US Cellular 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Income tax expense

The effective tax rates on Income before income taxes (‘‘pre-tax income’’) for 2011, 2010 and 2009 were

36.5%, 34.0% and 33.8%, respectively. The following significant discrete and other items impacted

income tax expense for these years:

2011—Includes a tax benefit of $9.9 million resulting from statute of limitations expirations and tax

expense of $6.1 million resulting from corrections of partnership basis.

2010—Includes a tax benefit of $7.9 million resulting from favorable settlements of state income tax

audits.

2009—Includes tax benefits of $7.7 million and $7.2 million resulting from a state tax law change and the

release of state valuation allowances, respectively.

See Note 5—Income Taxes in the Notes to Consolidated Financial Statements for a discussion of income

tax expense and the overall effective tax rate on Income before income taxes.

INFLATION

Management believes that inflation affects U.S. Cellular’s business to no greater or lesser extent than the

general economy.

RECENT ACCOUNTING PRONOUNCEMENTS

In general, recent accounting pronouncements did not have and are not expected to have a significant

effect on U.S. Cellular’s financial condition and results of operations.

See Note 1—Summary of Significant Accounting Policies and Recent Accounting Pronouncements in the

Notes to Consolidated Financial Statements for information on recent accounting pronouncements.

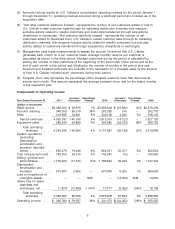

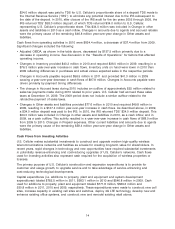

FINANCIAL RESOURCES

U.S. Cellular operates a capital- and marketing-intensive business. U.S. Cellular utilizes cash from its

operating activities, cash proceeds from divestitures, short-term credit facilities and long-term debt

financing to fund its acquisitions (including licenses), construction costs, operating expenses and

Common Share repurchases. Cash flows may fluctuate from quarter to quarter and year to year due to

seasonality, the timing of acquisitions, capital expenditures and other factors. The table below and the

following discussion in this Financial Resources section summarize U.S. Cellular’s cash flow activities in

2011, 2010 and 2009.

2011 2010 2009

(Dollars in thousands)

Cash flows from (used in)

Operating activities(1) ................... $987,862 $ 834,387 $ 871,809

Investing activities(1) .................... (759,603) (777,297) (545,462)

Financing activities ..................... (81,019) (83,166) (196,942)

Net increase in cash and cash equivalents ...... $147,240 $ (26,076) $ 129,405

(1) In preparing its Consolidated Statement of Cash Flows for the year ended December 31,

2011, U.S. Cellular discovered certain errors related to the classification of outstanding

checks with the right of offset and related to the classification of Accounts payable for

Additions to property, plant and equipment as non-cash investing activities for purposes of

preparing the Consolidated Statement of Cash Flows. These errors resulted in the

misstatement of Cash flows from operating activities and Cash flows used in investing

activities for the years ended December 31, 2010 and 2009. The amounts herein have been

revised to reflect the proper amounts. See Note 2—Revision of Prior Period Amounts in the

Notes to Consolidated Financial Statements for additional information.

12