UPS 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

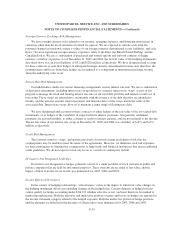

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

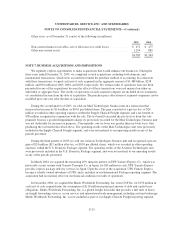

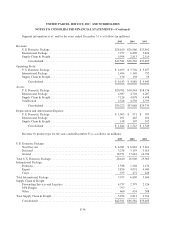

Geographic information as of, and for the years ended, December 31 is as follows (in millions):

2005 2004 2003

United States:

Revenue ...................................................... $31,871 $28,035 $26,968

Long-lived assets ............................................... $19,704 $16,033 $15,634

International:

Revenue ...................................................... $10,710 $ 8,547 $ 6,517

Long-lived assets ............................................... $ 4,044 $ 3,975 $ 3,567

Consolidated:

Revenue ...................................................... $42,581 $36,582 $33,485

Long-lived assets ............................................... $23,748 $20,008 $19,201

Revenue, for geographic disclosure, is based on the location in which service originates. Long-lived assets

include property, plant and equipment, prepaid pension costs, long-term investments, goodwill, and intangible

assets.

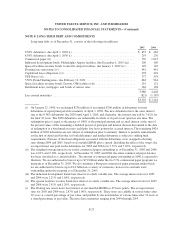

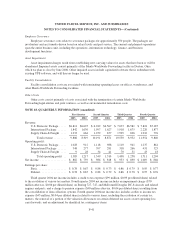

NOTE 13. OTHER OPERATING EXPENSES

The major components of other operating expenses for the years ended December 31 are as follows (in

millions):

2005 2004 2003

Repairs and maintenance .............................................. $ 1,097 $ 1,005 $ 955

Depreciation and amortization .......................................... 1,644 1,543 1,549

Purchased transportation .............................................. 4,050 2,059 1,828

Fuel............................................................... 2,085 1,416 1,050

Otheroccupancy..................................................... 872 752 730

Otherexpenses ...................................................... 4,173 3,995 3,677

$13,921 $10,770 $9,789

In 2005, we reclassified certain amounts between “other expenses” and “compensation and benefits”

expense, related to the capitalization of internally-developed software. Amounts were also reclassified in all prior

periods for consistent presentation in our consolidated income statement. The reclassification had the effect of

increasing other expenses, and reducing compensation and benefits expense, by $92, $93, and $77 million in

2005, 2004, and 2003, respectively.

F-35