US Cellular 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

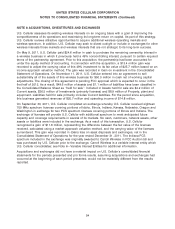

December 23, 2011, the FASB issued ASU 2011-12, Comprehensive Income (Topic 220): Deferral of the

Effective Date for Amendments to the Presentation of Reclassifications of Items Out of Accumulated Other

Comprehensive Income in Accounting Standards Update No. 2011-05. ASU 2011-12 defers the effective

date pertaining to reclassification adjustments out of accumulated other comprehensive income in ASU

2011-05. U.S. Cellular is required to adopt the revised provisions of ASU 2011-05 effective January 1,

2012. The adoption of ASU 2011-05 is not expected to have an impact on U.S. Cellular’s financial

position or results of operations.

On September 15, 2011, the FASB issued ASU 2011-08, Intangibles—Goodwill and Other (Topic 350):

Testing Goodwill for Impairment. ASU 2011-08 is intended to reduce the cost and complexity of the

annual goodwill impairment test by providing entities an option to perform a ‘‘qualitative’’ assessment to

determine whether further impairment testing is necessary. U.S. Cellular is required to adopt the

provisions of ASU 2011-08 effective January 1, 2012. Early adoption is permitted. The adoption of ASU

2011-08 is not expected to have a significant impact on U.S. Cellular’s financial position or results of

operations.

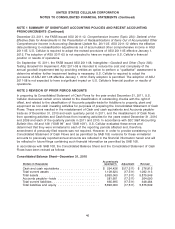

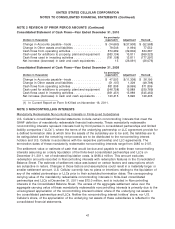

NOTE 2 REVISION OF PRIOR PERIOD AMOUNTS

In preparing its Consolidated Statement of Cash Flows for the year ended December 31, 2011, U.S.

Cellular discovered certain errors related to the classification of outstanding checks with the right of

offset, and related to the classification of Accounts payable-trade for Additions to property, plant and

equipment as non-cash investing activities for purposes of preparing the Consolidated Statement of Cash

Flows. These errors resulted in the misstatement of Cash and cash equivalents and Accounts payable-

trade as of December 31, 2010 and each quarterly period in 2011, and the misstatement of Cash flows

from operating activities and Cash flows from investing activities for the years ended December 31, 2010

and 2009 and each of the quarterly periods in 2011 and 2010. In accordance with SEC Staff Accounting

Bulletin Nos. 99 and 108 (‘‘SAB 99’’ and ‘‘SAB 108’’), U.S. Cellular evaluated these errors and

determined that they were immaterial to each of the reporting periods affected and, therefore,

amendment of previously filed reports was not required. However, in order to provide consistency in the

Consolidated Statement of Cash Flows and as permitted by SAB 108, revisions for these immaterial

amounts to previously reported annual amounts are reflected in the financial information herein and will

be reflected in future filings containing such financial information as permitted by SAB 108.

In accordance with SAB 108, the Consolidated Balance Sheet and the Consolidated Statement of Cash

Flows have been revised as follows:

Consolidated Balance Sheet—December 31, 2010

As previously

(Dollars in thousands) reported(1) Adjustment Revised

Cash and cash equivalents ...................... $ 294,426 $(17,511) $ 276,915

Total current assets ........................... 1,109,624 (17,511) 1,092,113

Total assets ................................. 5,893,060 (17,511) 5,875,549

Accounts payable—trade ....................... 281,601 (17,511) 264,090

Total current liabilities .......................... 665,995 (17,511) 648,484

Total liabilities and equity ....................... 5,893,060 (17,511) 5,875,549

46