UPS 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

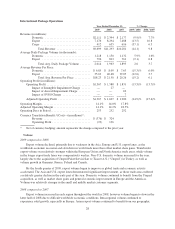

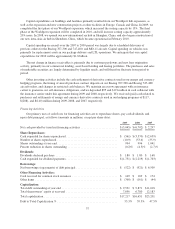

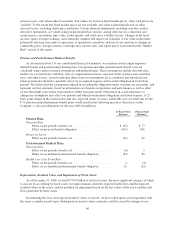

(a) Represents depreciation and amortization, gains and losses on derivative transactions and foreign exchange,

deferred income taxes, provisions for uncollectible accounts, pension and postretirement benefit expense,

stock compensation expense, impairment charges, and other non-cash items.

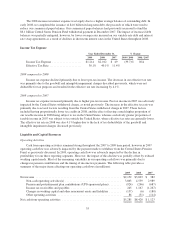

Contributions to our company-sponsored pension plans have largely varied based on whether any minimum

funding requirements are present for individual pension plans. The increase in contributions in 2009 was largely

due to minimum funding requirements related to the UPS IBT Pension Plan. As discussed further in the

“Contractual Commitments” section, we have minimum funding requirements in the next several years, primarily

related to the UPS IBT Pension Plan. During the 2007 to 2009 period, we made no significant discretionary

contributions to our plans.

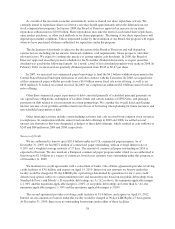

The Central States Pension Fund withdrawal payment was made in December 2007, and significantly

impacted operating cash flow. The payment was deductible for U.S. Federal and state income tax purposes, and

we therefore received cash tax benefits in the form of refunds or lower estimated payments during 2008 and

2007. The impact of the Central States Pension Fund withdrawal payment on our cash flow from operations was

as follows (in millions):

2009 2008 2007

Impact of Central States Pension Fund Withdrawal Payment:

Central States Pension Fund withdrawal payment ............................. $— $ — $(6,100)

Cash income tax benefits from withdrawal payment ............................ — 1,228 1,100

Impact of the Central States Pension Fund withdrawal payment and associated taxes

on cash flow from operations ............................................ $— $1,228 $(5,000)

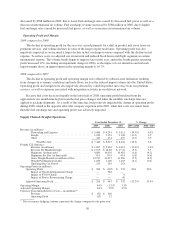

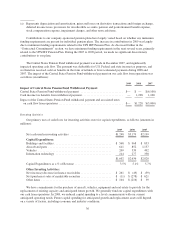

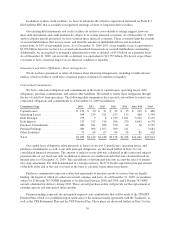

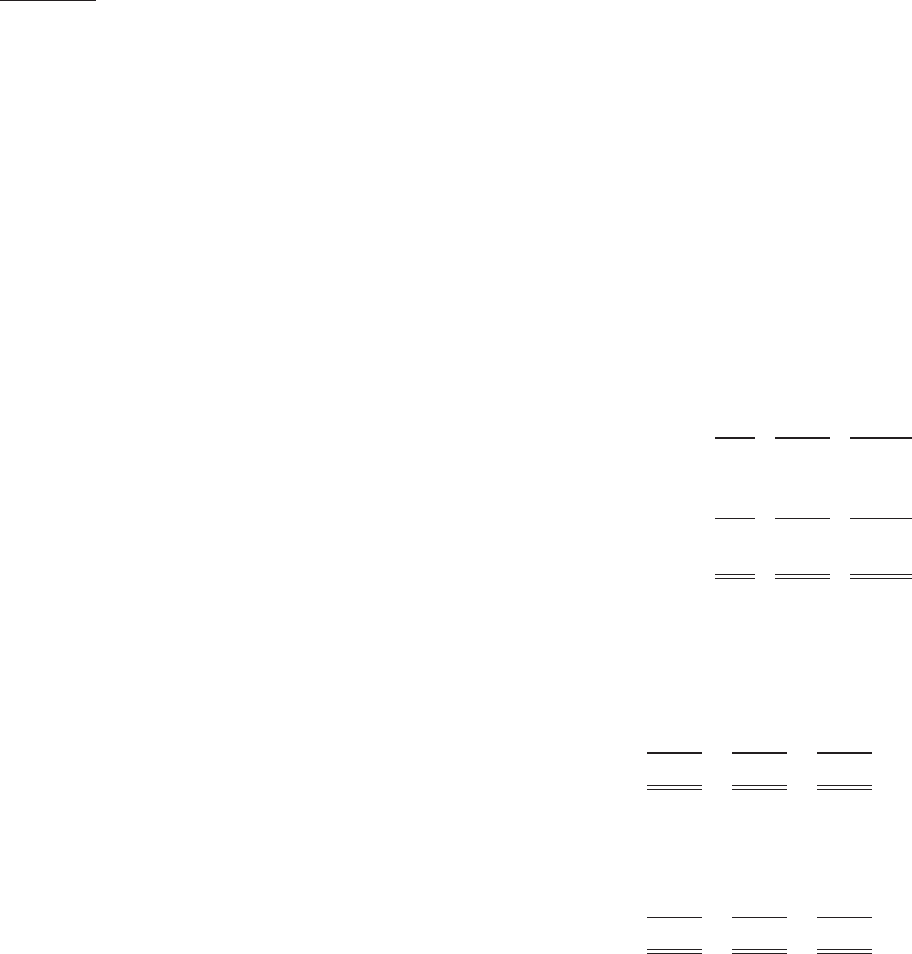

Investing Activities

Our primary uses of cash flows for investing activities were for capital expenditures, as follows (amounts in

millions):

2009 2008 2007

Net cash used in investing activities ............................ $1,248 $3,179 $2,199

Capital Expenditures:

Buildings and facilities ....................................... $ 568 $ 968 $ 853

Aircraft and parts ........................................... 611 852 1,137

Vehicles .................................................. 209 539 492

Information technology ...................................... 214 277 338

$1,602 $2,636 $2,820

Capital Expenditures as a % of Revenue ......................... 3.5% 5.1% 5.7%

Other Investing Activities:

Net (increase) decrease in finance receivables ..................... $ 261 $ (49) $ (39)

Net (purchases) sales of marketable securities ..................... $ (11) $ (278) $ 621

Other items ................................................ $ 104 $ (216) $ 39

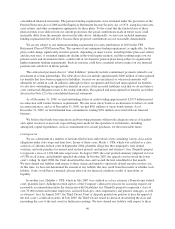

We have commitments for the purchase of aircraft, vehicles, equipment and real estate to provide for the

replacement of existing capacity and anticipated future growth. We generally fund our capital expenditures with

our cash from operations. In 2009, we reduced capital spending to a level commensurate with our current

anticipated operating needs. Future capital spending for anticipated growth and replacement assets will depend

on a variety of factors, including economic and industry conditions.

36