UPS 2009 Annual Report Download - page 50

Download and view the complete annual report

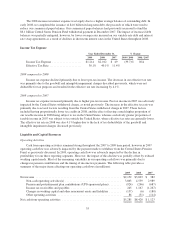

Please find page 50 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As a result of the uncertain economic environment, we have slowed our share repurchase activity. We

currently intend to repurchase shares in 2010 at a rate that should approximately offset the dilution from our

stock compensation programs. In January 2008, the Board of Directors approved an increase in our share

repurchase authorization to $10.0 billion. Share repurchases may take the form of accelerated share repurchases,

open market purchases, or other such methods as we deem appropriate. The timing of our share repurchases will

depend upon market conditions. Unless terminated earlier by the resolution of our Board, the program will expire

when we have purchased all shares authorized for repurchase under the program.

The declaration of dividends is subject to the discretion of the Board of Directors and will depend on

various factors, including our net income, financial condition, cash requirements, future prospects, and other

relevant factors. We expect to continue the practice of paying regular cash dividends. In 2008, the Board of

Directors approved an earlier payment schedule for the November dividend declaration, as in past years this

dividend was payable the following January. As a result, a total of five dividend payments were made in 2008. In

February 2010, we increased our quarterly dividend payment from $0.45 to $0.47 per share.

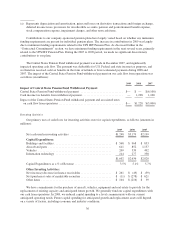

In 2007, we increased our commercial paper borrowings to fund the $6.1 billion withdrawal payment to the

Central States Pension Fund upon ratification of our labor contract with the Teamsters. In 2008, we repaid most

of this commercial paper with the proceeds from a $4.0 billion senior fixed rate notes offering, as well as an

$850 million U.S. federal tax refund received. In 2009, we completed an additional $2.0 billion senior fixed rate

notes offering.

Other than commercial paper, repayments of debt consisted primarily of scheduled principal payments on

our capital lease obligations, redemption of facilities bonds and certain tranches of UPS Notes, and principal

payments on debt related to our investment in certain partnerships. We consider the overall fixed and floating

interest rate mix of our portfolio and the related overall cost of borrowing when planning for future issuances and

non-scheduled repayments of debt.

Other financing activities include certain hedging activities and cash received from common stock issuances

to employees. In conjunction with the senior fixed rate debt offerings in 2009 and 2008, we settled several

interest rate derivatives that were designated as hedges of these debt offerings, which resulted in cash outflows of

$243 and $84 million in 2009 and 2008, respectively.

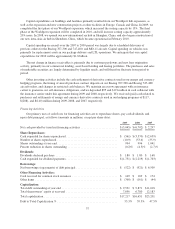

Sources of Credit

We are authorized to borrow up to $10.0 billion under our U.S. commercial paper program. As of

December 31, 2009, we had $672 million of commercial paper outstanding, with an average interest rate of

0.10% and a weighted average maturity of 17 days. The amount of commercial paper outstanding in 2010 is

expected to fluctuate. We also maintain a European commercial paper program under which we are authorized to

borrow up to €1.0 billion in a variety of currencies, however no amounts were outstanding under this program as

of December 31, 2009.

We maintain two credit agreements with a consortium of banks. One of these agreements provides revolving

credit facilities of $3.0 billion, and expires on April 15, 2010. Interest on any amounts we borrow under this

facility would be charged at 90-day LIBOR plus a percentage determined by quotations for our 1-year credit

default swap spread, subject to certain minimum rates and maximum rates based on our public debt ratings from

Standard & Poor’s and Moody’s. If our public debt ratings are A / A2 or above, the minimum applicable margin

is 1.00% and the maximum applicable margin is 2.00%; if our public debt ratings are lower than A / A2, the

minimum applicable margin is 1.50% and the maximum applicable margin is 3.00%.

The second agreement provides revolving credit facilities of $1.0 billion, and expires on April 19, 2012.

Interest on any amounts we borrow under this facility would be charged at 90-day LIBOR plus 15 basis points.

At December 31, 2009, there were no outstanding borrowings under either of these facilities.

38