US Cellular 2011 Annual Report Download - page 10

Download and view the complete annual report

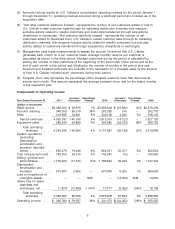

Please find page 10 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Additions to Property, plant and equipment totaled $782.5 million, including expenditures to construct

cell sites, increase capacity in existing cell sites and switches, deploy fourth generation Long-term

Evolution (‘‘4G LTE’’) equipment, outfit new and remodel existing retail stores, develop new billing and

other customer management related systems and platforms, and enhance existing office systems. Total

cell sites in service increased by 237, or 3%, year-over-year to 7,882.

• U.S. Cellular continued its efforts on a number of multi-year initiatives including the development of a

Billing and Operational Support System (‘‘B/OSS’’) with a new point-of-sale system to consolidate

billing on one platform; an Electronic Data Warehouse/Customer Relationship Management System to

collect and analyze information more efficiently and thereby build and improve customer relationships;

and a new Internet/Web platform to enable customers to complete a wide range of transactions and to

manage their accounts online.

• Operating income increased $79.3 million, or 39%, to $280.8 million in 2011 from $201.5 million in

2010. Factors in the increase were higher service revenues as discussed above and a gain from a

license swap completed in 2011, offset by higher costs of serving and retaining customers in an

increasingly competitive industry, including costs of investments in multi-year initiatives.

• On May 9, 2011, U.S. Cellular paid $24.6 million in cash to purchase the remaining ownership interest

in a wireless business in which it previously held a noncontrolling interest. In connection with this

transaction, U.S. Cellular recognized a gain of $13.4 million. See Note 8—Acquisitions, Divestitures and

Exchanges in the Notes to Consolidated Financial Statements for additional details.

• U.S. Cellular, taking advantage of lower interest rates, sold $342 million of unsecured 6.95% Senior

Notes due 2060 on May 16, 2011 and used the proceeds to redeem $330 million of unsecured 7.5%

Senior Notes due 2034 on June 20, 2011. See Note 13—Debt in the Notes to Consolidated Financial

Statements for additional details.

• Net income attributable to U.S. Cellular shareholders increased $39 million, or 29%, to $175.0 million in

2011 compared to $136.1 million in 2010, primarily due to higher operating income. Basic earnings per

share was $2.06 in 2011, which was $0.48 higher than in 2010, and Diluted earnings per share was

$2.05, which was $0.48 higher than in 2010.

U.S. Cellular anticipates that future results will be affected by the following factors:

– The Belief Project, which is intended to accelerate growth and have a positive impact on long-term

profitability by increasing postpaid gross additions over the next several years and by contributing to

incremental growth in average revenue per customer and improvement of U.S. Cellular’s already low

postpaid churn rate;

– Continued uncertainty related to current economic conditions and their impact on customer

purchasing and payment behaviors;

– Relative ability to attract and retain customers, including the ability to reverse recent customer net

losses, in a competitive marketplace in a cost effective manner;

– Increased competition in the wireless industry, including potential reductions in pricing for products

and services overall and impacts associated with the expanding presence of carriers offering

low-priced, unlimited prepaid service;

– Potential increases in prepaid customers, who generally generate lower ARPU, as a percentage of

U.S. Cellular’s customer base in response to changes in customer preferences and industry

dynamics;

– Increasing penetration in the wireless industry, requiring U.S. Cellular to grow revenues primarily

from selling additional products and services to its existing customers, increasing the number of

multi-device users among its existing customers, increasing data products and services and

attracting wireless customers switching from other wireless carriers rather than by adding customers

that are new to wireless service;

2