UPS 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

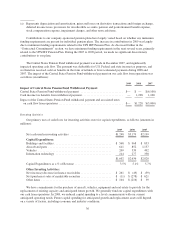

decreased by $788 million in 2009, due to lower fuel surcharge rates caused by decreased fuel prices as well as a

decrease in international air volume. Fuel surcharge revenue increased by $586 million in 2008, due to higher

fuel surcharge rates caused by increased fuel prices, as well as an increase in international air volume.

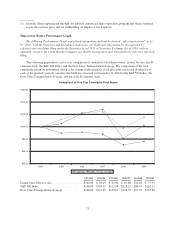

Operating Profit and Margin

2009 compared to 2008

The decline in operating profit for the year was caused primarily by a shift in product mix away from our

premium services, and volume declines in some of the longer export trade lanes. Operating profit was also

negatively impacted as we incurred a larger decline in fuel surcharge revenue compared with the decline in fuel

expense. To reduce costs, we adjusted our air network and reduced block hours and flight segments in certain

international regions. The volume trends began to improve later in the year, and in the fourth quarter operating

profit increased 19% (excluding an impairment charge in 2008), as the impact of cost initiatives and network

improvements drove an improvement in the operating margin to 16.7%.

2008 compared to 2007

The decline in operating profit and operating margin were affected by reduced asset utilization resulting

from changes in economic conditions and trade flows, such as the reduced import volume into the United States.

Operating profit and margin were also negatively affected by a shift in product mix away from our premium

services, as well as expenses associated with integration activities in our delivery network.

Because fuel costs decreased rapidly in the latter half of 2008, operating profit benefited from the

approximate two month time lag between the fuel price changes and when the monthly surcharge rates are

applied to package shipments. As a result of this time lag, fuel positively impacted the change in operating profit

during 2008, which is the opposite effect the company experienced in 2007, when fuel costs rose much faster

than the fuel surcharge rate and operating profit was adversely impacted.

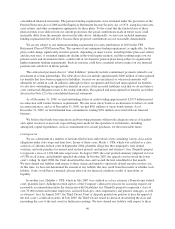

Supply Chain & Freight Operations

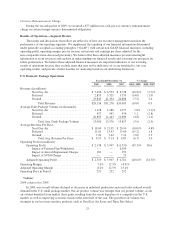

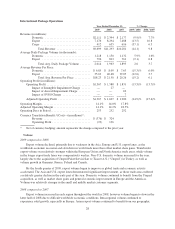

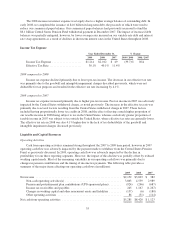

Year Ended December 31, % Change

2009 2008 2007 2009 / 2008 2008 / 2007

Revenue (in millions):

Forwarding and Logistics ...................... $ 5,080 $ 6,293 $ 5,911 (19.3)% 6.5%

Freight ..................................... 1,943 2,191 2,108 (11.3) 3.9

Other ...................................... 417 431 407 (3.2) 5.9

Total Revenue ........................... $ 7,440 $ 8,915 $ 8,426 (16.5) 5.8

Freight LTL Statistics:

Revenue (in millions) .......................... $ 1,807 $ 2,062 $ 2,013 (12.4)% 2.4%

Revenue Per Hundredweight .................... $ 17.69 $ 18.68 $ 17.41 (5.3) 7.3

Shipments (in thousands) ....................... 9,880 10,036 10,481 (1.6) (4.2)

Shipments Per Day (in thousands) ................ 39.1 39.5 41.4 (1.0) (4.6)

Gross Weight Hauled (in millions of lbs) .......... 10,211 11,037 11,560 (7.5) (4.5)

Weight Per Shipment (in lbs) .................... 1,033 1,100 1,103 (6.1) (0.3)

Operating Days in Period ....................... 253 254 253

Operating Profit (in millions):

Operating Profit .................................. $ 296 $ (105) $ 278 N/A N/A

Impact of Goodwill Impairment Charge ........... — 548 —

Impact of SVSO Charge ....................... — — 8

Impact of France Restructuring Charge ............ — — 46

Adjusted Operating Profit .......................... $ 296 $ 443 $ 332 (33.2)% 33.4%

Operating Margin ..................................... 4.0% (1.2)% 3.3%

Adjusted Operating Margin ............................. 4.0% 5.0% 3.9%

Currency Translation Benefit / (Cost)—(in millions)*:

Revenue .................................... $ (52) $ 166

Operating Profit .............................. (15) 12

* Net of currency hedging; amount represents the change compared to the prior year.

30