US Cellular 2011 Annual Report Download - page 11

Download and view the complete annual report

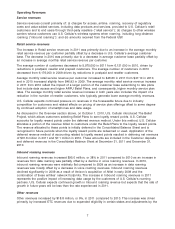

Please find page 11 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.– Continued growth in revenues from data products and services and lower growth or declines in

revenues from voice services;

– Rapid growth in the demand for new data devices and services which may result in increased cost

of equipment sold and other operating expenses and the need for additional investment in network

capacity;

– Effects of industry consolidation on roaming revenues, service pricing and equipment pricing;

– Costs of developing and enhancing office and customer support systems, including costs and risks

associated with the completion and potential benefits of the multi-year initiatives described above;

– Continued enhancements to U.S. Cellular’s wireless networks;

– Uncertainty related to various rulemaking proceedings underway at the Federal Communications

Commission (‘‘FCC’’), including uncertainty relating to the impacts on universal service funding,

intercarrier compensation and other matters of the Connect America Fund & Intercarrier

Compensation Reform Order and Further Notice of Proposed Rulemaking issued by the FCC on

October 27, 2011;

– The FCC’s adoption of mandatory roaming rules which will be of assistance in the negotiation of

data roaming agreements with other wireless operators in the future; and

– Exclusive arrangements between manufacturers of wireless devices and other carriers, or other

economic or competitive factors, that restrict U.S. Cellular’s access to devices desired by customers.

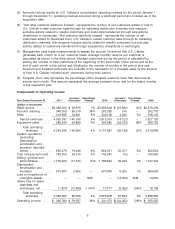

Cash Flows and Investments

U.S. Cellular believes that cash and investments on hand, expected future cash flows from operating

activities and sources of external financing provide substantial liquidity and financial flexibility and are

sufficient to permit U.S. Cellular to finance its contractual obligations and anticipated capital expenditures

for the foreseeable future. U.S. Cellular continues to seek to maintain a strong balance sheet and an

investment grade credit rating.

In May 2011, U.S. Cellular issued $342 million of 6.95% Senior Notes due 2060. In June 2011, the net

proceeds of such offering were used to redeem $330 million of U.S. Cellular’s 7.5% Senior Notes due

2034, which represents the entire outstanding amount of such notes. The redemption price of the 7.5%

Senior Notes was equal to 100% of the outstanding aggregate principal amount, plus accrued and

unpaid interest thereon until the redemption date.

See ‘‘Financial Resources’’ and ‘‘Liquidity and Capital Resources’’ below for additional information

related to cash flows and investments.

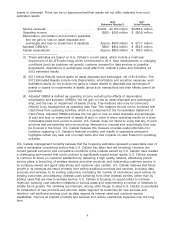

2012 Estimates

U.S. Cellular’s estimates of full-year 2012 results are shown below. Such estimates represent U.S.

Cellular’s views as of the date of filing of U.S. Cellular’s Form 10-K for the year ended December 31,

2011. Such forward-looking statements should not be assumed to be current as of any future date. U.S.

Cellular undertakes no duty to update such information whether as a result of new information, future

3