UPS 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

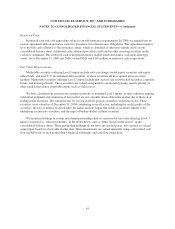

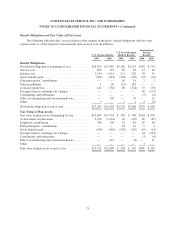

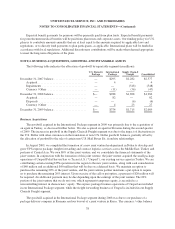

The impaired airframes, engines, and parts had a net carrying value of $192 million, and were written down

to an aggregate fair value of $11 million. The fair values for the impaired airframes, engines, and parts were

determined using unobservable inputs (Level 3).

As a result of business changes that occurred in the first quarter of 2007, including capacity-optimization

programs in our domestic and international air freight forwarding business as well as changes to our aircraft

orders and planned delivery dates, we began a review process of our aircraft fleet types to ensure that we

maintain the optimum mix of aircraft types to service our international and domestic package businesses. The

review was completed in March 2007, and based on the results of our evaluation, we accelerated the planned

retirement of certain Boeing 727 and 747 aircraft, and recognized an impairment and obsolescence charge of

$221 million for the aircraft and related engines and parts in 2007. This charge is included in the caption “Other

expenses” in the Statement of Consolidated Income, of which $159 million impacted our U.S. Domestic Package

segment and $62 million impacted our International Package segment.

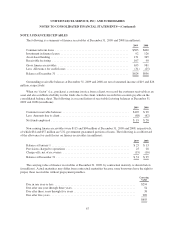

NOTE 5. EMPLOYEE BENEFIT PLANS

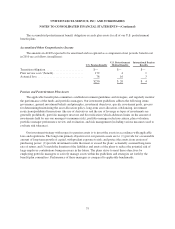

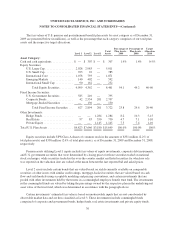

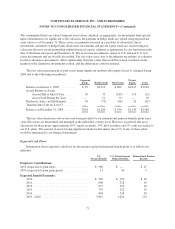

We sponsor various retirement and pension plans, including defined benefit and defined contribution plans

which cover our employees worldwide.

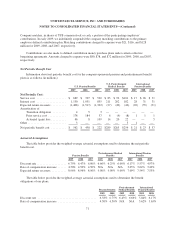

U.S. Pension Benefits

In the U.S. we maintain the following single-employer defined benefit pension plans: UPS Retirement Plan,

UPS Pension Plan, UPS IBT Pension Plan, and the UPS Excess Coordinating Benefit Plan, a non-qualified plan.

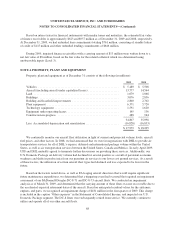

The UPS Retirement Plan is noncontributory and includes substantially all eligible employees of

participating domestic subsidiaries who are not members of a collective bargaining unit, as well as certain

employees covered by a collective bargaining agreement. This plan generally provides for retirement benefits

based on average compensation levels earned by employees prior to retirement. Benefits payable under this plan

are subject to maximum compensation limits and the annual benefit limits for a tax qualified defined benefit plan

as prescribed by the Internal Revenue Service.

The UPS Pension Plan is noncontributory and includes certain eligible employees of participating domestic

subsidiaries and members of collective bargaining units that elect to participate in the plan. This plan provides for

retirement benefits based on service credits earned by employees prior to retirement.

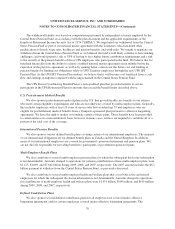

The UPS IBT Pension Plan is noncontributory and includes employees that were previously members of the

Central States, Southeast and Southwest Areas Pension Fund (“Central States Pension Fund”), a multi-employer

pension plan, in addition to other eligible employees who are covered under certain collective bargaining

agreements.

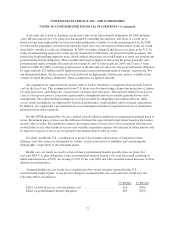

Our national master agreement with the International Brotherhood of Teamsters (“Teamsters”) allowed us,

upon ratification, to withdraw employees from the Central States Pension Fund and establish this jointly trusteed

single-employer plan for this group of employees. We recorded a pre-tax charge of $6.1 billion to establish our

withdrawal liability upon ratification of the national master agreement, and made a $6.1 billion payment to the

Central States Pension Fund in December 2007. In connection with the national master agreement and upon

establishment of the UPS IBT Pension Plan, we restored certain benefit levels to our employee group within the

new plan, which resulted in the initial recognition of a $1.701 billion pension liability and a corresponding

$1.062 billion reduction of AOCI and $639 million reduction of deferred tax liabilities.

69