UPS 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Currency Remeasurement Charge

During the second quarter of 2009, we incurred a $77 million non-cash, pre-tax currency remeasurement

charge on certain foreign currency denominated obligations.

Results of Operations—Segment Review

The results and discussions that follow are reflective of how our executive management monitors the

performance of our reporting segments. We supplement the reporting of our financial information determined

under generally accepted accounting principles (“GAAP”) with certain non-GAAP financial measures, including

operating profit, operating margin, pre-tax income, net income and earnings per share adjusted for the

non-comparable items discussed previously. We believe that these adjusted measures provide meaningful

information to assist investors and analysts in understanding our financial results and assessing our prospects for

future performance. We believe these adjusted financial measures are important indicators of our recurring

results of operations because they exclude items that may not be indicative of, or are unrelated to, our core

operating results, and provide a better baseline for analyzing trends in our underlying businesses.

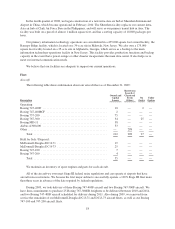

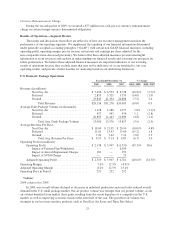

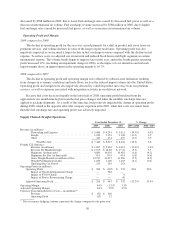

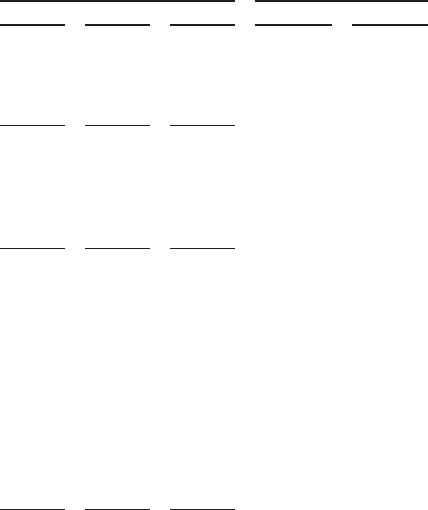

U.S. Domestic Package Operations

Year Ended December 31, % Change

2009 2008 2007 2009 / 2008 2008 / 2007

Revenue (in millions):

Next Day Air ........................... $ 5,456 $ 6,559 $ 6,738 (16.8)% (2.7)%

Deferred ............................... 2,859 3,325 3,359 (14.0) (1.0)

Ground ................................ 19,843 21,394 20,888 (7.2) 2.4

Total Revenue ...................... $28,158 $31,278 $30,985 (10.0) 0.9

Average Daily Package Volume (in thousands):

Next Day Air ........................... 1,198 1,186 1,277 1.0% (7.1)%

Deferred ............................... 957 947 974 1.1 (2.8)

Ground ................................ 10,895 11,443 11,606 (4.8) (1.4)

Total Avg. Daily Package Volume ...... 13,050 13,576 13,857 (3.9) (2.0)

Average Revenue Per Piece:

Next Day Air ........................... $ 18.00 $ 21.95 $ 20.94 (18.0)% 4.8%

Deferred ............................... 11.81 13.93 13.69 (15.2) 1.8

Ground ................................ 7.20 7.42 7.14 (3.0) 3.9

Total Avg. Revenue Per Piece .......... $ 8.53 $ 9.14 $ 8.87 (6.7) 3.0

Operating Profit (in millions):

Operating Profit ............................. $ 2,138 $ 3,907 $ (1,531) (45.3)% N/A

Impact of Pension Plan Withdrawal ......... — — 6,100

Impact of Aircraft Impairment Charges ...... 181 — 159

Impact of SVSO Charge .................. — — 53

Adjusted Operating Profit ..................... $ 2,319 $ 3,907 $ 4,781 (40.6)% (18.3)%

Operating Margin ................................ 7.6% 12.5% (4.9)%

Adjusted Operating Margin ........................ 8.2% 12.5% 15.4%

Operating Days in Period .......................... 253 252 252

Volume:

2009 compared to 2008

In 2009, our overall volume declined as decreases in industrial production and retail sales reduced overall

demand in the U.S. small package market. Our air product volume was stronger than our ground volume, as our

air volume benefited from market share gains resulting from the recent departure of a competitor in the U.S.

market, as well as improving economic trends in the latter half of the year. The growth in air volume was

strongest in our less time-sensitive products, such as Next Day Air Saver and Three Day Select.

25