UPS 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

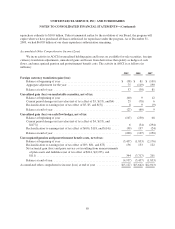

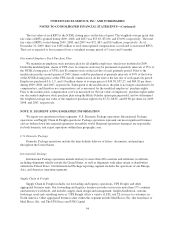

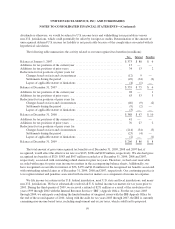

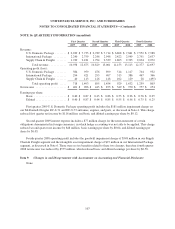

Deferred tax liabilities and assets are comprised of the following at December 31 (in millions):

2009 2008

Property, plant and equipment ......................................... $3,141 $3,047

Goodwill and intangible assets ......................................... 791 694

Other ............................................................. 401 352

Gross deferred tax liabilities ........................................... 4,333 4,093

Other postretirement benefits .......................................... 990 944

Pension plans ....................................................... 956 1,425

Loss and credit carryforwards (non-U.S. and state) ......................... 315 264

Insurance reserves ................................................... 634 617

Vacation pay accrual ................................................. 186 192

Stock compensation .................................................. 244 214

Other ............................................................. 589 534

Gross deferred tax assets .............................................. 3,914 4,190

Deferred tax assets valuation allowance .................................. (237) (117)

Net deferred tax asset ................................................ 3,677 4,073

Net deferred tax liability .............................................. $ 656 $ 20

Amounts recognized in the balance sheet:

Current deferred tax assets ............................................ $ 585 $ 494

Current deferred tax liabilities (included in other current liabilities) ............ $ 2 $ —

Non-current deferred tax assets (included in other non-current assets) .......... $ 54 $ 74

Non-current deferred tax liabilities ...................................... $1,293 $ 588

The valuation allowance increased by $120, $61, and $13 million during the years ended December 31,

2009, 2008 and 2007, respectively.

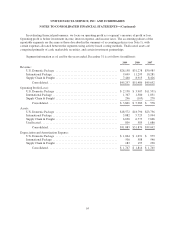

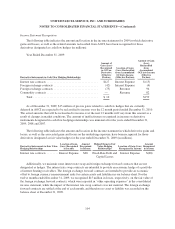

We have U.S. state and local operating loss and credit carryforwards as follows (in millions):

2009 2008

U.S. state and local operating loss carryforwards ........................... $1,178 $1,320

U.S. state and local credit carryforwards ................................. $ 65 $ 74

The operating loss carryforwards expire at varying dates through 2029. The state credits can be carried

forward for periods ranging from three years to indefinitely.

We also have non-U.S. loss carryforwards of approximately $1.053 billion as of December 31, 2009, the

majority of which may be carried forward indefinitely. As indicated in the table above, we have established a

valuation allowance for certain non-U.S. and state loss carryforwards, due to the uncertainty resulting from a lack

of previous taxable income within the applicable tax jurisdictions.

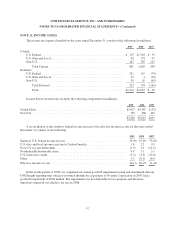

Undistributed earnings of our non-U.S. subsidiaries amounted to approximately $2.178 billion at

December 31, 2009. Those earnings are considered to be indefinitely reinvested and, accordingly, no U.S. federal

or state deferred income taxes have been provided thereon. Upon distribution of those earnings in the form of

98