US Cellular 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

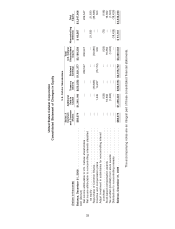

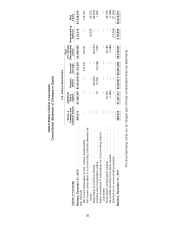

United States Cellular Corporation

Consolidated Statement of Changes in Equity

U.S. Cellular Shareholders

Series A Total

Common Additional U.S. Cellular

and Common Paid-In Treasury Retained Shareholders’ Noncontrolling Total

(Dollars in thousands) Shares Capital Shares Earnings Equity Interests Equity

Balance, December 31, 2009 ....................... $88,074 $1,356,322 $ (69,616) $2,015,752 $3,390,532 $ 51,701 $3,442,233

Add (Deduct)

Net income attributable to U.S. Cellular shareholders ...... — — — 136,074 136,074 — 136,074

Net income attributable to noncontrolling interests classified

as equity .................................. — — — — — 22,992 22,992

Repurchase of Common Shares .................... — — (52,827) — (52,827) — (52,827)

Incentive and compensation plans .................. — 606 16,827 (16,319) 1,114 — 1,114

Adjust investment in subsidiaries for noncontrolling interest

purchase .................................. — (4,268) — — (4,268) (1,544) (5,812)

Stock-based compensation awards .................. — 18,044 — — 18,044 — 18,044

Tax windfall (shortfall) from stock awards .............. — (2,217) — — (2,217) — (2,217)

Distributions to noncontrolling interests ............... — — — — — (19,631) (19,631)

Balance, December 31, 2010 ....................... $88,074 $1,368,487 $(105,616) $2,135,507 $3,486,452 $ 53,518 $3,539,970

The accompanying notes are an integral part of these consolidated financial statements.