UPS 2005 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

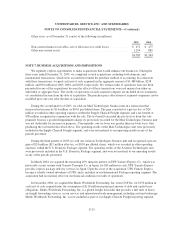

In December 2004, we agreed with Sinotrans Air Transportation Development Co., Ltd. (“Sinotrans”) to

acquire direct control of the international express operations in 23 cities within China, and to purchase

Sintotrans’ interest in our current joint venture in China. The agreement will result in the payment of $121

million to Sinotrans in 2005 and 2006. As of December 31, 2005, we have paid cash of $71 million, and have

taken direct control of operations in all 23 locations. The operations being acquired are reported within our

International Package reporting segment from the dates of acquisition.

In May 2005, we acquired Messenger Service Stolica S.A. (“Stolica”), one of the leading parcel and express

delivery companies in Poland. Stolica’s operating results are included in our International Package reporting

segment from the date of acquisition.

In August 2005, we acquired Overnite Corporation (“Overnite”) for approximately $1.225 billion in cash.

Overnite offers a variety of less-than-truckload and truckload services to more than 60,000 customers in North

America. The operating results of Overnite, which is now known as UPS Freight, are included in our Supply

Chain and Freight reporting segment from the date of acquisition.

In September 2005, we acquired Lynx Express Ltd. (“Lynx”) for approximately $68 million in cash. Lynx

Express was one of the largest independent parcel carriers in the United Kingdom. Lynx also offers customers a

broad suite of logistics and spare parts logistics services. The operating results of Lynx are included in our

International Package reporting segment from the date of acquisition.

We are in the process of finalizing the independent appraisals for certain assets and liabilities to assist

management in allocating the purchase price of Lynx and Overnite to the individual assets acquired and liabilities

assumed. This may result in adjustments to the carrying values of Lynx’s and Overnite’s recorded assets and

liabilities, including the amount of any residual value allocated to goodwill. The preliminary allocation of the

purchase price included in the current period balance sheet is based on the current best estimates of management

and is subject to revision based on final determination of fair values of acquired assets and assumed liabilities.

We anticipate the valuations and other studies will be completed prior to the anniversary dates of the

acquisitions.

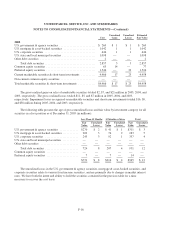

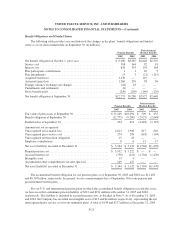

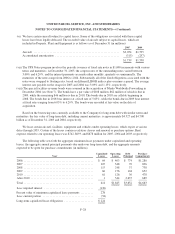

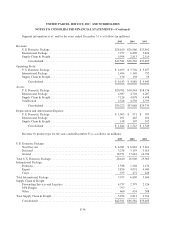

The allocation of the total purchase price of the 2005 acquisitions discussed above (preliminary allocation in

the case of Lynx and Overnite) and other smaller acquisitions, as well as the 2005 purchase price adjustments

related to acquisitions closed in 2004, resulted in the following condensed balance sheet of assets acquired and

liabilities assumed (in millions):

Assets Liabilities

Cash and cash equivalents ................. $ 25 Accounts payable ...................... $ 77

Accounts receivable ...................... 246 Accrued wages and withholdings ......... 41

Other current assets ...................... 57 Othercurrent liabilities ................. 254

Property, plant, and equipment ............. 701 Current maturities of long-term debt ....... 48

Goodwill .............................. 1,316 Deferred taxes, credits and other

liabilities .......................... 338

Intangible assets ......................... 119 Long-term debt ....................... 78

Other assets ............................ 4 Accumulatedpostretirement benefit

obligation .......................... 119

$2,468 $955

F-26