UPS 2009 Annual Report Download - page 54

Download and view the complete annual report

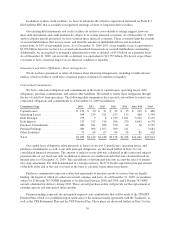

Please find page 54 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of Teamsters (“Teamsters”). These agreements run through July 31, 2013. We have approximately 2,800 pilots

who are employed under a collective bargaining agreement with the Independent Pilots Association, which

becomes amendable at the end of 2011. Our airline mechanics are covered by a collective bargaining agreement

with Teamsters Local 2727, which became amendable in November 2006. We began formal negotiations with

Teamsters Local 2727 in October 2006. In addition, the majority (approximately 3,400) of our ground mechanics

who are not employed under agreements with the Teamsters are employed under collective bargaining

agreements with the International Association of Machinists and Aerospace Workers (“IAM”). In June of 2009,

we reached a new agreement with the IAM, which was subsequently ratified in July 2009. The new agreement

runs through July 31, 2014.

Other Matters

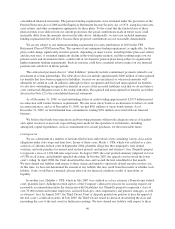

We received grand jury subpoenas from the Antitrust Division of the U.S. Department of Justice (“DOJ”)

regarding the DOJ’s investigations into certain pricing practices in the air cargo industry in July 2006, and into

certain pricing practices in the freight forwarding industry in December 2007.

In October 2007, June 2008, and February 2009, we received information requests from the European

Commission (“Commission”) relating to its investigation of certain pricing practices in the freight forwarding

industry, and subsequently responded to each request. On February 9, 2010, UPS received a Statement of

Objections by the Commission. This document contains the Commission’s preliminary view with respect to

alleged anticompetitive behavior in the freight forwarding industry by 18 freight forwarders, including UPS.

The Statement of Objections enables the addressees to respond. Although it alleges anticompetitive behavior, it

does not prejudge the Commission’s final decision, as to facts or law (which is subject to appeal to the European

courts). We intend to vigorously defend ourselves in this proceeding.

We also received and responded to related information requests from competition authorities in other

jurisdictions.

We are cooperating with each of these inquiries.

At this time, we are unable to determine the amount of any liability that may result from these matters or

whether such liability, if any, would have a material adverse effect on our financial condition, results of

operations, or liquidity.

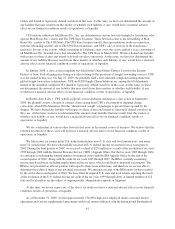

New Accounting Pronouncements

Recently Adopted Accounting Standards

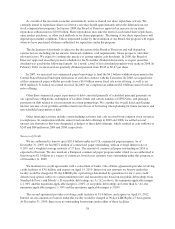

Provisions within the following accounting standards were adopted during the years covered by these

financial statements:

Financial Instruments: The Financial Accounting Standards Board (“FASB”) issued guidance in February

2007 that gives entities the option to measure eligible financial assets, financial liabilities and firm

commitments at fair value (i.e., the fair value option), on an instrument-by-instrument basis, that are

otherwise not accounted for at fair value under other accounting standards. The election to use the fair value

option is available at specified election dates, such as when an entity first recognizes a financial asset or

financial liability or upon entering into a firm commitment. Subsequent changes in fair value must be

recorded in earnings. Additionally, this guidance allowed for a one-time election for existing positions upon

adoption, with the transition adjustment recorded to beginning retained earnings. We adopted this standard

on January 1, 2008, and elected to apply the fair value option to our investment in certain investment

partnerships that were previously accounted for under the equity method. Accordingly, we recorded a

$16 million reduction to retained earnings as of January 1, 2008. These investments are reported in “other

non-current assets” on the consolidated balance sheet.

42