US Cellular 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

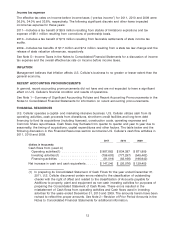

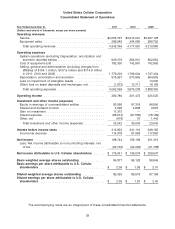

Carrying Value of Licenses

The carrying value of licenses at November 1, 2011 was as follows:

Unit of accounting(1) Carrying value

(Dollars in millions)

Developed Operating markets (5 units of accounting)

Central Region .......................................... $ 875

Mid-Atlantic Region ....................................... 224

New England Region ...................................... 101

Northwest Region ........................................ 67

New York Region ........................................ —

Non-operating markets (7 units of accounting)

North Northwest (2 states) .................................. 3

South Northwest (2 states) .................................. 2

North Central (5 states) .................................... 49

South Central (5 states) .................................... 15

East Central (5 states) ..................................... 44

Mid-Atlantic (8 states) ..................................... 47

Mississippi Valley (13 states) ................................ 43

Total(2) .............................................. $1,470

(1) U.S. Cellular participated in spectrum auctions indirectly through its interests in Aquinas

Wireless L.P. (‘‘Aquinas Wireless’’), King Street Wireless L.P. (‘‘King Street Wireless’’), Barat

Wireless L.P. (‘‘Barat Wireless’’) and Carroll Wireless L.P. (‘‘Carroll Wireless’’), collectively,

the ‘‘limited partnerships.’’ Each limited partnership participated in and was awarded

spectrum licenses in one of four separate spectrum auctions (FCC Auctions 78, 73, 66 and

58). All of the units of accounting above, except the New York Region, include licenses

awarded to the limited partnerships.

(2) Between November 1, 2011 and December 31, 2011, U.S. Cellular capitalized interest on

certain licenses pursuant to current network build-out in the amount of $1.0 million.

Licenses with an aggregate carrying value of $69.5 million were in units of accounting where the fair

value exceeded the carrying value by amounts less than 10% of the carrying value. Any further declines

in the fair value of such licenses in future periods could result in the recognition of impairment losses on

such licenses and any such impairment losses would have a negative impact on future results of

operations. The impairment losses on licenses are not expected to have a future impact on liquidity. U.S.

Cellular is unable to predict the amount, if any, of future impairment losses attributable to licenses.

Further, historical operating results, particularly amounts related to impairment losses, are not indicative

of future operating results.

Property, Plant and Equipment—Depreciation

U.S. Cellular provides for depreciation using the straight-line method over the estimated useful lives of

the assets. U.S. Cellular depreciates its leasehold improvement assets associated with leased properties

over periods ranging from one to thirty years, which approximates the shorter of the assets’ economic

lives or the specific lease terms.

Annually, U.S. Cellular reviews its property, plant and equipment lives to ensure that the estimated useful

lives are appropriate. The estimated useful lives of property, plant and equipment are a critical

accounting estimate because changing the lives of assets can result in larger or smaller charges for

depreciation expense. Factors used in determining useful lives include technology changes, regulatory

requirements, obsolescence and type of use. U.S. Cellular did not materially change the useful lives of its

property, plant and equipment in 2011, 2010 or 2009.

22