US Cellular 2011 Annual Report Download - page 18

Download and view the complete annual report

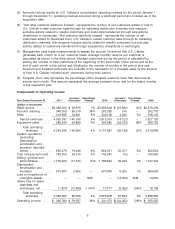

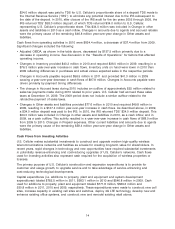

Please find page 18 of the 2011 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Key components of the net changes in Selling, general and administrative expenses were as follows:

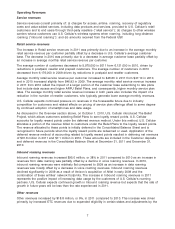

2011—

• Selling and marketing expenses decreased by $13.7 million, or 2%, primarily due to lower advertising

costs as a result of shifting advertising efforts to more cost effective methods as well as lower

commissions expense reflecting fewer eligible transactions.

• General and administrative expenses decreased by $3.7 million, reflecting a discrete adjustment to

property tax expense and continued cost containment efforts. See footnotes to Consolidated Quarterly

Information for additional information.

2010—

• Selling and marketing expenses increased by $9.3 million, or 1%, primarily due to higher sales related

expenses and higher advertising expenses due to an increase in media purchases, partially offset by

lower commissions expense reflecting fewer eligible customer additions. In 2010, media purchases

included advertising expenses related to the launch of The Belief Project.

• General and administrative expenses increased $39 million, or 4%, due to higher costs related to

investments in multi-year initiatives for business support systems as described in the Overview section;

and higher USF contributions (most of the USF contribution expense is offset by revenues for amounts

passed through to customers). These increases were partially offset by a reduction in bad debts

expense.

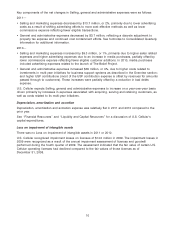

U.S. Cellular expects Selling, general and administrative expenses to increase on a year-over-year basis

driven primarily by increases in expenses associated with acquiring, serving and retaining customers, as

well as costs related to its multi-year initiatives.

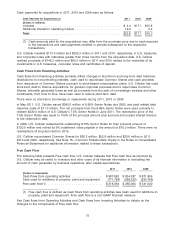

Depreciation, amortization and accretion

Depreciation, amortization and accretion expense was relatively flat in 2011 and 2010 compared to the

prior year.

See ‘‘Financial Resources’’ and ‘‘Liquidity and Capital Resources’’ for a discussion of U.S. Cellular’s

capital expenditures.

Loss on impairment of intangible assets

There was no Loss on impairment of intangible assets in 2011 or 2010.

U.S. Cellular recognized impairment losses on licenses of $14.0 million in 2009. The impairment losses in

2009 were recognized as a result of the annual impairment assessment of licenses and goodwill

performed during the fourth quarter of 2009. The assessment indicated that the fair value of certain U.S.

Cellular operating licenses had declined compared to the fair values of those licenses as of

December 31, 2008.

10