UPS 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

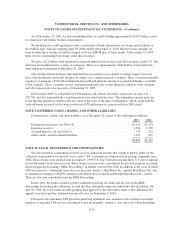

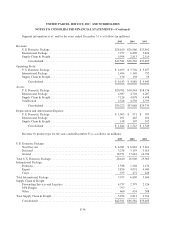

Foreign Currency Exchange Risk Management

We have foreign currency risks related to our revenue, operating expenses, and financing transactions in

currencies other than the local currencies in which we operate. We are exposed to currency risk from the

potential changes in functional currency values of our foreign currency denominated assets, liabilities, and cash

flows. Our most significant foreign currency exposures relate to the Euro, the British Pound Sterling, and the

Canadian Dollar. We use a combination of purchased and written options and forward contracts to hedge

currency cash flow exposures. As of December 31, 2005 and 2004, the net fair value of the hedging instruments

described above was an asset (liability) of $52 and $(28) million, respectively. We have designated and account

for these contracts as cash flow hedges of anticipated foreign currency denominated revenue and, therefore, the

resulting gains and losses from these hedges are recognized as a component of international package revenue

when the underlying sales occur.

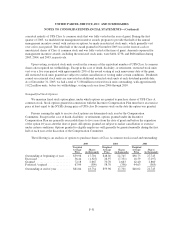

Interest Rate Risk Management

Our indebtedness under our various financing arrangements creates interest rate risk. We use a combination

of derivative instruments, including interest rate swaps and cross-currency interest rate swaps, as part of our

program to manage the fixed and floating interest rate mix of our total debt portfolio and related overall cost of

borrowing. These swaps are entered into concurrently with the issuance of the debt that they are intended to

modify, and the notional amount, interest payment, and maturity dates of the swaps match the terms of the

associated debt. Interest rate swaps allow us to maintain a target range of floating rate debt.

We have designated and account for these contracts as either hedges of the fair value of the associated debt

instruments, or as hedges of the variability in expected future interest payments. Any periodic settlement

payments are accrued monthly, as either a charge or credit to interest expense, and are not material to net income.

The net fair value of our interest rate swaps at December 31, 2005 and 2004 was a liability of $(47) and $(32)

million, respectively.

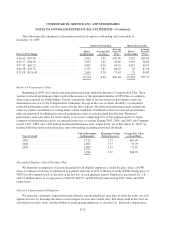

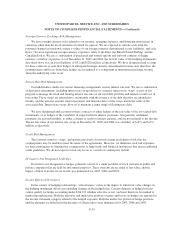

Credit Risk Management

The forward contracts, swaps, and options previously discussed contain an element of risk that the

counterparties may be unable to meet the terms of the agreements. However, we minimize such risk exposures

for these instruments by limiting the counterparties to large banks and financial institutions that meet established

credit guidelines. We do not expect to incur any losses as a result of counterparty default.

Derivatives Not Designated As Hedges

Derivatives not designated as hedges primarily consist of a small portfolio of stock warrants in public and

private companies that are held for investment purposes. These warrants are recorded at fair value, and the

impact of these warrants on our results was immaterial for 2005, 2004 and 2003.

Income Effects of Derivatives

In the context of hedging relationships, “effectiveness” refers to the degree to which fair value changes in

the hedging instrument offset corresponding changes in the hedged item. Certain elements of hedge positions

cannot qualify for hedge accounting under FAS 133 whether effective or not, and must therefore be marked to

market through income. Both the effective and ineffective portions of gains and losses on hedges are reported in

the income statement category related to the hedged exposure. Both the ineffective portion of hedge positions

and the elements excluded from the measure of effectiveness were immaterial for 2005, 2004 and 2003.

F-39