UPS 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

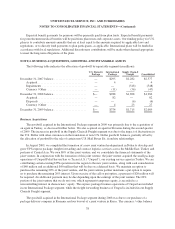

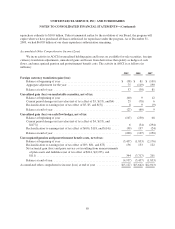

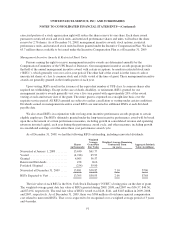

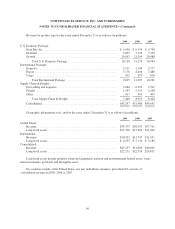

The following is a rollforward of our common stock, additional paid-in capital, and retained earnings

accounts (in millions, except per share amounts):

2009 2008 2007

Shares Dollars Shares Dollars Shares Dollars

Class A Common Stock

Balance at beginning of year .................. 314 $ 3 349 $ 3 401 $ 4

Common stock purchases ..................... (10) — (11) — (18) (1)

Stock award plans ........................... 5 — 6 — 3 —

Common stock issuances ..................... 4 — 3 — 3 —

Conversions of Class A to Class B common

stock ................................... (28) — (33) — (40) —

Class A shares issued at end of year ............. 285 $ 3 314 $ 3 349 $ 3

Class B Common Stock

Balance at beginning of year .................. 684 $ 7 694 $ 7 672 $ 7

Common stock purchases ..................... (1) — (43) — (18) —

Conversions of Class A to Class B common

stock ................................... 28 — 33 — 40 —

Class B shares issued at end of year ............. 711 $ 7 684 $ 7 694 $ 7

Additional Paid-In Capital

Balance at beginning of year .................. $ — $ — $ —

Stock award plans ........................... 381 497 462

Common stock purchases ..................... (569) (694) (627)

Common stock issuances ..................... 190 197 165

Balance at end of year ....................... $ 2 $ — $ —

Retained Earnings

Balance at beginning of year .................. $12,412 $14,186 $17,676

Net income attributable to controlling interests .... 2,152 3,003 382

Cumulative adjustment for accounting changes .... — (60) (104)

Dividends ($1.80, $1.80, and $1.68 per share) ..... (1,819) (1,853) (1,778)

Common stock purchases ..................... — (2,864) (1,990)

Balance at end of year ....................... $12,745 $12,412 $14,186

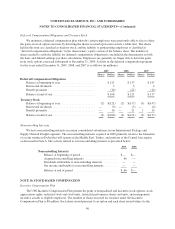

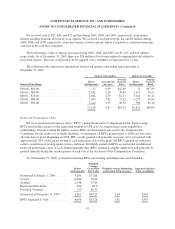

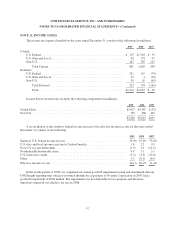

On January 1, 2007, we adopted a new accounting standard for income taxes, which resulted in a reduction

to retained earnings of $104 million. On January 1, 2008, we recognized a $44 million reduction to retained

earnings as a result of changing our measurement date under new accounting guidance related to retirement

benefits. Also on January 1, 2008, we recognized a $16 million reduction to retained earnings as a result of

adopting a new accounting standard for financial instruments. These accounting changes are discussed further in

Note 1.

As a result of the uncertain economic environment, we have slowed our share repurchase activity. We

currently intend to repurchase shares in 2010 at a rate that should approximately offset the dilution from our

stock compensation programs. For the years ended December 31, 2009, 2008 and 2007, we repurchased a total of

10.9, 53.6, and 35.9 million shares of Class A and Class B common stock for $569 million, $3.558 billion, and

$2.618 billion, respectively. In January 2008, our Board of Directors authorized an increase in our share

88