UPS 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

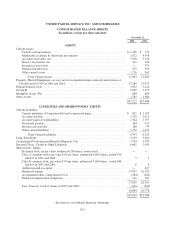

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

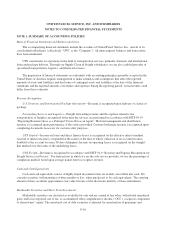

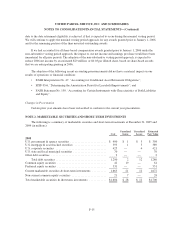

Stock-Based Compensation

Effective January 1, 2003, we adopted the fair value measurement provisions of FASB Statement No. 123

“Accounting for Stock-Based Compensation” (“FAS 123”). In years prior to 2003, we used the intrinsic value

method prescribed by Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to

Employees” (“APB 25”). Under APB 25, we did not have to recognize compensation expense for our stock

option grants and our discounted stock purchase plan, however we did recognize compensation expense for our

management incentive awards and certain other stock awards (see Note 11 for a description of these plans).

Under the provisions of FASB Statement No. 148 “Accounting for Stock-Based Compensation—Transition

and Disclosure,” we have elected to adopt the measurement provisions of FAS 123 using the prospective method.

Under this approach, all stock-based compensation granted subsequent to January 1, 2003 will be expensed to

compensation and benefits over the vesting period based on the fair value at the date the stock-based

compensation is granted. Stock compensation awards granted to date include stock options, management

incentive awards, restricted performance units, and employer matching contributions (in shares of UPS stock) for

a defined contribution benefit plan. The adoption of the measurement provisions of FAS 123 reduced 2005, 2004,

and 2003 net income by $52 million ($0.05 per diluted share), $35 million ($0.03 per diluted share), and $20

million ($0.02 per diluted share), respectively.

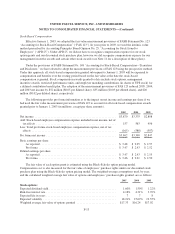

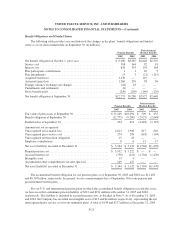

The following provides pro forma information as to the impact on net income and earnings per share if we

had used the fair value measurement provisions of FAS 123 to account for all stock-based compensation awards

granted prior to January 1, 2003 (in millions, except per share amounts).

2005 2004 2003

Netincome ........................................................ $3,870 $3,333 $2,898

Add: Stock-based employee compensation expense included in net income, net of

tax effects ....................................................... 157 563 456

Less: Total pro forma stock-based employee compensation expense, net of tax

effects .......................................................... (165) (588) (507)

Proformanetincome ................................................ $3,862 $3,308 $2,847

Basic earnings per share

As reported .................................................... $ 3.48 $ 2.95 $ 2.57

Proforma ..................................................... $ 3.47 $ 2.93 $ 2.52

Diluted earnings per share

As reported .................................................... $ 3.47 $ 2.93 $ 2.55

Proforma ..................................................... $ 3.46 $ 2.91 $ 2.50

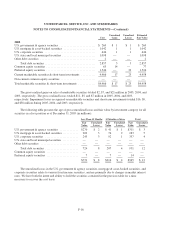

The fair value of each option grant is estimated using the Black-Scholes option pricing model.

Compensation cost is also measured for the fair value of employees’ purchase rights under our discounted stock

purchase plan using the Black-Scholes option pricing model. The weighted-average assumptions used, by year,

and the calculated weighted average fair value of options and employees’ purchase rights granted, are as follows:

2005 2004 2003

Stock options:

Expected dividend yield .............................................. 1.60% 1.50% 1.22%

Risk-free interest rate ................................................ 4.18% 4.31% 3.70%

Expected life in years ................................................778

Expected volatility .................................................. 18.21% 15.69% 19.55%

Weighted average fair value of options granted ........................... $17.33 $16.24 $17.02

F-13