UPS 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

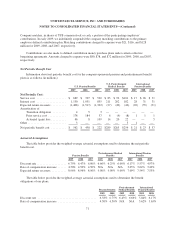

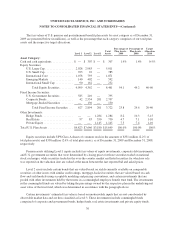

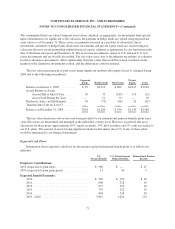

Expected benefit payments for pensions will be primarily paid from plan trusts. Expected benefit payments

for postretirement medical benefits will be paid from plan trusts and corporate assets. Our funding policy for U.S.

plans is to contribute amounts annually that are at least equal to the amounts required by applicable laws and

regulations, or to directly fund payments to plan participants, as applicable. International plans will be funded in

accordance with local regulations. Additional discretionary contributions will be made when deemed appropriate

to meet the long-term obligations of the plans.

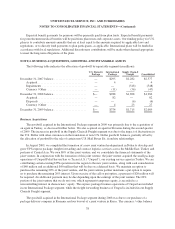

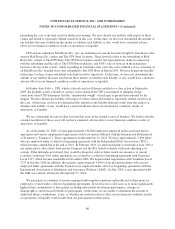

NOTE 6. BUSINESS ACQUISITIONS, GOODWILL AND INTANGIBLE ASSETS

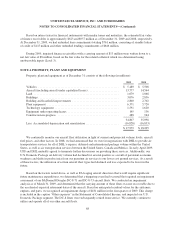

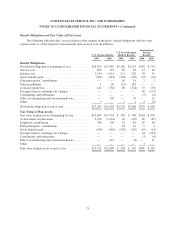

The following table indicates the allocation of goodwill by reportable segment (in millions):

U.S. Domestic

Package

International

Package

Supply Chain &

Freight Consolidated

December 31, 2007 balance ...................... — $295 $2,282 $2,577

Acquired ................................. — 4 — 4

Impairments .............................. — — (548) (548)

Currency / Other .......................... — (11) (36) (47)

December 31, 2008 balance ...................... $— $288 $1,698 $1,986

Acquired ................................. — 82 — 82

Disposals ................................ — — (6) (6)

Currency / Other .......................... — 4 23 27

December 31, 2009 balance ...................... $— $374 $1,715 $2,089

Business Acquisitions

The goodwill acquired in the International Package segment in 2009 was primarily due to the acquisition of

an agent in Turkey, as discussed further below. We also acquired an agent in Slovenia during the second quarter

of 2009. The increase in goodwill in the Supply Chain & Freight segment was due to the impact of fluctuations in

the U.S. Dollar with other currencies on the translation of non-U.S. Dollar goodwill balances, partially offset by

the allocation of goodwill to the sale of certain non-U.S. Mail Boxes Etc. franchise relationships.

In August 2009, we completed the formation of a new joint venture headquartered in Dubai to develop and

grow UPS express package, freight forwarding and contract logistics services across the Middle East, Turkey and

portions of Central Asia. We own 80% of this joint venture, and we consolidate the financial statements of the

joint venture. In conjunction with the formation of this joint venture, the joint venture acquired the small package

operations of Unsped Paket Servisi San ve Ticaret A.S. (“Unsped”), our existing service agent in Turkey. We are

contributing certain existing UPS operations in the region to the new joint venture, along with cash consideration

of $40 million and an additional $40 million that will be due on a deferred basis. We maintain an option to

purchase the remaining 20% of the joint venture, and the joint venture partner maintains a put option to require

us to purchase the remaining 20% interest. Upon exercise of the call or put option, a payment of $20 million will

be required. An additional payment may be due depending upon the earnings of the joint venture. The 20%

portion of the joint venture that we do not own, which represents temporary equity, is recorded as a

noncontrolling interest in shareowners’ equity. The express package business operations of Unsped are included

in our International Package segment, while the freight forwarding business of Unsped is included in our Supply

Chain & Freight segment.

The goodwill acquired in the International Package segment during 2008 was due to our purchase of a

package delivery company in Romania and our buyout of a joint venture in Korea. The currency / other balance

78