UPS 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

take advantage of our I.T. platform by linking their

systems directly into the UPS global network. This

seamless integration allows us to provide unique

solutions that help customers improve their

profi tability and access new markets.

All of this is supported by one of the most trusted

and recognized brands on the planet — a brand that

symbolizes UPS’s heritage of reliable service.

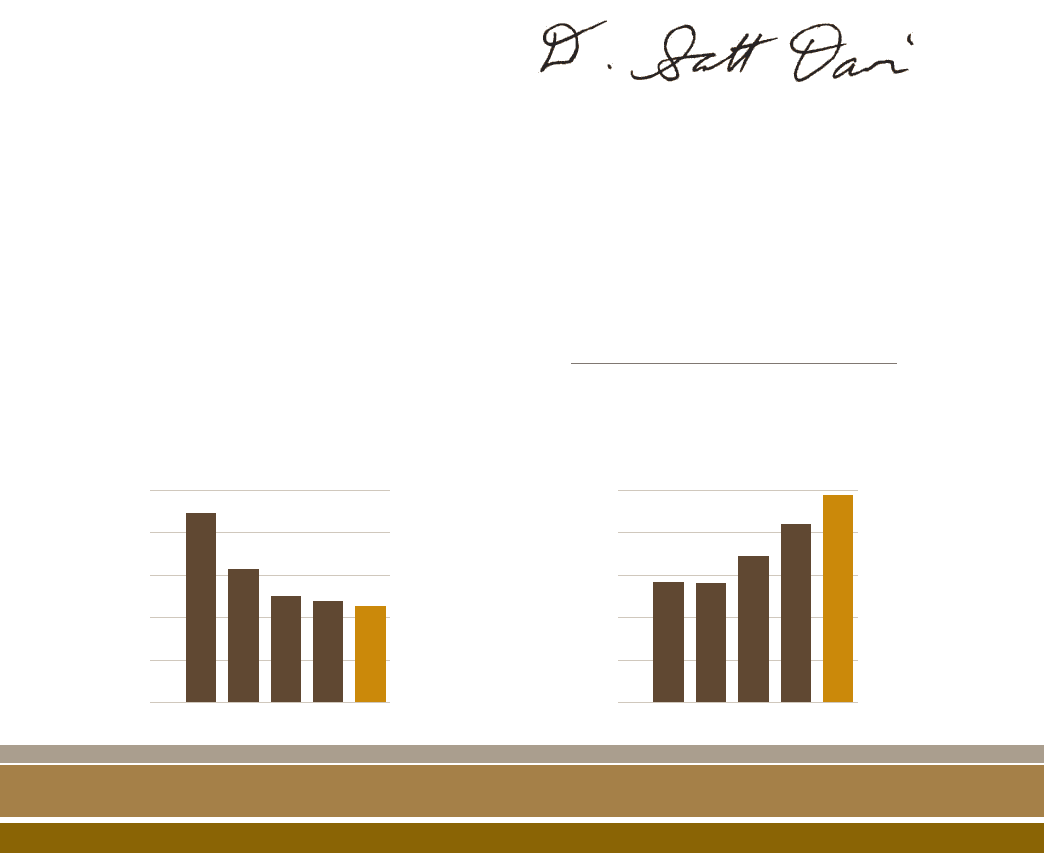

Consistent, superior fi nancial performance

UPS has a track record of compelling fi nancial

performance. For example, return on equity has been

over 20 percent almost every year for the past two

decades, our compound annual earnings growth rate

is 14 percent for the last decade, and long-term debt

to total capitalization was only 15.8 percent in 2005.

Our business generates substantial, positive cash fl ow

that supports reinvestment in the business through

new technologies, infrastructure enhancements, new

services, and acquisitions. In 2005, UPS generated

$3.6 billion in free cash fl ow.*

This fi nancial strength underscores a commitment to

shareowner value. In 2005, UPS spent $2.5 billion to

repurchase 33.9 million shares, reducing outstanding

shares by 2.6 percent. Over the last fi ve years (2001

through 2005), UPS has distributed over $5.4 billion

in dividends. In fact, from February 2003 to February

2006, UPS increased dividends declared 81 percent.

Decades of employee ownership have produced a

culture aligned with investor interests — UPS is a

company that’s run by investors for investors.

This ownership philosophy results in long-term

investment decision-making, with a focus on

appropriate investment returns.

Our business is straightforward. The balance sheet

provides a clear picture of our fi nancial strength. Since

we are a service company, we have minimal inventories

on hand, and our revenue recognition is easy to

understand. These characteristics of our business

result in a high level of transparency.

I speak for UPSers the world over when I say we’re

excited about the prospects afforded us in the

transportation industry. Our business both supports

and benefi ts from increased trade. As the world’s

communities move closer together economically,

we believe UPS is an exceptional way to invest in

global commerce.

D. Scott Davis

Chief Financial Offi cer

*Reconciliation of 2005 Free Cash Flow (in millions)

Net cash from operations $ 5,793

Capital expenditures (2,187)

Proceeds from disposals of PP&E 27

Net change in fi nance receivables 95

Other investing activities (174)

Free cash fl ow $ 3,554

%

,

&)

'&

'-

(*

%*

%)%(%'

%&

Adc\"IZgb9ZWiid

IdiVa8Ve^iVa^oVi^dc^ceZgXZci

(&#'

&*#-

&+#+

&,#*

'&#.

%

(%%

+%%

.%%

&!'%%

&!*%%

%*

%)%(%'

%&

IdiVa9^k^YZcYhEV^Y^cb^aa^dch

-*+

&!)+-

&!'+'

&!%(,

-).

UPS Annual Report 2005

10