US Cellular 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

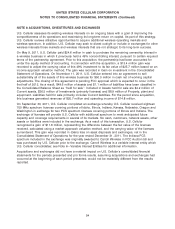

NOTE 14 COMMITMENTS AND CONTINGENCIES (Continued)

Rent revenue totaled $39.2 million, $35.4 million and $31.8 million in 2011, 2010 and 2009, respectively.

Indemnifications

U.S. Cellular enters into agreements in the normal course of business that provide for indemnification of

counterparties. The terms of the indemnifications vary by agreement. The events or circumstances that

would require U.S. Cellular to perform under these indemnities are transaction specific; however, these

agreements may require U.S. Cellular to indemnify the counterparty for costs and losses incurred from

litigation or claims arising from the underlying transaction. U.S. Cellular is unable to estimate the

maximum potential liability for these types of indemnifications as the amounts are dependent on the

outcome of future events, the nature and likelihood of which cannot be determined at this time.

Historically, U.S. Cellular has not made any significant indemnification payments under such agreements.

Legal Proceedings

U.S. Cellular is involved or may be involved from time to time in legal proceedings before the FCC, other

regulatory authorities, and/or various state and federal courts. If U.S. Cellular believes that a loss arising

from such legal proceedings is probable and can be reasonably estimated, an amount is accrued in the

financial statements for the estimated loss. If only a range of loss can be determined, the best estimate

within that range is accrued; if none of the estimates within that range is better than another, the low end

of the range is accrued. The assessment of the expected outcomes of legal proceedings is a highly

subjective process that requires judgments about future events. The legal proceedings are reviewed at

least quarterly to determine the adequacy of accruals and related financial statement disclosures. The

ultimate outcomes of legal proceedings could differ materially from amounts accrued in the financial

statements.

U.S. Cellular has accrued $1.7 million and $1.5 million with respect to legal proceedings and unasserted

claims as of December 31, 2011 and 2010, respectively. U.S. Cellular has not accrued any amount for

legal proceedings if it cannot estimate the amount of the possible loss or range of loss. U.S. Cellular

does not believe that the amount of any contingent loss in excess of the amounts accrued would be

material.

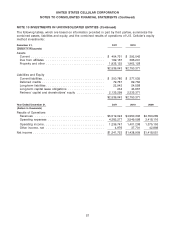

NOTE 15 COMMON SHAREHOLDERS’ EQUITY

Tax-Deferred Savings Plan

U.S. Cellular has reserved 67,215 Common Shares for issuance under the TDS Tax-Deferred Savings

Plan, a qualified profit-sharing plan pursuant to Sections 401(a) and 401(k) of the Internal Revenue Code.

Participating employees have the option of investing their contributions in a U.S. Cellular Common Share

fund, a TDS Common Share fund, a TDS Special Common Share fund, or certain unaffiliated funds.

Series A Common Shares

Series A Common Shares are convertible on a share-for-share basis into Common Shares. In matters

other than the election of directors, each Series A Common Share is entitled to ten votes per share,

compared to one vote for each Common Share. The Series A Common Shares are entitled to elect 75%

of the directors (rounded down), and the Common Shares elect 25% of the directors (rounded up). As of

December 31, 2011, a majority of U.S. Cellular’s Common Shares and all of U.S. Cellular’s outstanding

Series A Common Shares were held by TDS.

62