UPS 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

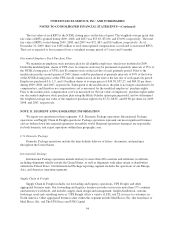

assessments. The IRS has not presented an official position with regard to these taxes at this time, and therefore

we are not able to determine the technical merit of any potential assessment. We anticipate receipt of the IRS

reports on these matters by the end of the second quarter of 2010. We have filed all required U.S. state and local

returns reporting the result of the resolution of the U.S. federal income tax audit of the tax years 1999 through

2002. A limited number of U.S. state and local matters are the subject of ongoing audits, administrative appeals

or litigation.

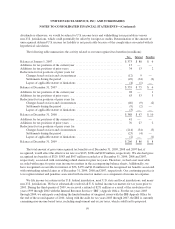

A number of years may elapse before an uncertain tax position is audited and ultimately settled. It is

difficult to predict the ultimate outcome or the timing of resolution for uncertain tax positions. It is reasonably

possible that the amount of unrecognized tax benefits could significantly increase or decrease within the next

twelve months. Items that may cause changes to unrecognized tax benefits include the timing of interest

deductions and the allocation of income and expense between tax jurisdictions. These changes could result from

the settlement of ongoing litigation, the completion of ongoing examinations, the expiration of the statute of

limitations, or other unforeseen circumstances. At this time, an estimate of the range of the reasonably possible

change cannot be made.

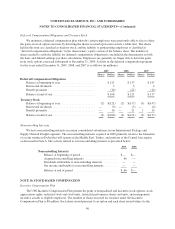

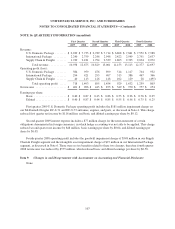

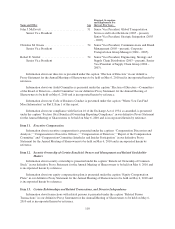

NOTE 13. EARNINGS PER SHARE

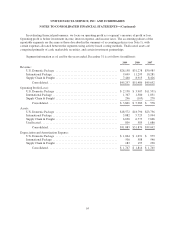

The following table sets forth the computation of basic and diluted earnings per share (in millions except per

share amounts):

2009 2008 2007

Numerator:

Net income attributable to common shareowners ......................... $2,152 $3,003 $ 382

Denominator:

Weighted average shares ............................................ 995 1,014 1,055

Deferred compensation obligations ....................................222

Vested portion of restricted shares ..................................... 1 — —

Denominator for basic earnings per share ................................... 998 1,016 1,057

Effect of dilutive securities:

Restricted performance units .........................................222

Restricted stock units ...............................................432

Stock options ..................................................... — 1 2

Denominator for diluted earnings per share .................................. 1,004 1,022 1,063

Basic earnings per share ................................................. $ 2.16 $ 2.96 $ 0.36

Diluted earnings per share ............................................... $ 2.14 $ 2.94 $ 0.36

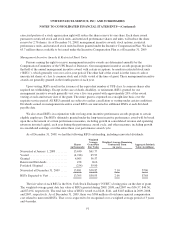

Diluted earnings per share for the years ended December 31, 2009, 2008, and 2007 exclude the effect of

17.4, 11.7, and 8.9 million shares, respectively, of common stock that may be issued upon the exercise of

employee stock options because such effect would be antidilutive.

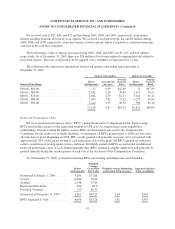

NOTE 14. DERIVATIVE INSTRUMENTS AND RISK MANAGEMENT

Risk Management Policies

We are exposed to market risk, primarily related to foreign exchange rates, commodity prices, equity prices,

and interest rates. These exposures are actively monitored by management. To manage the volatility relating to

100