US Cellular 2011 Annual Report Download - page 62

Download and view the complete annual report

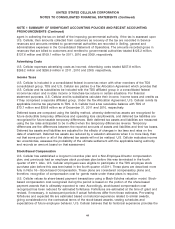

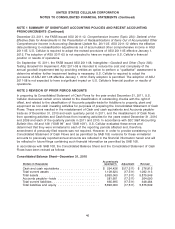

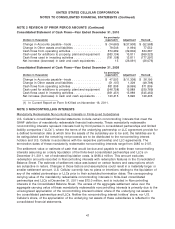

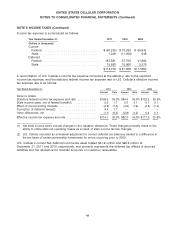

Please find page 62 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 8 ACQUISITIONS, DIVESTITURES AND EXCHANGES

U.S. Cellular assesses its existing wireless interests on an ongoing basis with a goal of improving the

competitiveness of its operations and maximizing its long-term return on capital. As part of this strategy,

U.S. Cellular reviews attractive opportunities to acquire additional wireless operating markets and

wireless spectrum. In addition, U.S. Cellular may seek to divest outright or include in exchanges for other

wireless interests those markets and wireless interests that are not strategic to its long-term success.

On May 9, 2011, U.S. Cellular paid $24.6 million in cash to purchase the remaining ownership interest in

a wireless business in which it previously held a 49% noncontrolling interest, pursuant to certain required

terms of the partnership agreement. Prior to this acquisition, the partnership had been accounted for

under the equity method of accounting. In connection with the acquisition, a $13.4 million gain was

recorded to adjust the carrying value of this 49% investment to its fair value of $25.7 million based on an

income approach valuation method. The gain was recorded in Gain on investment in the Consolidated

Statement of Operations. On November 11, 2011, U.S. Cellular entered into an agreement to sell

substantially all of the assets of this wireless business for $50.0 million in cash net of working capital

adjustments. The closing of this agreement is pending FCC approval which is expected to occur in the

first half of 2012. As a result, $49.6 million of assets and $1.1 million of liabilities have been classified in

the Consolidated Balance Sheet as ‘‘held for sale’’. Included in Assets held for sale are $4.2 million of

Current assets, $36.5 million of Investments (primarily licenses) and $8.9 million of Property, plant and

equipment. Liabilities held for sale primarily includes Current liabilities. For the period since acquisition,

this business generated revenues of $20.7 million and operating income of $14.8 million.

On September 30, 2011, U.S. Cellular completed an exchange whereby U.S. Cellular received eighteen

700 MHz spectrum licenses covering portions of Idaho, Illinois, Indiana, Kansas, Nebraska, Oregon and

Washington in exchange for two PCS spectrum licenses covering portions of Illinois and Indiana. The

exchange of licenses will provide U.S. Cellular with additional spectrum to meet anticipated future

capacity and coverage requirements in several of its markets. No cash, customers, network assets, other

assets or liabilities were included in the exchange. As a result of this transaction, U.S. Cellular

recognized a gain of $11.8 million, representing the difference between the fair value of the licenses

received, calculated using a market approach valuation method, and the carrying value of the licenses

surrendered. This gain was recorded in (Gain) loss on asset disposals and exchanges, net in the

Consolidated Statement of Operations for the year ended December 31, 2011. The Indiana PCS

spectrum included in the exchange was originally awarded to Carroll Wireless in FCC Auction 58 and

was purchased by U.S. Cellular prior to the exchange. Carroll Wireless is a variable interest entity which

U.S. Cellular consolidates; see Note 6—Variable Interest Entities for additional information.

Acquisitions and exchanges did not have a material impact on U.S. Cellular’s consolidated financial

statements for the periods presented and pro forma results, assuming acquisitions and exchanges had

occurred at the beginning of each period presented, would not be materially different from the results

reported.

54