UPS 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UP S 2 0 0 9 A n n u a l R e p o r t

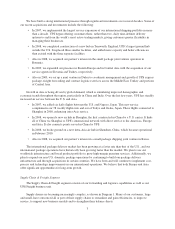

Net Income

(billions of dollars )

3

4

5

2

1

0

05 06 07 08 09

3.9

4.2

0.4

3.0

3.6

4.4

2.2

2.3

Adjusted*

Diluted Earnings Per Share

(dollars)

3

4

5

2

1

0

05 06 07 08 09

3.47 3.86

0.36

2.94

3.50

4.11

2.14

2.31

Adjusted*

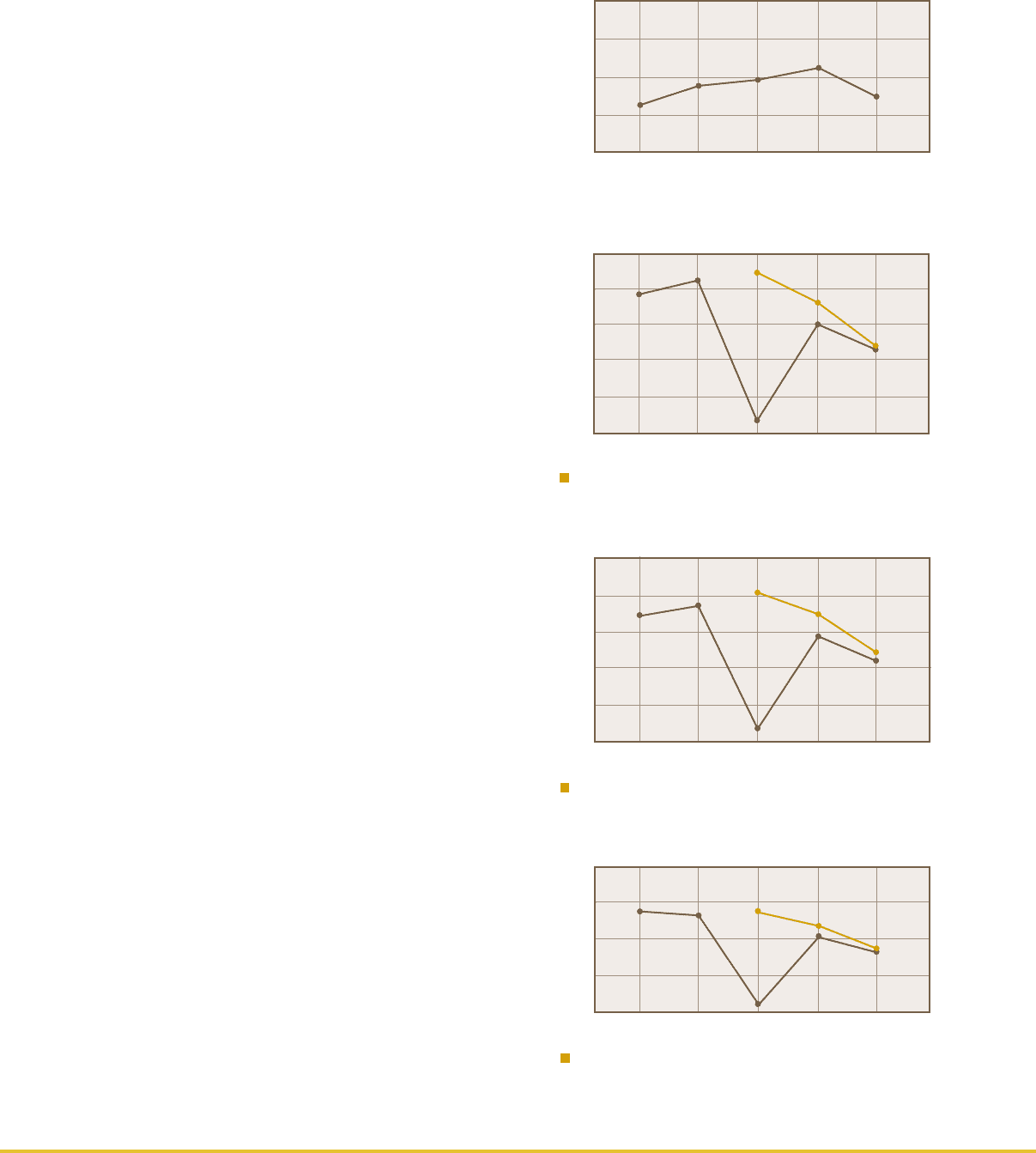

Revenue

(billions of dollars)

60

70

50

40

30

05 06 07 08 09

42.6

47.5 49.7 51.5

45.3

15

20

10

5

0

05 06 07 08 09

14.4 14.0

1.2

10.5

11.6

14.1

8.4

8.8

Adjusted*

Operating Margin

(percent)

*See ”Items Affecting Comparability” on pages 20-21 of our Form 10-K. 05

volumes and characteristics had begun to improve,

resulting in operating leverage and yield gains—among

our key objectives for 2010.

Supply Chain and Freight

Revenue in the Supply Chain and Freight segment

declined over 16.5 percent in 2009, reflecting the

economic slowdown. Adjusted operating margin*

declined 100 basis points to 4.0 percent, due primarily

to the very challenging conditions through the year in

the LTL business and, at the end of the year, in freight

forwarding. The Logistics business, however, experi-

enced revenue and profit gains due to strength in the

healthcare and high-tech sectors.

In the first half of the year, Forwarding benefited from

small package customer tradedown to less costly

service options. However, capacity constraints out of

Asia drove up purchased transportation costs in the

latter part of the year, which could not be passed on

to customers, pressuring operating margins.

In an extremely price competitive environment, UPS

Freight opted to maintain pricing to the extent possible

to ensure payment for the value we provide our cus-

tomers. As a result, shipments and tonnage declined,

and the unit posted a slight loss for the year. Neverthe-

less, we believe this is the best strategy to preserve

the long-term health of our business, while leveraging

our small package customer base. UPS Freight did gain

market share in 2009.

Outlook for 2010

I’m optimistic about the future. I firmly believe global

trade will be a major stimulus that powers economic

recovery. And UPS is better positioned than ever to

synchronize that trade. While recovery is under way,

regaining global economic health will be a slow

process. Therefore, we believe 2010 will show gradual

improvement over 2009 as the year progresses.

For the year we anticipate generating diluted earnings

per share within a range of $2.70 and $3.05. This is

a 17- to 32-percent gain over 2009 adjusted results.

The first quarter will be the most challenging, with

momentum building later in the year. Each of our busi-

ness segments is expected to post revenue, profit, and

operating margin improvement.

100235_TXT.indd 5 3/1/10 5:52 PM