US Cellular 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

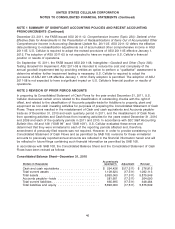

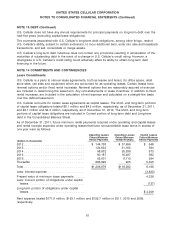

NOTE 5 INCOME TAXES (Continued)

As of December 31, 2011, U.S. Cellular believes it is reasonably possible that unrecognized tax benefits

could decrease by approximately $9.7 million in the next twelve months. The nature of the uncertainty

primarily relates to state income tax positions and their resolution or the expiration of statutes of

limitation.

U.S. Cellular recognizes accrued interest and penalties related to unrecognized tax benefits in Income tax

expense. The amounts charged to Income tax expense related to interest and penalties resulted in a

benefit in 2011 of $2.6 million, and expense in 2010 and 2009 of $3.0 million and $2.1 million,

respectively. Net accrued interest and penalties were $15.6 million and $19.3 million at December 31,

2011 and 2010, respectively.

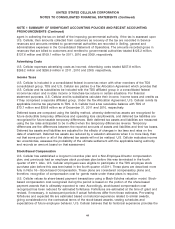

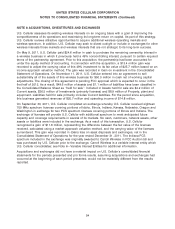

A summary of U.S. Cellular’s deferred tax asset valuation allowance is as follows:

2011(1) 2010 2009

(Dollars in thousands)

Balance at January 1 ...................................... $29,891 $19,234 $ 23,565

Charged to costs and expenses ............................ (1,450) (832) (10,348)

Charged to other accounts ................................ 1,820 11,489 6,017

Balance at December 31, ................................... $30,261 $29,891 $ 19,234

(1) As of December 31, 2011, the valuation allowance reduced current deferred tax assets by

$1.0 million and noncurrent deferred tax assets by $29.3 million.

U.S. Cellular is included in TDS’ consolidated federal income tax return. U.S. Cellular also files various

state and local income tax returns. The TDS consolidated group remains subject to federal income tax

audits for the tax years after 2007. With only a few exceptions, TDS is no longer subject to state income

tax audits for years prior to 2007.

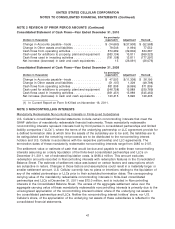

NOTE 6 VARIABLE INTEREST ENTITIES (VIEs)

From time to time, the FCC conducts auctions through which additional spectrum is made available for

the provision of wireless services. U.S. Cellular participated in spectrum auctions indirectly through its

interests in Aquinas Wireless L.P. (‘‘Aquinas Wireless’’), King Street Wireless L.P. (‘‘King Street Wireless’’),

Barat Wireless L.P. (‘‘Barat Wireless’’) and Carroll Wireless L.P. (‘‘Carroll Wireless’’), collectively, the

‘‘limited partnerships.’’ Each limited partnership participated in and was awarded spectrum licenses in

one of four separate spectrum auctions (FCC Auctions 78, 73, 66 and 58). Each limited partnership

qualified as a ‘‘designated entity’’ and thereby was eligible for bidding credits with respect to licenses

purchased in accordance with the rules defined by the FCC for each auction. In most cases, the bidding

credits resulted in a 25% discount from the gross winning bid.

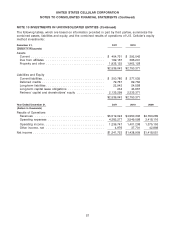

Consolidated VIEs

As of December 31, 2011, U.S. Cellular consolidates the following VIEs under GAAP:

• Aquinas Wireless;

• King Street Wireless and King Street Wireless, Inc., the general partner of King Street Wireless;

• Barat Wireless and Barat Wireless, Inc., the general partner of Barat Wireless; and

• Carroll Wireless and Carroll PCS, Inc., the general partner of Carroll Wireless.

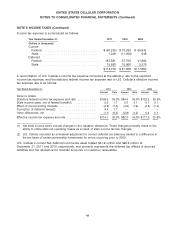

U.S. Cellular holds a variable interest in the entities listed above. It has made capital contributions and/or

advances to these entities. The power to direct the activities of the VIEs that most significantly impact

51