UPS 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

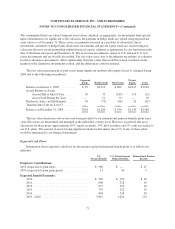

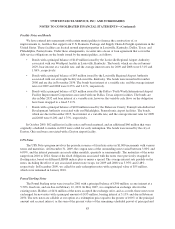

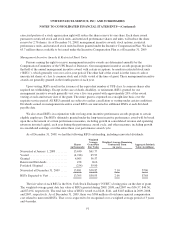

Facility Notes and Bonds

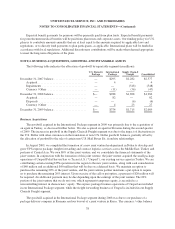

We have entered into agreements with certain municipalities to finance the construction of, or

improvements to, facilities that support our U.S. Domestic Package and Supply Chain & Freight operations in the

United States. These facilities are located around airport properties in Louisville, Kentucky; Dallas, Texas; and

Philadelphia, Pennsylvania. Under these arrangements, we enter into a lease or loan agreement that covers the

debt service obligations on the bonds issued by the municipalities, as follows:

• Bonds with a principal balance of $149 million issued by the Louisville Regional Airport Authority

associated with our Worldport facility in Louisville, Kentucky. The bonds, which are due in January

2029, bear interest at a variable rate, and the average interest rates for 2009 and 2008 were 0.31% and

1.86%, respectively.

• Bonds with a principal balance of $43 million issued by the Louisville Regional Airport Authority

associated with our air freight facility in Louisville, Kentucky. The bonds were issued in November

2006 and are due in November 2036. The bonds bear interest at a variable rate, and the average interest

rates for 2009 and 2008 were 0.25% and 2.11%, respectively.

• Bonds with a principal balance of $29 million issued by the Dallas / Forth Worth International Airport

Facility Improvement Corporation associated with our Dallas, Texas airport facilities. The bonds are

due in May 2032 and bear interest at a variable rate, however the variable cash flows on the obligation

have been swapped to a fixed 5.11%.

• Bonds with a principal balance of $100 million issued by the Delaware County, Pennsylvania Industrial

Development Authority associated with our Philadelphia, Pennsylvania airport facilities. The bonds,

which are due in December 2015, bear interest at a variable rate, and the average interest rates for 2009

and 2008 were 0.20% and 1.75%, respectively.

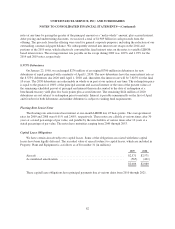

In October 2009, $62 million in facility notes and bonds matured, and an additional $46 million that were

originally scheduled to mature in 2018 were called for early redemption. The bonds were issued by the city of

Dayton, Ohio and were associated with a Dayton airport facility.

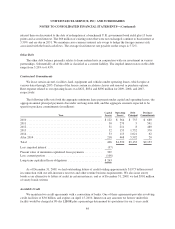

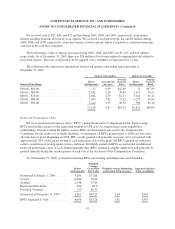

UPS Notes

The UPS Notes program involves the periodic issuance of fixed rate notes in $1,000 increments with various

terms and maturities. At December 31, 2009, the coupon rates of the outstanding notes varied between 3.00% and

6.00%, and the interest payments are made either monthly, quarterly or semiannually. The maturities of the notes

range from 2010 to 2024. Some of the fixed obligations associated with the notes were previously swapped to

floating rates, based on different LIBOR indices plus or minus a spread. The average interest rate payable on the

notes, including the effect of any associated interest rate swaps, for 2009 and 2008 was 3.95% and 2.48%,

respectively. In December 2009, we called for early redemption notes with a principal value of $55 million,

which were redeemed in January 2010.

Pound Sterling Notes

The Pound Sterling notes were issued in 2001 with a principal balance of £500 million, accrue interest at a

5.50% fixed rate, and are due on February 12, 2031. In May 2007, we completed an exchange offer for the

existing notes. Holders of £434 million of the notes accepted the exchange offer, and as a result, these notes were

exchanged for new notes with a principal amount of £455 million, bearing interest at 5.13% and due in February

2050. The new notes are callable at our option at a redemption price equal to the greater of 100% of the principal

amount and accrued interest, or the sum of the present values of the remaining scheduled payout of principal and

83