 to June 7, 2013, the six months ended June 30, 2014, the Successor period from June 8 to June 30, 2013 and the Predecessor period from January 1 to June 7, 2013, as required by the applicable underlying indentures. As of June 30, 2014, Virgin Media Secured Finance is the issuer of the... -

Page 46

VIRGIN MEDIA INC. (See note 1) Notes to Condensed Consolidated Financial Statements - (Continued) June 30, 2014 (unaudited) Successor June 30, 2014 Balance sheets ASSETS Virgin Media Virgin Media Secured Finance NonGuarantors guarantors in millions Eliminations Total Current assets: Cash and cash ... -

Page 47

... to Condensed Consolidated Financial Statements - (Continued) June 30, 2014 (unaudited) Successor December 31, 2013 Balance sheets ASSETS Virgin Media Virgin Media Secured Finance NonGuarantors guarantors in millions Eliminations Total Current assets: Cash and cash equivalents ...£ Related-party... -

Page 48

...Three months ended June 30, 2014 Virgin Media Virgin Media Secured Finance NonGuarantors guarantors in millions Statements of operations Eliminations Total Revenue ...£ Operating costs and expenses: Operating (other than depreciation and amortization) ...SG&A (including share-based compensation... -

Page 49

...June 30, 2013 Virgin Media Virgin Media Secured Finance NonGuarantors Guarantors in millions Statements of operations Eliminations Total Revenue ...£ Operating costs and expenses: Operating (other than depreciation and amortization)...SG&A (including share-based compensation)...Depreciation and... -

Page 50

...April 1, 2013 to June 7, 2013 Old Virgin Media Virgin Media Secured Finance NonGuarantors guarantors in millions Statements of operations Eliminations Total Revenue...£ Operating costs and expenses: Operating (other than depreciation and amortization) ...SG&A (including share-based compensation... -

Page 51

... Six months ended June 30, 2014 Virgin Media Virgin Media Secured Finance NonGuarantors Guarantors in millions Statements of operations Eliminations Total Revenue ...£ Operating costs and expenses: Operating (other than depreciation and amortization)...SG&A (including share-based compensation... -

Page 52

...June 30, 2013 Virgin Media Virgin Media Secured Finance NonGuarantors Guarantors in millions Statements of operations Eliminations Total Revenue ...£ Operating costs and expenses: Operating (other than depreciation and amortization)...SG&A (including share-based compensation)...Depreciation and... -

Page 53

... June 7, 2013 Old Virgin Media Virgin Media Secured Finance NonGuarantors Guarantors in millions Statements of operations Eliminations Total Revenue...£ Operating costs and expenses: Operating (other than depreciation and amortization)...SG&A (including share-based compensation)...Depreciation... -

Page 54

... Six months ended June 30, 2014 Virgin Media NonSecured Guarantors guarantors Finance in millions Statements of cash flows Virgin Media Total Cash flows from operating activities: Net cash provided (used) by operating activities ...£ Cash flows from investing activities: Loans to related... -

Page 55

... Financial Statements - (Continued) June 30, 2014 (unaudited) Statements of cash flows Virgin Media Successor Period from June 8 to June 30, 2013 Virgin Media NonSecured Guarantors guarantors Finance in millions Total Cash flows from operating activities: (6.5) £ Net cash provided (used... -

Page 56

... 30, 2014 (unaudited) Predecessor Period from January 1 to June 7, 2013 Virgin Media NonSecured Guarantors Guarantors Eliminations Finance in millions Statements of cash flows Old Virgin Media Total Cash flows from operating activities: Net cash provided (used) by operating activities...£ Cash... -

Page 57

... existing service offerings, including our digital cable, broadband internet, fixed-line telephony, mobile and B2B service offerings, and of new technology, programming alternatives and other products and services that we may offer in the future; our ability to manage rapid technological changes; 55... -

Page 58

... maintain or increase the number of subscriptions to our digital cable, broadband internet, fixed-line telephony and mobile service offerings and our average revenue per household; our ability to provide satisfactory customer service, including support for new and evolving products and services; our... -

Page 59

... of Liberty Global that provides digital cable, broadband internet, fixed-line telephony and mobile services in the U.K. to both residential and B2B customers. We are one of the U.K.'s largest providers of residential digital cable, broadband internet and fixed-line telephony services in terms of... -

Page 60

... depreciation expense, (ii) increased amortization expense and (iii) increased share-based compensation expense; conforming accounting policy changes, primarily to align to Liberty Global's accounting policy for the recognition of installation fees received on B2B contracts, as further described in... -

Page 61

... ended June 30, 2014 Period from June 8 to June 30, 2013 Predecessor Period from April 1 to June 7, 2013 Combined Three months ended June 30, 2013 Change Condensed Consolidated Statements of Operations £ % Revenue...£1,054.4 £ Operating costs and expenses: Operating (other than depreciation... -

Page 62

.... We use the term "subscription revenue" in the following discussion to refer to amounts received from cable and mobile residential subscribers for ongoing services, excluding installation fees and late fees. Subscription revenue from subscribers who purchase bundled services at a discounted rate is... -

Page 63

... authorities introduce fixed-line or mobile termination rate changes, we would experience prospective changes in our interconnect revenue and costs. The ultimate impact of any such changes in termination rates on our operating cash flow would be dependent on the call or text messaging patterns that... -

Page 64

... the six months ended June 30, 2014 and 2013, respectively, of mobile interconnect revenue. Mobile interconnect revenue and revenue from mobile handset sales are included in other revenue. B2B revenue includes revenue from business broadband internet, voice, wireless and data services offered to... -

Page 65

... rates in April 2013 and fixed-line termination rates in February 2014, (ii) our non-cable subscriber base and (iii) mobile handset sales. (b) (c) (d) On March 19, 2014, the U.K. government announced a change in legislation with respect to the charging of VAT in connection with prompt payment... -

Page 66

...amount that was based on the relative standalone selling price methodology. Our current accounting policy is generally to defer upfront and nonrecurring fees on B2B contracts where we maintain ownership of the installed equipment and recognize the associated revenue on a straight line basis over the... -

Page 67

... changes in other operating expense categories. • • SG&A expenses SG&A expenses include human resources, information technology, general services, management, finance, legal and sales and marketing costs, share-based compensation and other general expenses. We do not include share-based... -

Page 68

... (a) Includes share-based compensation expense related to Liberty Global PSUs and the Challenge Performance Awards, which were issued on June 24, 2013. In connection with the LG/VM Transaction, Liberty Global issued Virgin Media Replacement Awards to employees and former directors of our company in... -

Page 69

... dollar market. In addition, the gains during the three and six months ended June 30, 2013 include net losses of £0.5 million and £17.0 million, respectively, resulting from changes in our credit risk valuation adjustments. These amounts represent activity related to the Virgin Media Capped Calls... -

Page 70

...rates and are non-cash in nature until such time as the amounts are settled. The details of our foreign currency transaction gains (losses), net, are as follows: Three months ended June 30, 2014 Six months ended June 30, 2013 2013 2014 in millions U.S. dollar denominated debt issued by our company... -

Page 71

... tax expenses. Operating cash flow is defined as revenue less operating and SG&A expenses (excluding share-based compensation, depreciation and amortization and impairment, restructuring and other operating items). Due largely to the fact that Liberty Global generally seeks to cause our company... -

Page 72

...company to maintain our debt at levels that result in a consolidated debt balance (measured using debt figures at swapped foreign currency exchange rates, consistent with the covenant calculation requirements of our debt agreements) that is between four and five times our consolidated operating cash... -

Page 73

... Six months ended June 30, 2014 Period from June 8 to June 30, 2013 Predecessor Period from January 1 to June 7, 2013 Combined Six months ended June 30, 2013 Change Net cash provided (used) by operating activities...£ Net cash used by investing activities ...Net cash provided (used) by financing... -

Page 74

... pay in these periods under these contracts. Payments to programming vendors have in the past represented, and are expected to continue to represent in the future, a significant portion of our operating costs. In this regard, during the six months ended June 30, 2014 and 2013, the programming costs... -

Page 75

... benefit plans and similar agreements, pursuant to which we expect to make payments in future periods. For information concerning our derivative instruments, including the net cash paid or received in connection with these instruments during the six months ended June 30, 2014 and 2013, see note 3 to...