US Cellular 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 16 STOCK-BASED COMPENSATION (Continued)

stock issued under these plans was required. Compensation cost is measured as the difference between

the cost of the shares to plan participants and the market value of the shares on the date of issuance.

Compensation of Non-Employee Directors—U.S. Cellular issued 6,600, 9,000 and 5,200 Common Shares

in 2011, 2010 and 2009, respectively, under its Non-Employee Director compensation plan.

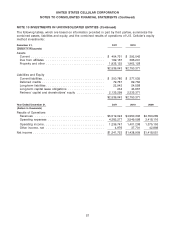

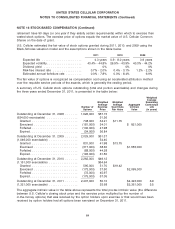

Stock-Based Compensation Expense

The following table summarizes stock-based compensation expense recognized during 2011, 2010 and

2009:

Year Ended December 31, 2011 2010 2009

(Dollars in thousands)

Stock option awards ....................................... $ 9,549 $ 7,179 $ 7,024

Restricted stock unit awards ................................. 10,037 10,056 8,640

Deferred compensation matching stock unit awards ................ 12 165 151

Awards under employee stock purchase plan ..................... 255 314 241

Awards under Non-Employee Director compensation plan ............ 330 330 306

Total stock-based compensation, before income taxes ............... 20,183 18,044 16,362

Income tax benefit ........................................ (7,581) (6,812) (6,154)

Total stock-based compensation expense, net of income taxes ........ $12,602 $11,232 $10,208

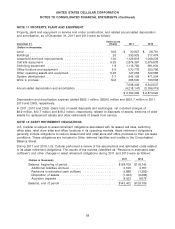

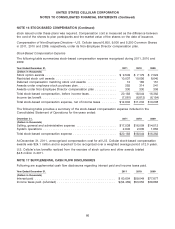

The following table provides a summary of the stock-based compensation expense included in the

Consolidated Statement of Operations for the years ended:

December 31, 2011 2010 2009

(Dollars in thousands)

Selling, general and administrative expense ...................... $17,538 $16,009 $14,512

System operations ........................................ 2,645 2,035 1,850

Total stock-based compensation expense ........................ $20,183 $18,044 $16,362

At December 31, 2011, unrecognized compensation cost for all U.S. Cellular stock-based compensation

awards was $24.1 million and is expected to be recognized over a weighted average period of 2.0 years.

U.S. Cellular’s tax benefits realized from the exercise of stock options and other awards totaled

$4.6 million in 2011.

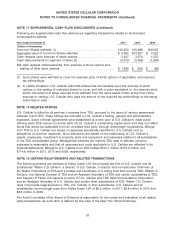

NOTE 17 SUPPLEMENTAL CASH FLOW DISCLOSURES

Following are supplemental cash flow disclosures regarding interest paid and income taxes paid.

Year Ended December 31, 2011 2010 2009

(Dollars in thousands)

Interest paid ............................................ $60,604 $59,049 $77,877

Income taxes paid (refunded) ................................ $(54,469) $53,050 $36,863

66