UPS 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

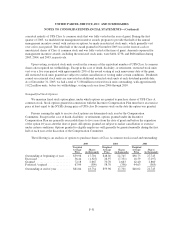

As of December 31, 2005, $64 million in gains related to cash flow hedges that are currently deferred in

OCI are expected to be reclassified to income over the 12 month period ending December 31, 2006. The actual

amounts that will be reclassified to income over the next 12 months will vary from this amount as a result of

changes in market conditions. No amounts were reclassified to income during 2005 in connection with forecasted

transactions that were no longer considered probable of occurring.

At December 31, 2005, the maximum term of derivative instruments that hedge forecasted transactions,

except those related to cross-currency interest rate swaps on existing financial instruments, was two years. We

maintain cross-currency interest rate swaps that extend through 2009.

Fair Value of Financial Instruments

At December 31, 2005 and 2004, our financial instruments included cash and cash equivalents, marketable

securities and short-term investments, accounts receivable, finance receivables, accounts payable, short-term and

long-term borrowings, and commodity, interest rate, foreign currency, and equity options, forwards, and swaps.

The fair values of cash and cash equivalents, accounts receivable, and accounts payable approximate carrying

values because of the short-term nature of these instruments. The fair value of our marketable securities and

short-term investments is disclosed in Note 2, finance receivables in Note 3, and debt instruments in Note 8.

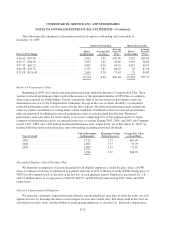

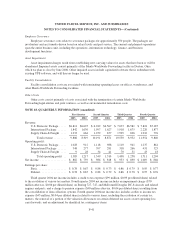

NOTE 17. MENLO RESTRUCTURING PROGRAM AND RELATED EXPENSES

In February 2005, we announced our intention to transfer operations currently taking place at the Menlo

Worldwide Forwarding facility in Dayton, Ohio to other UPS facilities over approximately 12 to 18 months. This

action is being taken to remove redundancies between the Menlo Worldwide Forwarding and existing UPS

transportation networks, and thus provide efficiencies and better leverage the current UPS facilities in the

movement of air freight. During the third quarter of 2005, we finalized our plans to exit the Dayton facility, as

well as various other Menlo Worldwide Forwarding facilities, and accrued certain costs related to employee

severance, lease terminations, and related items. As part of this program, the recorded value of the Dayton

facility was reduced to its fair market value as of the date of the acquisition. These accrued costs, and related

reductions in the fair value of recorded assets, resulted in an adjustment to the amount of goodwill initially

recorded in the Menlo Worldwide Forwarding acquisition.

The total cost of the program is estimated at $229 million, of which $160 million resulted in an adjustment

of the purchase price allocation of Menlo Worldwide Forwarding. The remaining $69 million of the total

program cost relates to integration activities, such as employee relocations, the moving of inventory and fixed

assets, and the consolidation of information systems, and are therefore being expensed as incurred. The program

will be completed by the end of 2006.

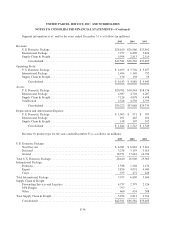

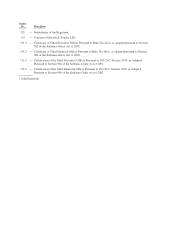

Set forth below is a summary of activity related to the restructuring program and resulting liability for 2005

(in millions):

Employee

Severance

Asset

Impairment

Facility

Consolidation Other Total

Balance at January 1, 2005 .......................... $— $— $— $— $—

Costs accrued ..................................... 31 56 48 25 160

Cashspent ....................................... (7) — (1) — (8)

Charges against assets .............................. — (56) — — (56)

Balance at December 31, 2005 ....................... $ 24 $— $ 47 $ 25 $ 96

F-40