US Cellular 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

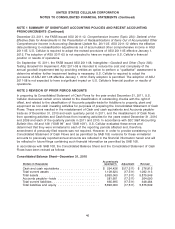

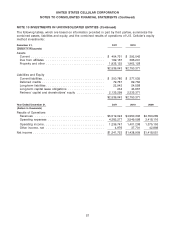

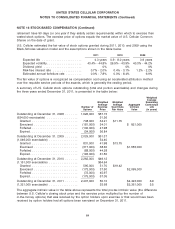

NOTE 9 LICENSES AND GOODWILL (Continued)

Goodwill

Year Ended December 31, 2011 2010

(Dollars in thousands)

Assigned value at time of acquisition .................... $494,737 $494,737

Accumulated impairment losses in prior periods ............ — —

Balance, beginning of year ........................... 494,737 494,737

Acquisitions ..................................... — —

Balance, end of year ................................ $494,737 $494,737

See Note 1—Summary of Significant Accounting Policies and Recent Accounting Pronouncements for a

description of accounting policies related to licenses and goodwill.

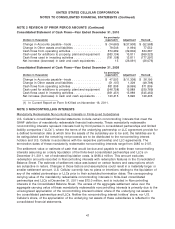

Impairment Assessments

U.S. Cellular performs its annual impairment assessment of its licenses and goodwill in the fourth quarter

of each year. No impairment of goodwill or licenses resulted from the assessments performed in 2011 or

2010. In 2009, the assessment resulted in no impairment of goodwill and an impairment loss of

$14.0 million on licenses. The entire impairment loss related to licenses in developed operating markets

(built licenses).

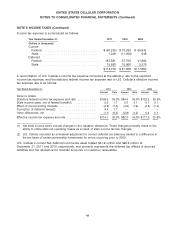

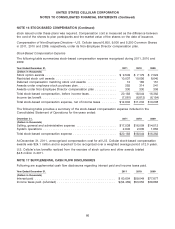

NOTE 10 INVESTMENTS IN UNCONSOLIDATED ENTITIES

Investments in unconsolidated entities consist of amounts invested in wireless entities which are

accounted for using either the equity or cost method as shown in the following table:

December 31, 2011 2010

(Dollars in thousands)

Equity method investments:

Capital contributions, loans and advances .............. $ 13,787 $ 22,885

Cumulative share of income ........................ 928,019 857,533

Cumulative share of distributions .................... (805,321) (721,182)

136,485 159,236

Cost method investments ........................... 1,611 1,611

Total investments in unconsolidated entities .............. $138,096 $ 160,847

Equity in earnings of unconsolidated entities totaled $83.6 million, $97.3 million and $96.8 million in

2011, 2010 and 2009, respectively; of those amounts, U.S. Cellular’s investment in the Los Angeles

SMSA Limited Partnership (‘‘LA Partnership’’) contributed $55.3 million, $64.8 million and $64.7 million in

2011, 2010 and 2009, respectively. U.S. Cellular held a 5.5% ownership interest in the LA Partnership

throughout and at the end of each of these years.

56