UPS 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Nonqualified Stock Options

We maintain fixed stock option plans, under which options are granted to purchase shares of UPS class A

common stock. Stock options granted in connection with the Incentive Compensation Plan must have an exercise

price at least equal to the NYSE closing price of UPS class B common stock on the date the option is granted.

Persons earning the right to receive stock options are determined each year by the Compensation

Committee. Except in the case of death, disability, or retirement, options granted under the Incentive

Compensation Plan prior to 2008 are generally exercisable three to five years from the date of grant and before

the expiration of the option 10 years after the date of grant. Beginning in 2008, option awards have been made to

a more limited group of employees, and options granted will generally vest over a five year period with

approximately 20% of the award vesting at each anniversary date of the grant. All options granted are subject to

earlier cancellation or exercise under certain conditions. Option holders may exercise their options via the tender

of cash or class A common stock, and new class A shares are issued upon exercise. Options granted to eligible

employees will generally be granted annually during the second quarter of each year at the discretion of the

Compensation Committee.

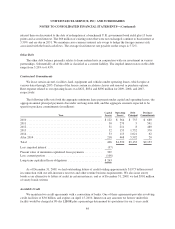

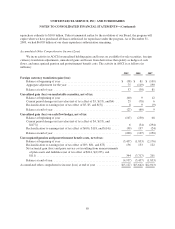

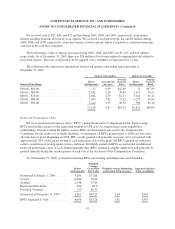

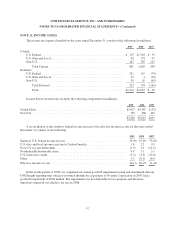

The following is an analysis of options to purchase shares of class A common stock issued and outstanding:

Shares

(in thousands)

Weighted

Average

Exercise

Price

Weighted Average Remaining

Contractual Term

(in years)

Aggregate Intrinsic

Value (in millions)

Outstanding at January 1, 2009 ........ 18,297 $66.65

Exercised ......................... (918) 50.08

Granted .......................... 265 55.83

Forfeited / Expired ................. (446) 60.73

Outstanding at December 31, 2009 ..... 17,198 $67.52 4.47 $ 2

Options Vested and Expected to Vest . . . 17,018 $67.46 4.44 $ 2

Exercisable at December 31, 2009 ..... 10,829 $64.00 3.23 $ 1

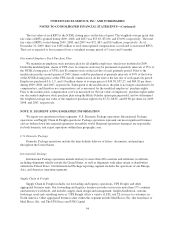

The fair value of each option grant is estimated using the Black-Scholes option pricing model. The weighted

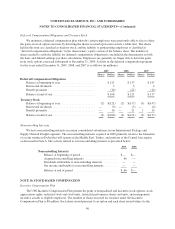

average assumptions used, by year, and the calculated weighted average fair values of options are as follows:

2009 2008 2007

Expected dividend yield ............................................... 3.25% 2.39% 2.28%

Risk-free interest rate ................................................. 3.22% 3.79% 4.65%

Expected life in years ................................................. 7.5 7.5 7.5

Expected volatility ................................................... 23.16% 22.24% 19.15%

Weighted average fair value of options granted ............................ $10.86 $16.77 $16.85

Expected volatilities are based on the historical returns on our stock and the implied volatility of our

publicly-traded options. The expected dividend yield is based on the recent historical dividend yields for our

stock, taking into account changes in dividend policy. The risk-free interest rate is based on the term structure of

interest rates at the time of the option grant. The expected life represents an estimate of the period of time options

are expected to remain outstanding, and we have relied upon a combination of the observed exercise behavior of

our prior grants with similar characteristics, the vesting schedule of the grants, and an index of peer companies

with similar grant characteristics.

92