UPS 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

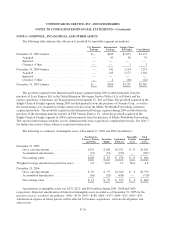

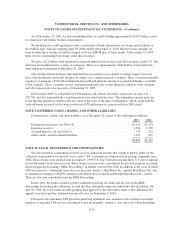

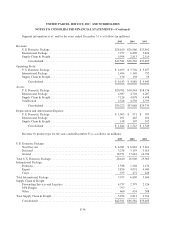

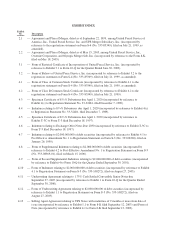

The following table summarizes information about stock options outstanding and exercisable at

December 31, 2005:

Options Outstanding Options Exercisable

Exercise Price Range

Shares

(in thousands)

Average Life

(in years)

Average

Exercise

Price

Shares

(in thousands)

Average

Exercise

Price

$ 16.60 - $50.00 ............................ 2,052 3.85 $49.90 2,052 $49.90

$ 50.37 - $56.90 ............................ 3,953 5.22 56.85 3,953 56.85

$ 57.45 - $60.22 ............................ 4,831 6.26 60.19 4,831 60.19

$ 60.38 - $70.70 ............................ 5,253 7.81 66.43 28 61.94

$ 71.88 - $116.48 ........................... 2,645 9.28 72.43 29 94.85

18,734 6.64 $61.84 10,893 $57.13

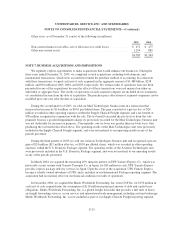

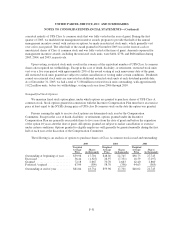

Restricted Performance Units

Beginning in 2003, we issued restricted performance units under the Incentive Compensation Plan. Upon

vesting, restricted performance units result in the issuance of the equivalent number of UPS Class A common

shares after required tax withholdings. Persons earning the right to receive restricted performance units are

determined each year by the Compensation Committee. Except in the case of death, disability, or retirement,

restricted performance units vest five years after the date of grant. All restricted performance units granted are

subject to earlier cancellation or vesting under certain conditions. Dividends earned on restricted performance

units are reinvested in additional restricted performance units at each dividend payable date. Restricted

performance units also allow for bonus shares to be issued, comprising 10% of the original award, if certain

company-wide performance goals are attained in the year of vesting. During 2005, 2004, and 2003, the Company

issued 1.076, 1.083, and 1.164 million restricted performance units, respectively. As of December 31, 2005, we

had the following restricted performance units outstanding, including reinvested dividends:

Year of Award

Units Outstanding

(in thousands)

Remaining Vesting

Period (in years)

Average Fair Value

at Grant Date

2003 ............................... 1,129 2.33 $62.40

2004 ............................... 1,067 3.33 70.70

2005 ............................... 1,068 4.33 72.07

3,264 3.31 $68.28

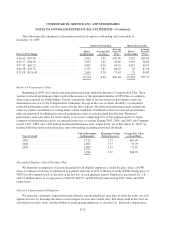

Discounted Employee Stock Purchase Plan

We maintain an employee stock purchase plan for all eligible employees. Under the plan, shares of UPS

Class A common stock may be purchased at quarterly intervals at 90% of the lower of the NYSE closing price of

UPS Class B common stock on the first or the last day of each quarterly period. Employees purchased 2.0, 1.8,

and 1.9 million shares at average prices of $64.54, $62.75, and $54.08 per share during 2005, 2004, and 2003,

respectively.

Deferred Compensation Obligations

We maintain a deferred compensation plan whereby certain employees may elect to defer the gains on stock

option exercises by deferring the shares received upon exercise into a rabbi trust. The shares held in this trust are

classified as treasury stock, and the liability to participating employees is classified as “Deferred compensation

F-32