US Cellular 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

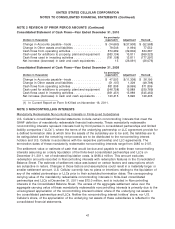

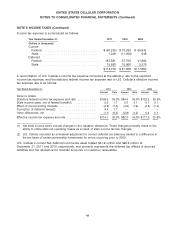

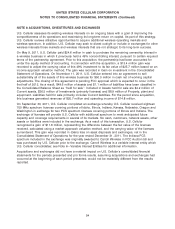

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

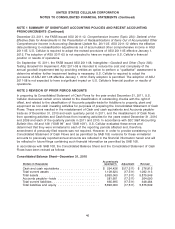

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

best estimates of future pre-vesting forfeitures and future expected life. The expected volatility

assumption is based on the historical volatility of U.S. Cellular’s common stock over a period

commensurate with the expected life. The dividend yield assumption is zero because U.S. Cellular has

never paid a dividend and has expressed its intention to retain all future earnings in the business. The

risk-free interest rate assumption is determined using the implied yield for zero-coupon U.S. government

issues with a remaining term that approximates the expected life of the stock options.

Compensation cost for stock option awards is recognized over the respective requisite service period of

the awards, which is generally the vesting period, on a straight-line basis for each separate vesting

portion of the awards as if the awards were, in-substance, multiple awards (graded vesting attribution

method).

Defined Contribution Plans

U.S. Cellular participates in a qualified noncontributory defined contribution pension plan sponsored by

TDS; such plan provides pension benefits for the employees of U.S. Cellular and its subsidiaries. Under

this plan, pension benefits and costs are calculated separately for each participant and are funded

currently. Pension costs were $11.6 million, $11.6 million and $12.8 million in 2011, 2010 and 2009,

respectively.

U.S. Cellular also participates in a defined contribution retirement savings plan (‘‘401(k) plan’’) sponsored

by TDS. Total costs incurred from U.S. Cellular’s contributions to the 401(k) plan were $15.5 million,

$15.3 million and $14.3 million in 2011, 2010 and 2009, respectively.

Operating Leases

U.S. Cellular is a party to various lease agreements for office space, retail stores, cell sites and

equipment that are accounted for as operating leases. Certain leases have renewal options and/or fixed

rental increases. Renewal options that are reasonably assured of exercise are included in determining

the lease term. U.S. Cellular accounts for certain operating leases that contain rent abatements, lease

incentives and/or fixed rental increases by recognizing lease revenue and expense on a straight-line

basis over the lease term.

Recent Accounting Pronouncements

On May 12, 2011, the FASB issued Accounting Standards Update (‘‘ASU’’) 2011-04, Fair Value

Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure.

Although U.S. Cellular does not currently have any financial assets or liabilities that are required to be

recorded at fair value in its Consolidated Balance Sheet in accordance with GAAP, certain assets and

liabilities are disclosed at fair value (see Note 4—Fair Value Measurements). Under ASU 2011-04, for

these instruments, U.S. Cellular will be required to disclose, in a tabular format, the level within the fair

value hierarchy that each of these assets and liabilities are measured. U.S. Cellular is required to adopt

the provisions of ASU 2011-04 effective January 1, 2012. Early adoption is prohibited. The adoption of

ASU 2011-04 is not expected to have a significant impact on U.S. Cellular’s financial position or results of

operations.

On June 16, 2011, the FASB issued ASU 2011-05, Comprehensive Income (Topic 220): Presentation of

Comprehensive Income. ASU 2011-05 amends how Other Comprehensive Income (‘‘OCI’’) is presented

in the financial statements. Under this standard, the Statement of Operations and OCI can be presented

either continuously in a Statement of Comprehensive Income or in two separate but consecutive

statements. ASU 2011-05 also required entities to present reclassification adjustments by component in

both the statement where net income is presented and the statement where OCI is presented. On

45