US Cellular 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

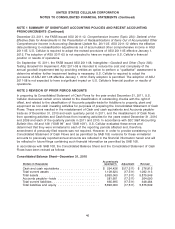

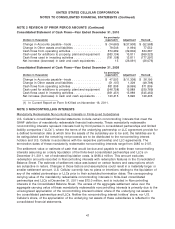

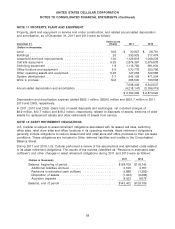

NOTE 4 FAIR VALUE MEASUREMENTS

As of December 31, 2011 and 2010, U.S. Cellular did not have any financial assets or liabilities that were

required to be recorded at fair value in its Consolidated Balance Sheet in accordance with GAAP.

However, U.S. Cellular has applied the provisions of fair value accounting for purposes of computing the

fair value of financial instruments for disclosure purposes as displayed below.

December 31, 2011 December 31, 2010

Book Value Fair Value Book Value Fair Value

(Dollars in thousands)

Cash and cash equivalents(1) .............. $424,155 $424,155 $276,915 $276,915

Short-term investments(2)(3)

Certificates of deposit .................. — — 250 250

Government-backed securities(4) .......... 127,039 127,039 146,336 146,336

Long-term investments(2)(5)

Government-backed securities(4) ............ 30,057 30,140 46,033 46,034

Long-term debt(6) ...................... 876,111 899,022 863,657 850,374

(1) In preparing its Consolidated Statement of Cash Flows for the year ended December 31, 2011,

U.S. Cellular discovered certain errors related to the classification of outstanding checks with the

right of offset. This error resulted in the misstatement of Cash for the year ended December 31,

2010. The amounts herein have been revised to reflect the proper amounts. See Note 2—

Revision of Prior Period Amounts for additional information.

(2) Designated as held-to-maturity investments and are recorded at amortized cost in the

Consolidated Balance Sheet.

(3) Maturities are less than twelve months from the respective balance sheet dates.

(4) Includes U.S. treasuries and corporate notes guaranteed under the Federal Deposit Insurance

Corporation’s Temporary Liquidity Guarantee Program.

(5) Maturities range between 18 and 21 months from the balance sheet date.

(6) Excludes capital lease obligations and current portion of Long-term debt.

The fair values of Cash and cash equivalents and Short-term investments approximate their book values

due to the short-term nature of these financial instruments. The fair values of Long-term investments were

estimated using quoted market prices for the individual issuances. The fair value of long-term debt,

excluding capital lease obligations and the current portion of such long-term debt, was estimated using

market prices for the 6.95% Senior Notes at December 31, 2011 and 7.5% Senior Notes at December 31,

2010, and discounted cash flow analysis for the 6.7% Senior Notes at December 31, 2011 and 2010.

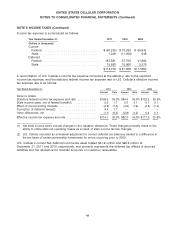

NOTE 5 INCOME TAXES

U.S. Cellular’s Income taxes receivable at December 31, 2011 and 2010 were as follows:

December 31, 2011 2010

(Dollars in thousands)

Federal income taxes receivable ......................... $73,525 $39,656

State income taxes receivable ........................... 1,266 1,741

$74,791 $41,397

48