UPS 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

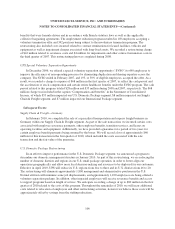

effectively lock a portion of our interest rate exposure between the time the agreement is entered into and the

date when the debt offering is completed, thereby mitigating the impact of interest rate changes on future interest

expense. These derivatives are settled commensurate with the issuance of the debt, and any gain or loss upon

settlement is amortized as an adjustment to the effective interest yield on the debt.

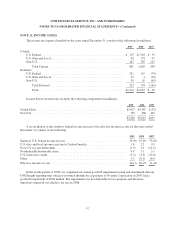

Outstanding Positions

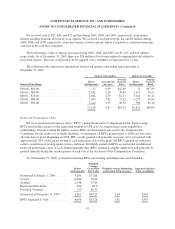

As of December 31, 2009, the notional amounts of our outstanding derivative positions were as follows:

Notional Value

(in millions)

Currency Hedges:

Euro .......................................................... €1,372

British Pound Sterling ............................................ £ 692

Canadian Dollar ................................................ C$ 228

Interest Rate Hedges:

Fixed to Floating Interest Rate Swaps ............................... $ 3,751

Floating to Fixed Interest Rate Swaps ............................... $ 28

As of December 31, 2009, we had no outstanding commodity hedge positions. The maximum term over

which we are hedging exposures to the variability of cash flow is 41 years.

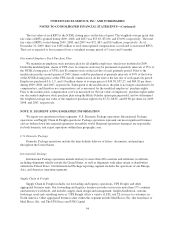

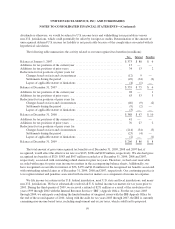

Balance Sheet Recognition

The following table indicates the location on the balance sheet in which our derivative assets and liabilities

have been recognized, and the related fair values of those derivatives (in millions). The table is segregated

between those derivative instruments that qualify and are designated as hedging instruments and those that are

not, as well as by type of contract and whether the derivative is in an asset or liability position.

Asset Derivatives Balance Sheet Location

December 31, 2009

Fair Value

Derivatives designated as hedges:

Foreign exchange contracts ........... Other current assets $ 63

Interest rate contracts ................ Other non-current assets 74

Total Asset Derivatives .......... $137

Liability Derivatives Balance Sheet Location

December 31, 2009

Fair Value

Derivatives designated as hedges:

Foreign exchange contracts ........... Other non-current liabilities $ (51)

Interest rate contracts ................ Other non-current liabilities (13)

Derivatives not designated as hedges:

Interest rate contracts ................ Other non-current liabilities (2)

Total Liability Derivatives ........ $(66)

103