UPS 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

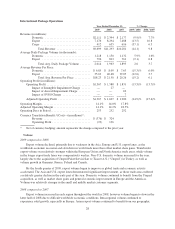

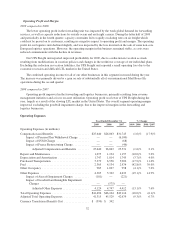

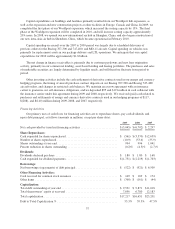

Other Occupancy

The decrease in other occupancy expense in 2009 was primarily caused by lower electricity and natural gas

costs, as well as lower rent expense. The 2008 increase in other occupancy expense resulted from higher rent,

property tax, electricity and natural gas expense. The changes in both years were significantly impacted by

changes in energy commodity prices.

Other Expenses

The decline in other expenses in 2009, exclusive of impairment charges, was due in part to certain variable

costs that declined as a result of lower package volume, such as the expense associated with customer claims for lost

or damaged packages, rent expense for transportation equipment, cargo handling costs, and aircraft landing fees.

Additionally, certain other costs declined primarily as a result of cost containment programs, such as employee

expense reimbursements, office supplies, professional services, and advertising costs.

The increase in other expenses in 2008, exclusive of impairment charges, was attributable to increased

expenses for leased transportation equipment, data processing, advertising, professional services, and bad debts.

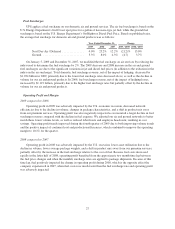

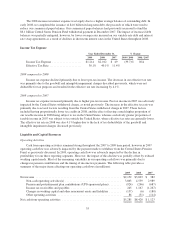

Investment Income and Interest Expense

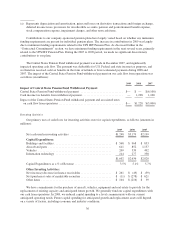

Year Ended December 31, % Change

2009 2008 2007 2009 / 2008 2008 / 2007

Investment Income and Interest Expense (in millions):

Investment Income .................................... $ 10 $ 75 $ 99 (86.7)% (24.2)%

Interest Expense ...................................... $(445) $(442) $(246) 0.7% 79.7%

Impact of Currency Remeasurement Charge ............ 77 — —

Adjusted Interest Expense ...................... (368) (442) (246) (16.7)% 79.7%

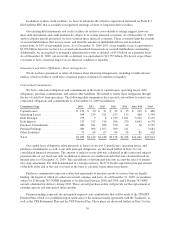

Investment Income

The 2009 decline was largely due to a lower average balance of interest-earning investments, a significantly

lower yield earned on our invested assets as a result of declines in short-term interest rates in the United States,

and a loss on the fair value adjustments of certain investment partnerships. The 2008 decline was primarily due

to a lower average balance of interest-earning investments, a lower yield earned on our investments, and

impairment losses.

During the second quarter of 2009, we recorded impairment losses on certain perpetual preferred securities,

and an auction rate security collateralized by preferred securities, issued by large financial institutions.

The impairment charge resulted from conversion offers from the issuers of these securities at prices well below

the stated redemption value of the preferred shares. These securities, which had a cost basis of $42 million, were

written down to their fair value of $25 million as of June 30, 2009, resulting in an other-than-temporary

impairment of $17 million.

During the third quarter of 2008, we recorded impairment losses on two auction rate securities that were

collateralized by preferred stock issued by the Federal National Mortgage Association (“FNMA”) and the

Federal Home Loan Mortgage Corporation (“FHLMC”). The impairment resulted from actions by the U.S.

Treasury Department and the Federal Housing Finance Agency to place FNMA and FHLMC under

conservatorship. Additionally, we recorded impairment losses on a municipal auction rate security and on

holdings of several medium term notes issued by Lehman Brothers Inc., which declared bankruptcy during the

third quarter of 2008. The total of these credit-related impairment losses was $23 million.

Interest Expense

Excluding the currency remeasurement charge, the 2009 decrease in interest expense was largely due to lower

average debt balances and lower average interest rates incurred on variable rate debt and interest rate swaps.

34